Record Bitcoin ETF Investment: The Implications Of Large-Scale Directional Bets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record Bitcoin ETF Investment: The Implications of Large-Scale Directional Bets

The world of finance is abuzz with the news of record-breaking investments pouring into Bitcoin exchange-traded funds (ETFs). This surge represents a significant shift in the investment landscape, signaling a growing acceptance of Bitcoin as a viable asset class and prompting crucial questions about the implications of these large-scale directional bets. This unprecedented inflow of capital could drastically alter the future price trajectory of Bitcoin and ripple through the broader cryptocurrency market.

The Numbers Speak Volumes:

Recent reports reveal a dramatic increase in assets under management (AUM) for Bitcoin ETFs, surpassing previous records by a considerable margin. While specific figures vary depending on the reporting source and ETF in question, the overall trend is undeniable: institutional and retail investors are increasingly embracing Bitcoin ETFs as a relatively accessible and regulated entry point into the cryptocurrency market. This surge in investment highlights a shift in perception – Bitcoin is no longer solely the domain of early adopters and tech enthusiasts. Mainstream investors are now taking notice.

Why the Sudden Surge in Bitcoin ETF Investments?

Several factors contribute to this remarkable growth:

- Increased Regulatory Clarity: The approval of Bitcoin ETFs in major markets like the US has provided a much-needed boost to investor confidence. The regulatory framework, while still evolving, offers a level of security and transparency previously lacking in the largely unregulated cryptocurrency space.

- Institutional Adoption: Large institutional investors, including hedge funds and pension funds, are increasingly allocating a portion of their portfolios to Bitcoin, driven by diversification strategies and the potential for high returns. The availability of ETFs provides a more manageable and regulated way for these institutions to gain exposure to Bitcoin.

- Inflation Hedge Narrative: With persistent inflation concerns in many global economies, Bitcoin's limited supply and decentralized nature continue to appeal to investors seeking a hedge against inflation. This narrative has fueled substantial demand.

- Ease of Access: Bitcoin ETFs offer a simple and convenient way to invest in Bitcoin without the complexities of managing private keys or navigating cryptocurrency exchanges. This ease of access has significantly lowered the barrier to entry for many investors.

The Implications of Large-Scale Directional Bets:

The massive influx of capital into Bitcoin ETFs carries significant implications:

- Price Volatility: While ETFs can help stabilize price to some degree, the sheer scale of these investments could still lead to increased price volatility in the short term. Large buy orders can quickly drive up the price, while sudden sell-offs could trigger sharp corrections.

- Market Manipulation Concerns: The potential for market manipulation remains a concern, particularly with large-scale, coordinated trading activity. Regulators need to remain vigilant in monitoring trading patterns to ensure fair market practices.

- Increased Institutional Influence: The growing dominance of institutional investors in the Bitcoin market could shift the dynamics of price discovery and potentially lead to less volatility driven by individual retail investors.

- Wider Cryptocurrency Adoption: The success of Bitcoin ETFs could pave the way for the approval of ETFs for other cryptocurrencies, potentially accelerating the adoption of the broader crypto ecosystem.

Looking Ahead:

The record-breaking investment in Bitcoin ETFs marks a pivotal moment in the history of cryptocurrencies. While the future price trajectory of Bitcoin remains uncertain, the trend towards institutional adoption and regulated access is undeniable. It will be crucial to monitor the market closely for potential consequences and to keep abreast of evolving regulations. The long-term implications of these large-scale directional bets are likely to shape the future of the cryptocurrency market for years to come. Further research and analysis are needed to fully understand the evolving landscape. Stay informed and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record Bitcoin ETF Investment: The Implications Of Large-Scale Directional Bets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Experience The Intensity A Riveting Ww 1 Movie Featuring Daniel Craig Cillian Murphy And Tom Hardy Streaming Now

May 21, 2025

Experience The Intensity A Riveting Ww 1 Movie Featuring Daniel Craig Cillian Murphy And Tom Hardy Streaming Now

May 21, 2025 -

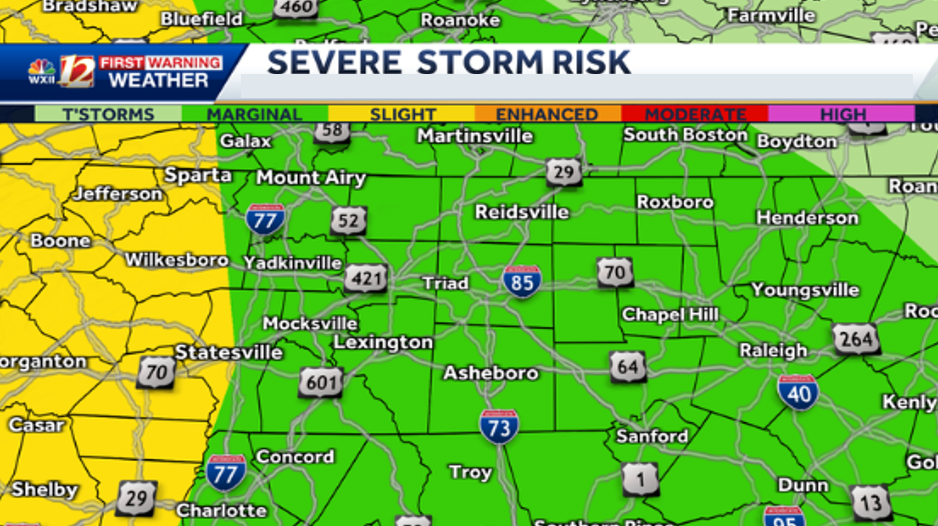

North Carolina Residents Urged To Prepare For Severe Rain And Storms Overnight

May 21, 2025

North Carolina Residents Urged To Prepare For Severe Rain And Storms Overnight

May 21, 2025 -

Angel Reese Faces Criticism Espn Investigates Players Post Game Remarks

May 21, 2025

Angel Reese Faces Criticism Espn Investigates Players Post Game Remarks

May 21, 2025 -

Will They Or Wont They Evaluating The Fringe Nfl Teams Path To The 2023 Playoffs

May 21, 2025

Will They Or Wont They Evaluating The Fringe Nfl Teams Path To The 2023 Playoffs

May 21, 2025 -

Nascars Integrity At Stake Ganassi Demands Higher Standards For Penske

May 21, 2025

Nascars Integrity At Stake Ganassi Demands Higher Standards For Penske

May 21, 2025