Recession-Proofing Your Portfolio: 2 Top S&P 500 Stocks To Buy On The Dip

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Recession-Proofing Your Portfolio: 2 Top S&P 500 Stocks to Buy on the Dip

Economic uncertainty has many investors scrambling to recession-proof their portfolios. While nobody can predict the future with certainty, strategically positioning your investments can significantly mitigate risk during an economic downturn. This article highlights two top S&P 500 stocks that historically perform well even during periods of economic contraction, offering potential opportunities for savvy investors to buy on the dip.

Why Recession-Proofing Matters

A recession, characterized by a significant decline in economic activity, can severely impact stock markets. However, not all stocks are created equal. Some sectors and companies demonstrate resilience, even thriving amidst economic hardship. Identifying these "recession-resistant" stocks is crucial for building a robust portfolio that can weather economic storms. Understanding the factors that contribute to a stock's resilience is key. This includes examining the company's business model, its financial strength, and the overall demand for its products or services, even during economic downturns.

Top 2 S&P 500 Stocks to Consider:

Here are two S&P 500 stalwarts that often show resilience during economic contractions:

1. Consumer Staples: Procter & Gamble (PG)

Procter & Gamble, a consumer staples giant, produces a wide range of everyday household goods. Think Tide detergent, Pampers diapers, and Gillette razors – products people consistently need regardless of the economic climate. This defensive characteristic makes PG a compelling choice for recession-proofing.

- Key Strengths: PG boasts a strong brand portfolio, consistent cash flow, and a history of dividend increases, making it attractive to income-focused investors. Its diverse product line reduces reliance on any single product category, further enhancing its resilience.

- Why it's Recession-Resistant: People still need essential household goods, even during a recession. Demand for PG's products tends to remain relatively stable, even if consumers trade down to cheaper options within their brand portfolio.

- Potential Risks: Inflationary pressures can impact profitability, and increased competition could affect market share.

2. Healthcare: Johnson & Johnson (JNJ)

Johnson & Johnson is a diversified healthcare company with a presence in pharmaceuticals, medical devices, and consumer health. The demand for healthcare products and services is relatively inelastic, meaning it doesn't fluctuate significantly even during economic downturns.

- Key Strengths: JNJ possesses a vast research and development pipeline, a diverse portfolio of products, and a robust financial position. Its consistent track record of innovation and strong brand reputation further enhance its appeal.

- Why it's Recession-Resistant: Healthcare is a non-cyclical sector; people require healthcare regardless of economic conditions. While discretionary spending might decrease during a recession, essential healthcare remains a priority.

- Potential Risks: Regulatory changes in the pharmaceutical and medical device industries could impact profitability, and patent expirations can affect revenue streams.

Investing Strategies for a Recession-Proof Portfolio:

Beyond specific stock selection, consider diversifying across different sectors and asset classes. A balanced portfolio incorporating bonds, real estate, and alternative investments can further enhance resilience. Remember to conduct thorough due diligence before making any investment decisions and consult with a financial advisor if needed.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research or consult a qualified financial advisor before making any investment decisions.

Call to Action: Want to learn more about building a recession-resistant investment strategy? [Link to relevant resource, e.g., a blog post on portfolio diversification]. Stay informed on market trends by subscribing to our newsletter [Link to newsletter signup].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Recession-Proofing Your Portfolio: 2 Top S&P 500 Stocks To Buy On The Dip. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Roland Garros 2025 In Depth Preview Of Rybakina Vs Riera Encounter

May 27, 2025

Roland Garros 2025 In Depth Preview Of Rybakina Vs Riera Encounter

May 27, 2025 -

Ice Hockey World Championship Usa Edges Out Switzerland In Thrilling Finale

May 27, 2025

Ice Hockey World Championship Usa Edges Out Switzerland In Thrilling Finale

May 27, 2025 -

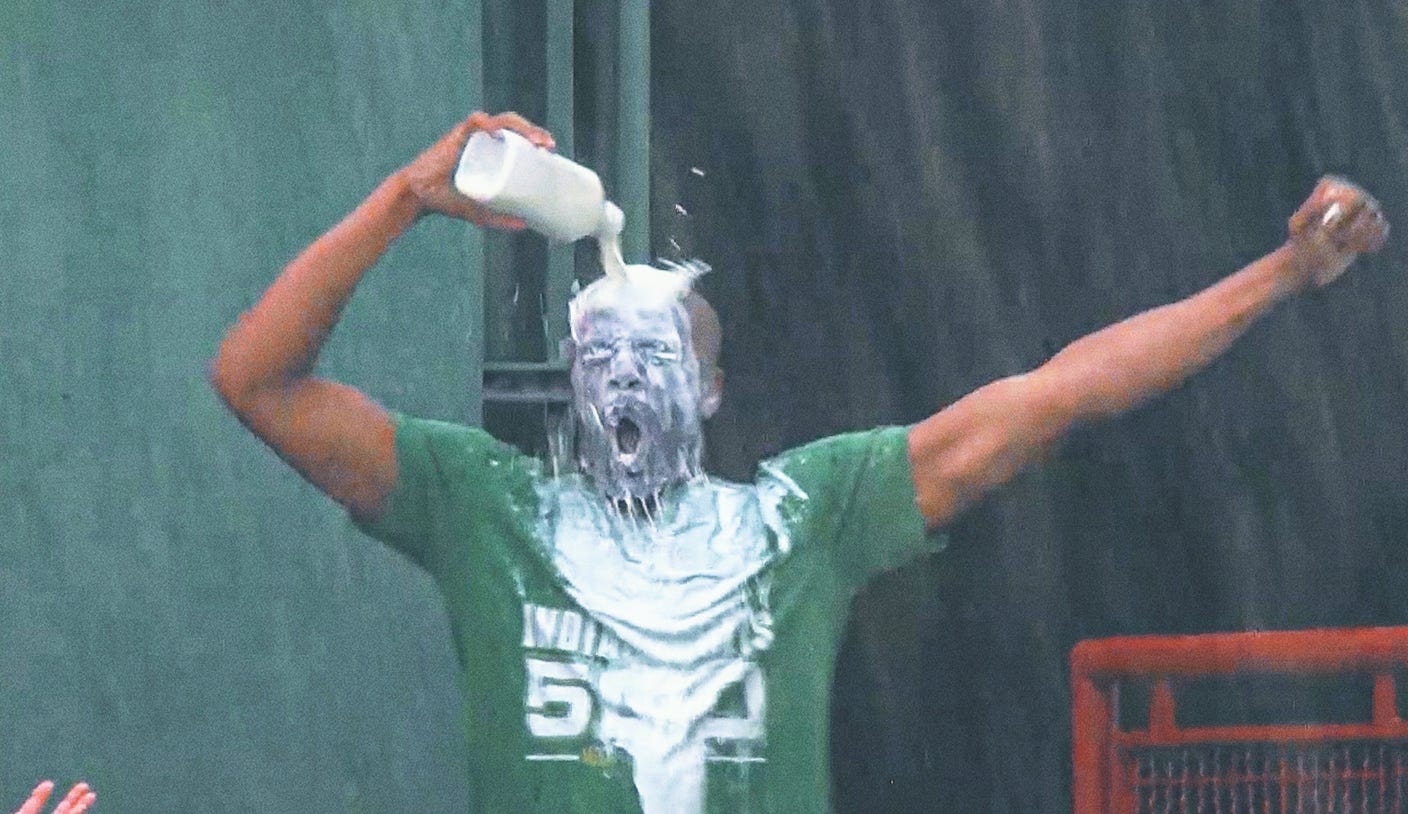

Milk Showers And Indy Excitement A Baseball Tradition Takes Hold

May 27, 2025

Milk Showers And Indy Excitement A Baseball Tradition Takes Hold

May 27, 2025 -

Northeast China Ev Infrastructure Expands With Nios 100 New Swap Stations

May 27, 2025

Northeast China Ev Infrastructure Expands With Nios 100 New Swap Stations

May 27, 2025 -

Ohtanis Transition To Dodgers Early Success On The Mound

May 27, 2025

Ohtanis Transition To Dodgers Early Success On The Mound

May 27, 2025