Rate Cut Speculation Intensifies As Nasdaq 100 Misses All-Time High After US-China Agreement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rate Cut Speculation Intensifies as Nasdaq 100 Misses All-Time High After US-China Agreement

The Nasdaq 100's failure to reach a new all-time high, despite a seemingly positive US-China trade agreement, has ignited intense speculation about potential interest rate cuts by the Federal Reserve. This development sends ripples through the financial markets, leaving investors questioning the future direction of the economy and their portfolios.

The recent "phase one" trade deal between the US and China, while hailed by some as a victory, hasn't delivered the expected boost to tech stocks, a key component of the Nasdaq 100. This underperformance is fueling concerns about the broader economic outlook and is prompting analysts to reassess the likelihood of future interest rate adjustments.

Nasdaq 100 Stumbles: A Sign of Deeper Economic Concerns?

The Nasdaq 100's inability to break through its previous high suggests underlying anxieties within the market. While the trade deal removed some uncertainty, other factors are clearly at play. These include:

- Global Economic Slowdown: Concerns about a global economic slowdown, particularly in Europe and Asia, continue to weigh on investor sentiment. These fears are amplified by persistent trade tensions beyond the US-China agreement.

- Inflationary Pressures: While inflation remains relatively subdued, the potential for future inflationary pressures could influence the Fed's monetary policy decisions. The central bank walks a tightrope between stimulating economic growth and controlling inflation.

- Corporate Earnings: Recent corporate earnings reports have been mixed, adding to the uncertainty. Disappointing results from major tech companies could contribute to the Nasdaq 100's underperformance and further fuel rate cut speculation.

Interest Rate Cuts: A Necessary Stimulant?

Many market analysts now believe that a rate cut is increasingly likely in the coming months. The argument centers around the need to stimulate economic growth and counteract the potential negative impacts of the global slowdown. A rate cut could potentially:

- Boost Investor Confidence: Lower interest rates can make borrowing cheaper for businesses, encouraging investment and expansion. This can lead to increased job creation and overall economic activity.

- Stimulate Spending: Lower rates could also incentivize consumers to borrow and spend more, further boosting economic growth.

- Weaken the Dollar: A rate cut could potentially weaken the US dollar, making American exports more competitive in the global market.

What Happens Next?

The coming weeks will be crucial in determining the Federal Reserve's next move. Investors will be closely watching economic indicators like inflation data, employment figures, and consumer spending. Further disappointing economic data could significantly increase the pressure on the Fed to act. The market reaction to any announcement regarding interest rates will be intense and potentially volatile.

Investing in Uncertain Times:

Navigating these uncertain times requires a careful and well-informed approach. Investors should consider diversifying their portfolios, conducting thorough due diligence, and consulting with financial advisors before making any significant investment decisions. Staying updated on economic news and market trends is essential for making informed choices. Learn more about (replace with a relevant link).

Conclusion:

The recent market activity highlights the complex interplay between trade agreements, economic indicators, and monetary policy. While the US-China trade deal was a positive development, its impact on the Nasdaq 100 suggests deeper underlying concerns. The increased speculation around interest rate cuts reflects a growing belief that the Federal Reserve may need to intervene to maintain economic momentum. The situation remains fluid, and investors must remain vigilant and adapt their strategies accordingly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rate Cut Speculation Intensifies As Nasdaq 100 Misses All-Time High After US-China Agreement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2026 Fifa World Cup Which Teams Are Poised For Victory

Jun 12, 2025

2026 Fifa World Cup Which Teams Are Poised For Victory

Jun 12, 2025 -

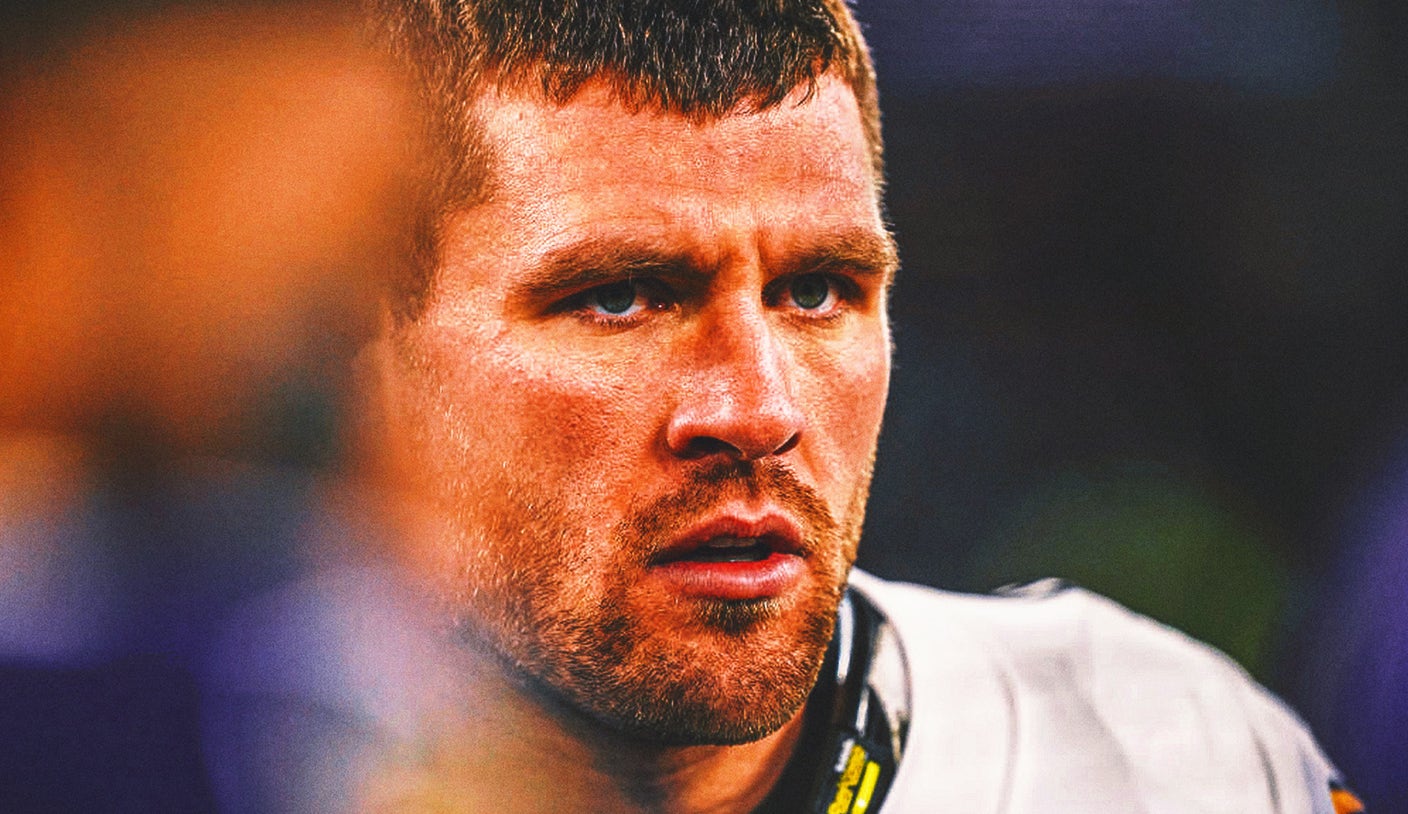

Preseason 2025 Nfl Defensive Player Of The Year Odds Analyzing T J Watts Absence

Jun 12, 2025

Preseason 2025 Nfl Defensive Player Of The Year Odds Analyzing T J Watts Absence

Jun 12, 2025 -

Caitlin Clark Injury Update Quad Strain Sidelines Star Player

Jun 12, 2025

Caitlin Clark Injury Update Quad Strain Sidelines Star Player

Jun 12, 2025 -

Unforgettable Ufl Conference Championship Best Plays From Panthers And Defenders

Jun 12, 2025

Unforgettable Ufl Conference Championship Best Plays From Panthers And Defenders

Jun 12, 2025 -

Superfight Showdown Analyzing Canelo Vs Crawford Odds And Predictions

Jun 12, 2025

Superfight Showdown Analyzing Canelo Vs Crawford Odds And Predictions

Jun 12, 2025