Rate Cut Probability Increases As Nasdaq 100 Falters Near Record High

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rate Cut Probability Increases as Nasdaq 100 Falters Near Record High

The Nasdaq 100's recent stumble near its all-time high has sent ripples through the financial markets, significantly increasing the probability of a Federal Reserve interest rate cut. While inflation remains a concern, the weakening tech sector and growing recessionary fears are forcing a reassessment of the monetary policy outlook. This shift in sentiment could have major implications for investors and the broader economy.

Nasdaq 100's Wobbly Ascent:

The Nasdaq 100, a bellwether for the tech industry and a key indicator of overall market health, has recently experienced a period of volatility. After reaching near record highs, the index has faltered, prompting analysts to scrutinize the underlying economic forces at play. This slowdown, coupled with underwhelming corporate earnings reports from several tech giants, is fueling concerns about a potential economic downturn. Many experts believe this weakness signals a potential correction, reflecting anxieties surrounding future growth prospects. The lingering effects of aggressive interest rate hikes implemented throughout 2022 and 2023 are also contributing factors.

The Shifting Narrative on Interest Rates:

For months, the prevailing narrative focused on the Federal Reserve's commitment to combating inflation, even at the cost of slowing economic growth. However, the recent market turmoil is changing that conversation. The probability of a rate cut, previously considered unlikely, is now climbing, according to several market indicators and expert predictions. This is primarily due to:

- Weakening Economic Data: Recent economic indicators, including softening consumer spending and a slowing manufacturing sector, point towards a potential economic slowdown or even recession.

- Tech Sector Weakness: The underperformance of the tech sector, a significant driver of economic growth, is a major concern. This weakness suggests a broader economic vulnerability.

- Inflation Showing Signs of Cooling: While inflation remains above the Federal Reserve's target, recent data indicates a cooling trend, giving the central bank more flexibility in its monetary policy decisions.

What This Means for Investors:

The increased probability of a rate cut presents both opportunities and challenges for investors. Lower interest rates could boost the stock market, particularly growth stocks that have been heavily impacted by higher borrowing costs. However, a rate cut could also signal a weaker economic outlook, potentially leading to increased market volatility. Investors should carefully consider their risk tolerance and portfolio diversification strategies in light of these developments.

Looking Ahead:

The coming weeks will be crucial in determining the Federal Reserve's next move. Further economic data releases and corporate earnings reports will provide valuable insights into the health of the economy and influence the central bank's decision-making process. The market is closely watching for any signs of further weakening in the economy or a significant shift in inflation trends. This uncertainty highlights the importance of staying informed and adapting investment strategies to the evolving economic landscape.

Further Reading:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rate Cut Probability Increases As Nasdaq 100 Falters Near Record High. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Experience Android 16 Improved Notifications And Camera Functionality

Jun 12, 2025

Experience Android 16 Improved Notifications And Camera Functionality

Jun 12, 2025 -

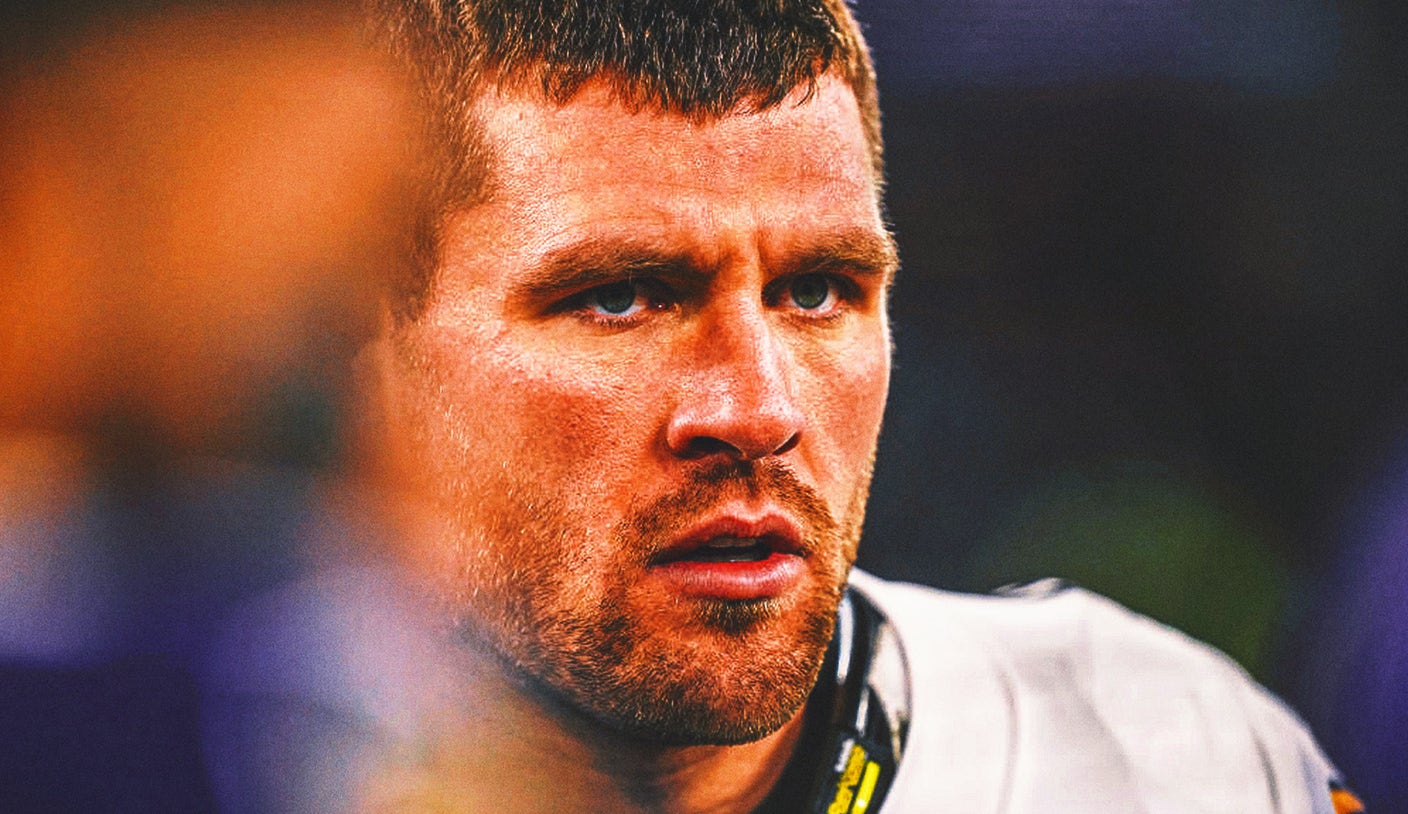

T J Watts Holdout Updated 2025 Nfl Defensive Player Of The Year Odds

Jun 12, 2025

T J Watts Holdout Updated 2025 Nfl Defensive Player Of The Year Odds

Jun 12, 2025 -

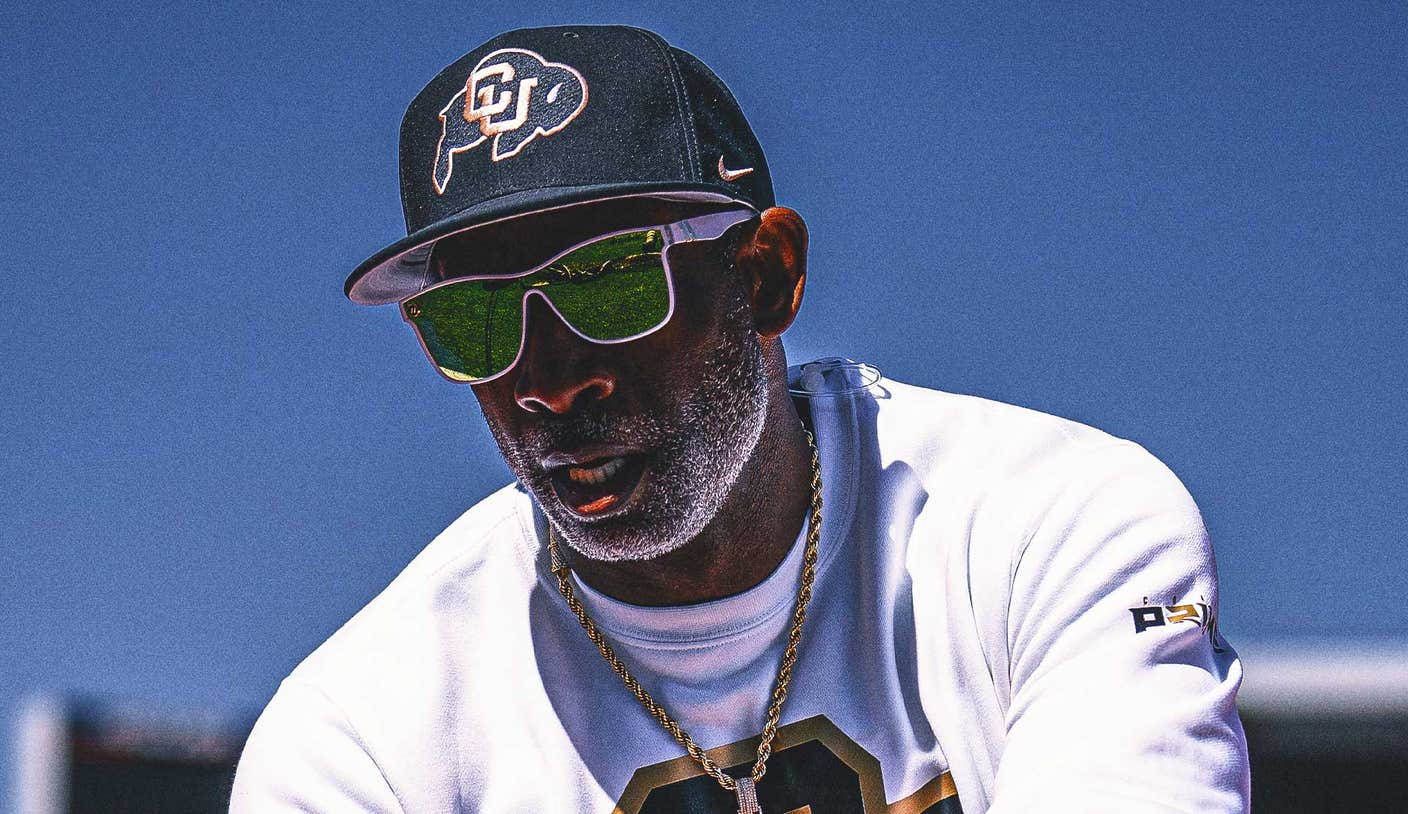

Illness Forces Deion Sanders Away From Colorado Football Latest Updates

Jun 12, 2025

Illness Forces Deion Sanders Away From Colorado Football Latest Updates

Jun 12, 2025 -

Misiorowskis Major League Debut A Look At The Brewers Future

Jun 12, 2025

Misiorowskis Major League Debut A Look At The Brewers Future

Jun 12, 2025 -

Six Key Android Updates Designed For You

Jun 12, 2025

Six Key Android Updates Designed For You

Jun 12, 2025