Rate Cut Probability Increases As Nasdaq 100 Fails To Break All-Time High Following Trade Agreement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rate Cut Probability Increases as Nasdaq 100 Fails to Break All-Time High Following Trade Agreement

The much-anticipated trade agreement between the US and China has failed to deliver the expected boost to the Nasdaq 100, raising the probability of a Federal Reserve interest rate cut. While the agreement removes some uncertainty from the market, its inability to propel the tech-heavy index to new highs signals underlying economic weakness, prompting analysts to reassess their forecasts.

This development marks a significant shift in market sentiment. Just weeks ago, a rate cut seemed unlikely. Now, however, the lackluster performance of the Nasdaq 100, a bellwether for technological innovation and economic growth, is fueling speculation about a potential easing of monetary policy.

Nasdaq 100 Stalls at Critical Juncture:

The Nasdaq 100's failure to surpass its all-time high is a key indicator. This suggests that despite the positive news on trade, investors remain cautious. Several factors could be at play, including:

- Global Economic Slowdown: Concerns about a global economic slowdown, particularly in Europe and China, are continuing to weigh on investor confidence.

- Corporate Earnings: Upcoming corporate earnings reports could reveal further signs of weakening economic activity, potentially exacerbating investor anxiety.

- Geopolitical Uncertainty: While the trade deal addresses a specific concern, broader geopolitical risks remain, contributing to market volatility.

Increased Probability of a Fed Rate Cut:

The market reaction has led many experts to predict an increased likelihood of a Federal Reserve interest rate cut in the coming months. This would aim to stimulate economic growth and counter the potential for a recession. Several leading economists have already revised their forecasts, citing the Nasdaq 100's performance as a key factor in their analysis.

What this means for Investors:

This shift in the economic landscape presents both challenges and opportunities for investors. Those holding riskier assets might experience increased volatility. However, the anticipation of a rate cut could also present buying opportunities for long-term investors. It's crucial to carefully analyze individual investment strategies and diversify portfolios to mitigate risk.

Looking Ahead:

The coming weeks will be critical. The release of corporate earnings reports and further economic data will provide more clarity on the direction of the market. The Federal Reserve's next policy meeting will be closely watched for any indication of their intentions regarding interest rates. Investors should stay informed and adapt their strategies accordingly.

Keywords: Nasdaq 100, interest rate cut, Federal Reserve, trade agreement, US-China trade, economic slowdown, market volatility, investment strategy, stock market, recession, corporate earnings, geopolitical uncertainty

Further Reading:

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rate Cut Probability Increases As Nasdaq 100 Fails To Break All-Time High Following Trade Agreement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analyzing The Steelers Offense 3 Potential Wide Receiver Additions Following Rodgers Signing

Jun 12, 2025

Analyzing The Steelers Offense 3 Potential Wide Receiver Additions Following Rodgers Signing

Jun 12, 2025 -

Mc Dermott Praises Cooks Minicamp Attendance A Positive Sign For Bills

Jun 12, 2025

Mc Dermott Praises Cooks Minicamp Attendance A Positive Sign For Bills

Jun 12, 2025 -

Updated Mc Cutchens Place In Pirates History After Passing Clemente In Home Runs

Jun 12, 2025

Updated Mc Cutchens Place In Pirates History After Passing Clemente In Home Runs

Jun 12, 2025 -

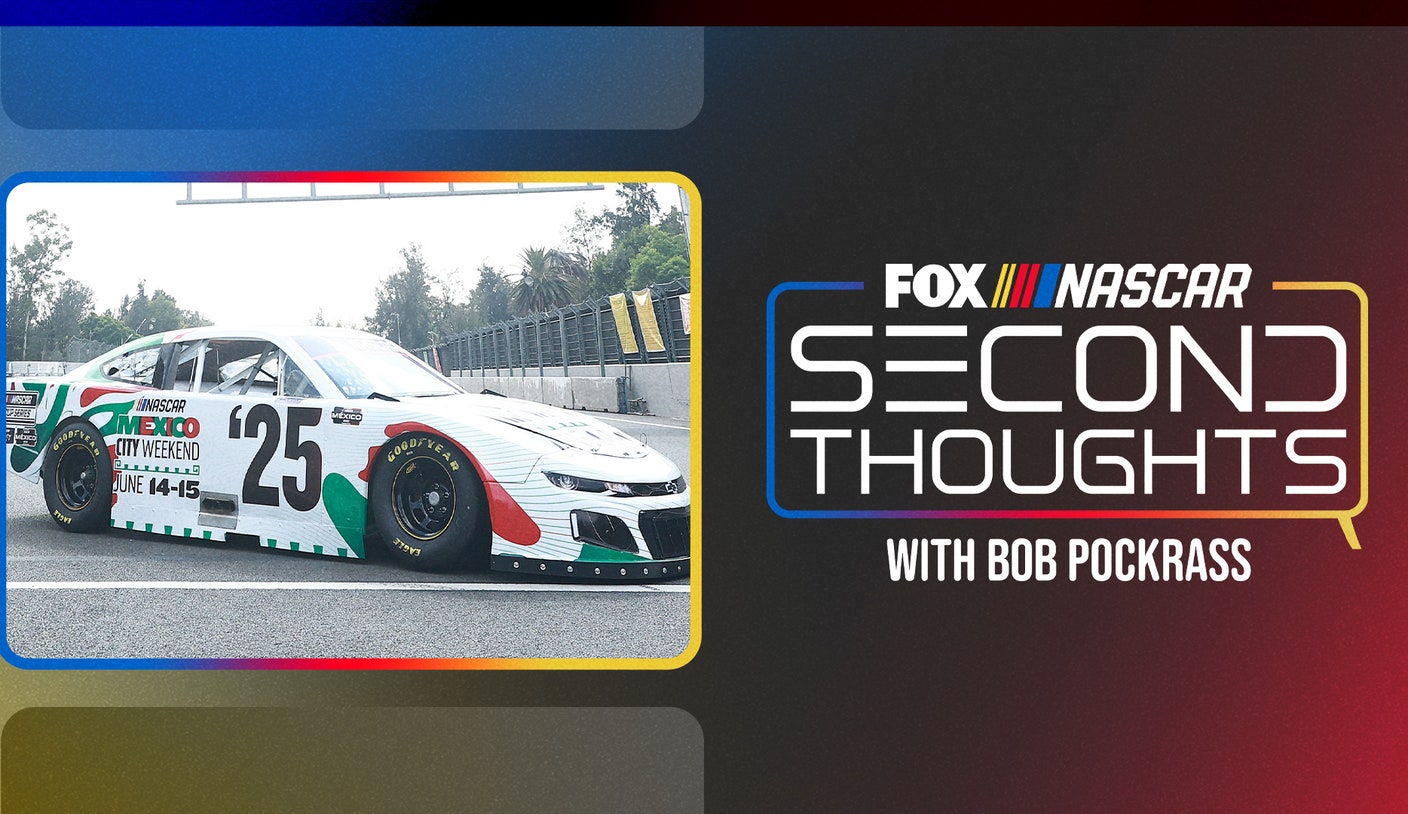

Nascar In Mexico City Worth The Investment For International Growth

Jun 12, 2025

Nascar In Mexico City Worth The Investment For International Growth

Jun 12, 2025 -

Iran Nuclear Deal Faces Setback Amid Trumps Pessimism

Jun 12, 2025

Iran Nuclear Deal Faces Setback Amid Trumps Pessimism

Jun 12, 2025