Rate Cut Outlook Shifts: Impact On U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rate Cut Outlook Shifts: Impact on U.S. Treasury Yields

The recent shift in the outlook for Federal Reserve interest rate cuts has sent ripples through the financial markets, significantly impacting U.S. Treasury yields. For months, investors anticipated a swift easing of monetary policy to combat inflation. However, persistent inflation and a resilient jobs market have forced a reassessment, leading to uncertainty and volatility in the Treasury market. This article explores the reasons behind this shift and its consequences for Treasury yields.

The Changing Narrative: From Cuts to Holds (or Even Hikes?)

The initial expectation of rate cuts stemmed from concerns about a potential economic slowdown. Inflation, while still elevated, was showing signs of cooling, and economic data pointed towards a potential recession. This narrative, however, has been challenged. Stronger-than-expected economic growth, persistent inflation, and a robust labor market have prompted the Federal Reserve to adopt a more cautious, data-dependent approach. Instead of imminent rate cuts, the possibility of holding rates steady, or even further increases, is now being discussed by economists and market analysts.

This shift has major implications for investors and the overall economy. Let's delve into the specifics:

Impact on U.S. Treasury Yields:

- Increased Yields: The expectation of higher interest rates generally leads to increased Treasury yields. When the Fed holds rates steady or raises them, investors demand higher returns on their investments to compensate for the increased risk. This results in a rise in yields across the Treasury yield curve.

- Yield Curve Dynamics: The shift in rate cut expectations impacts the shape of the yield curve. A flatter or even inverted yield curve (where short-term yields exceed long-term yields) can be a predictor of economic slowdowns or even recessions. However, the current situation is more nuanced, with the yield curve's shape reflecting the interplay of various economic factors.

- Increased Volatility: The uncertainty surrounding future interest rate decisions has led to increased volatility in the Treasury market. Yields are fluctuating more frequently and with larger magnitudes, creating challenges for investors trying to manage risk.

What This Means for Investors:

The changing outlook necessitates a reassessment of investment strategies. Investors holding Treasury bonds might experience capital losses if yields continue to rise. On the other hand, rising yields can present opportunities for new investments, particularly for those with a longer-term horizon. It's crucial for investors to consult with financial advisors to tailor their portfolios to the evolving economic landscape.

Looking Ahead:

The future direction of U.S. Treasury yields depends heavily on several key factors: the persistence of inflation, the strength of the labor market, and the Federal Reserve's future policy decisions. Closely monitoring economic indicators, including inflation data (CPI and PCE), employment reports (non-farm payrolls), and Federal Reserve statements, is crucial for navigating this period of uncertainty.

Further Reading:

Call to Action: Stay informed about economic developments and consult with a financial professional to adjust your investment strategy accordingly. The evolving landscape requires careful planning and a proactive approach to managing risk and maximizing returns.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rate Cut Outlook Shifts: Impact On U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stock Market Soars S And P 500s 6 Day Rally Dow And Nasdaq Gains Defy Moodys Downgrade

May 20, 2025

Stock Market Soars S And P 500s 6 Day Rally Dow And Nasdaq Gains Defy Moodys Downgrade

May 20, 2025 -

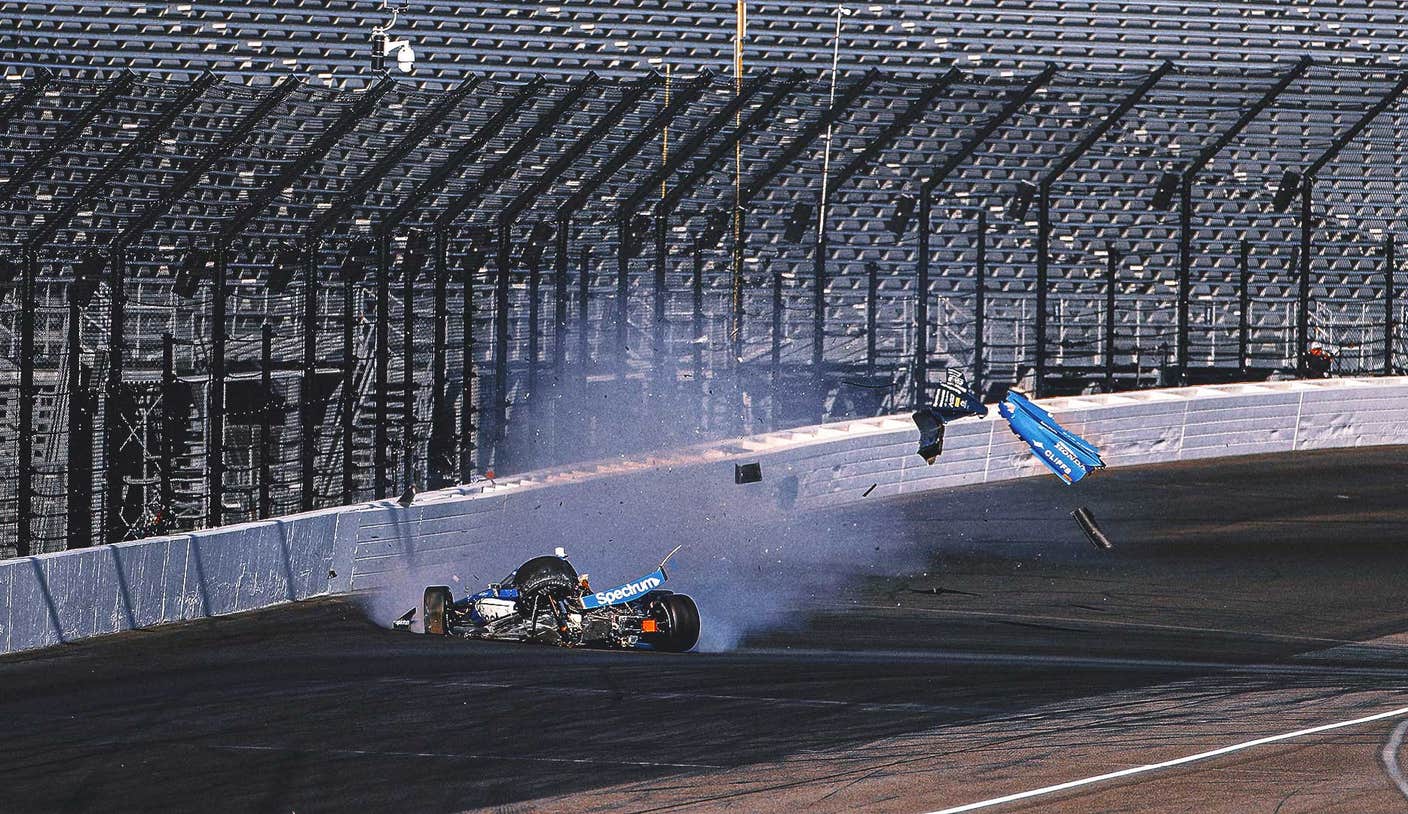

Multiple Crashes Rock Indy 500 Pre Race Preparations

May 20, 2025

Multiple Crashes Rock Indy 500 Pre Race Preparations

May 20, 2025 -

Cannes Film Festival Kevin Spaceys Unanticipated Award Acceptance

May 20, 2025

Cannes Film Festival Kevin Spaceys Unanticipated Award Acceptance

May 20, 2025 -

Nascar All Star Race At North Wilkesboro Live Updates And Race Results

May 20, 2025

Nascar All Star Race At North Wilkesboro Live Updates And Race Results

May 20, 2025 -

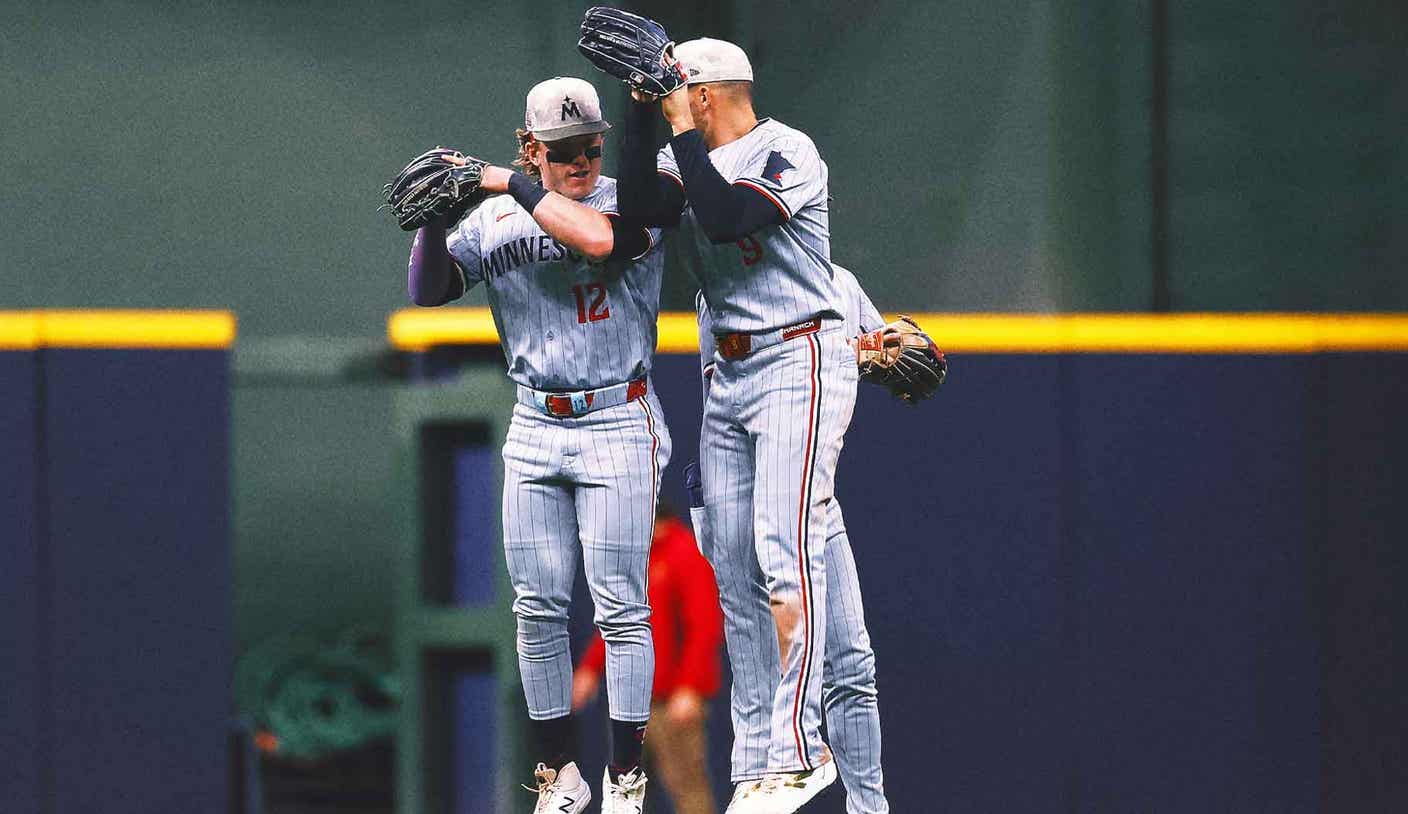

Mlb Powerhouse Twins 13 Game Winning Streak Breaks Record

May 20, 2025

Mlb Powerhouse Twins 13 Game Winning Streak Breaks Record

May 20, 2025