Rate Cut Expectations Surge As Nasdaq 100 Misses All-Time High Despite Trade Deal Progress

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rate Cut Expectations Surge as Nasdaq 100 Misses All-Time High Despite Trade Deal Progress

Markets react cautiously to the latest trade developments, fueling speculation of imminent Federal Reserve intervention.

The global markets experienced a rollercoaster ride today, with the Nasdaq 100 narrowly missing a record high despite significant progress in US-China trade negotiations. This seemingly contradictory situation has sent ripples through the financial world, igniting a surge in expectations for an upcoming Federal Reserve interest rate cut. While a "Phase One" trade deal is closer than ever, anxieties about the broader economic outlook remain prominent.

The Nasdaq's failure to breach its all-time high, despite positive trade news, highlights a complex interplay of factors influencing investor sentiment. While the de-escalation of trade tensions is undoubtedly a positive development, concerns about global growth and the potential impact of ongoing geopolitical uncertainties continue to weigh heavily on market confidence.

Trade Deal Optimism vs. Economic Uncertainty:

The latest developments in the US-China trade war have undoubtedly boosted investor morale. The anticipated "Phase One" deal promises to alleviate some of the tariffs imposed on billions of dollars worth of goods, potentially easing supply chain disruptions and boosting business confidence. However, this optimism is tempered by several key factors:

- Global Economic Slowdown: The International Monetary Fund (IMF) recently lowered its global growth forecast, citing persistent weakness in major economies. This underscores a broader concern that even with a trade deal, the global economy is facing headwinds.

- Inflation Concerns: While some believe a rate cut is necessary to stimulate growth, others worry it could fuel inflation. The current inflation rate remains relatively low, but any significant increase could counteract the benefits of a rate cut.

- Geopolitical Risks: Ongoing tensions in various parts of the world, from the Middle East to Europe, continue to create uncertainty and impact investor risk appetite.

The Case for a Rate Cut:

The market's reaction suggests that many believe a rate cut is not just desirable, but necessary. The failure of the Nasdaq to hit a new high, despite positive trade news, points towards deeper underlying anxieties about economic growth. Analysts are increasingly predicting that the Federal Reserve will lower interest rates in the coming months to counteract the potential negative impact of a global slowdown.

What's Next?

The coming weeks will be crucial in determining the direction of the markets. Further details regarding the "Phase One" trade deal are expected soon, which could further influence investor sentiment. The Federal Reserve's next meeting will also be closely watched, as investors eagerly await any indication of their future monetary policy decisions. [Link to Federal Reserve website]

Looking Ahead: Investors should carefully consider diversifying their portfolios and monitoring macroeconomic indicators closely. Staying informed about global events and economic forecasts is crucial for navigating this period of uncertainty. Consult with a financial advisor for personalized advice tailored to your investment goals and risk tolerance.

Keywords: Nasdaq 100, Interest Rate Cut, Federal Reserve, Trade Deal, US-China Trade War, Economic Growth, Global Economy, Market Volatility, Investment Strategy, Financial Advice

Internal Links (example - replace with actual links if applicable):

- [Link to a previous article about the US-China trade war]

- [Link to an article discussing global economic slowdown]

External Links (example - replace with actual links):

- [Link to the International Monetary Fund (IMF) website]

- [Link to a reputable financial news source]

This article is for informational purposes only and does not constitute financial advice. Consult a qualified professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rate Cut Expectations Surge As Nasdaq 100 Misses All-Time High Despite Trade Deal Progress. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Scottie Schefflers U S Open Reign A Look At The Competitions Strategy

Jun 12, 2025

Scottie Schefflers U S Open Reign A Look At The Competitions Strategy

Jun 12, 2025 -

James Cooks Minicamp Performance Positive Feedback From Buffalo Bills Coach

Jun 12, 2025

James Cooks Minicamp Performance Positive Feedback From Buffalo Bills Coach

Jun 12, 2025 -

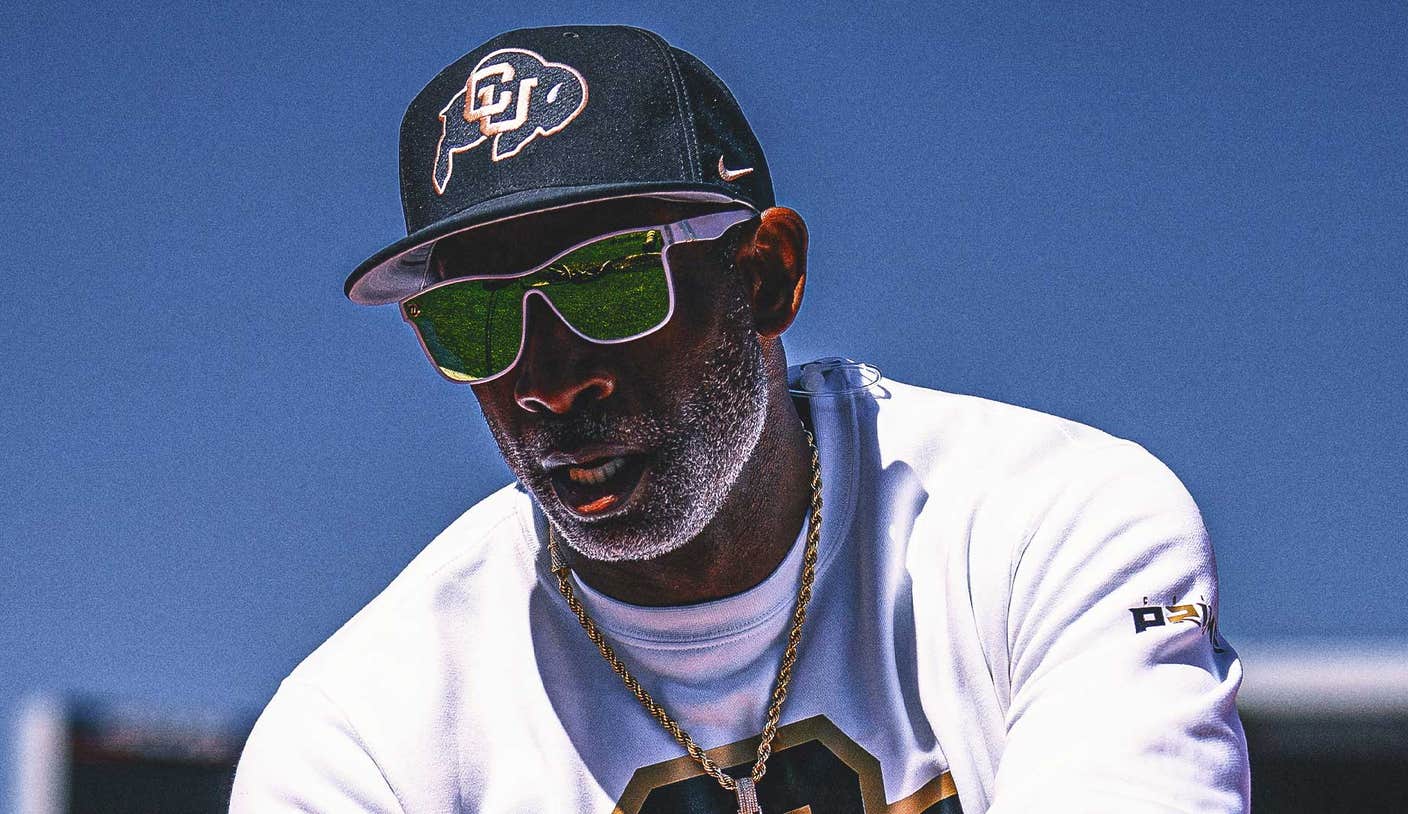

Reports Colorados Deion Sanders Dealing With Undisclosed Illness

Jun 12, 2025

Reports Colorados Deion Sanders Dealing With Undisclosed Illness

Jun 12, 2025 -

Nhl Futures Draft Bruins Add Overocker To Prospect Pool

Jun 12, 2025

Nhl Futures Draft Bruins Add Overocker To Prospect Pool

Jun 12, 2025 -

Seahawks Noah Brown Suffers Injury During Wednesday Practice

Jun 12, 2025

Seahawks Noah Brown Suffers Injury During Wednesday Practice

Jun 12, 2025