Quit Job, Cashed 401(k), Sailed To Hawaii: An Oregon Man's Unconventional Retirement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Quit Job, Cashed 401(k), Sailed to Hawaii: An Oregon Man's Unconventional Retirement

The American Dream, Reimagined: For many, retirement conjures images of quiet afternoons on a porch swing, gentle rocking chairs, and the rhythmic ticking of a grandfather clock. But for 58-year-old Oregon resident, Mark Johnson, retirement looks a little different. It involves turquoise waters, salty sea air, and the gentle sway of a sailboat in the Hawaiian archipelago. Johnson's unconventional retirement plan – cashing out his 401(k) and sailing to Hawaii – is making waves online, sparking conversations about financial freedom and pursuing unconventional life paths.

Johnson, a former software engineer, spent years meticulously planning his escape. "The corporate grind was wearing me down," he explained in a recent interview. "I realized I was trading my life for a paycheck, and that wasn't a trade I wanted to make anymore." This sentiment resonates with many feeling the pressure of modern work culture, leading to a growing interest in early retirement and financial independence.

From Code to Coastline: Planning the Great Escape

Johnson's journey wasn't impulsive. He meticulously planned his finances for years, carefully considering the implications of cashing out his 401(k). While financial advisors often caution against this strategy due to potential tax penalties and the loss of long-term investment growth, Johnson’s careful planning mitigated these risks. He invested significantly in passive income streams before leaving his job and detailed a budget that prioritized essential needs while maintaining a safety net.

His plan involved:

- Minimizing expenses: He downsized his living situation, sold his car, and adopted a minimalist lifestyle.

- Diversifying income: He explored several passive income opportunities, including rental properties and online courses, to supplement his 401(k) payout.

- Investing in sailing education: He enrolled in sailing courses and gained extensive experience before embarking on his solo voyage.

- Thorough research and planning: He meticulously researched weather patterns, navigation routes, and potential challenges of a solo transpacific voyage.

This highlights the importance of detailed retirement planning and considering alternative strategies beyond traditional retirement accounts.

The Open Sea and the Open Road: Life in Hawaii

Johnson’s journey wasn’t without challenges. He faced rough seas, equipment malfunctions, and the occasional bout of loneliness. However, he views these as mere bumps in the road compared to the immense freedom he's found. He now spends his days exploring the Hawaiian islands, snorkeling in crystal-clear waters, and connecting with the local community. He documents his experiences on a popular travel blog, attracting a large following of people inspired by his unconventional lifestyle.

Lessons Learned: A New Paradigm for Retirement?

Johnson's story presents a compelling alternative to the traditional retirement narrative. It prompts us to consider:

- The importance of financial literacy: Understanding your finances and exploring various investment options is crucial for achieving financial freedom.

- The value of pursuing passions: Retirement shouldn't be the end of life's adventures, but a new beginning.

- The potential of unconventional paths: There's no one-size-fits-all approach to retirement. Finding what works best for you is key.

While Johnson's journey is undoubtedly unique, it underscores a broader shift in societal attitudes toward retirement and financial independence. More and more people are re-evaluating their priorities and seeking alternative paths to a fulfilling life beyond the traditional workplace. His story serves as an inspiring example, challenging the conventional wisdom and encouraging others to dream big and explore their own unconventional retirement possibilities. Are you ready to redefine your own retirement plan? Share your thoughts in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Quit Job, Cashed 401(k), Sailed To Hawaii: An Oregon Man's Unconventional Retirement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Updated Cfp Championship Odds For 2025 Osu And Texas Still Leading

May 26, 2025

Updated Cfp Championship Odds For 2025 Osu And Texas Still Leading

May 26, 2025 -

Aaron Rodgers Steelers Next Comments Fuel Nfl Trade Speculation

May 26, 2025

Aaron Rodgers Steelers Next Comments Fuel Nfl Trade Speculation

May 26, 2025 -

Oregon Job Quitter Sails 2 000 Miles To Hawaii With His Cat

May 26, 2025

Oregon Job Quitter Sails 2 000 Miles To Hawaii With His Cat

May 26, 2025 -

2 000 Mile Voyage Oregon Mans Post Retirement Sailing Trip To Hawaii

May 26, 2025

2 000 Mile Voyage Oregon Mans Post Retirement Sailing Trip To Hawaii

May 26, 2025 -

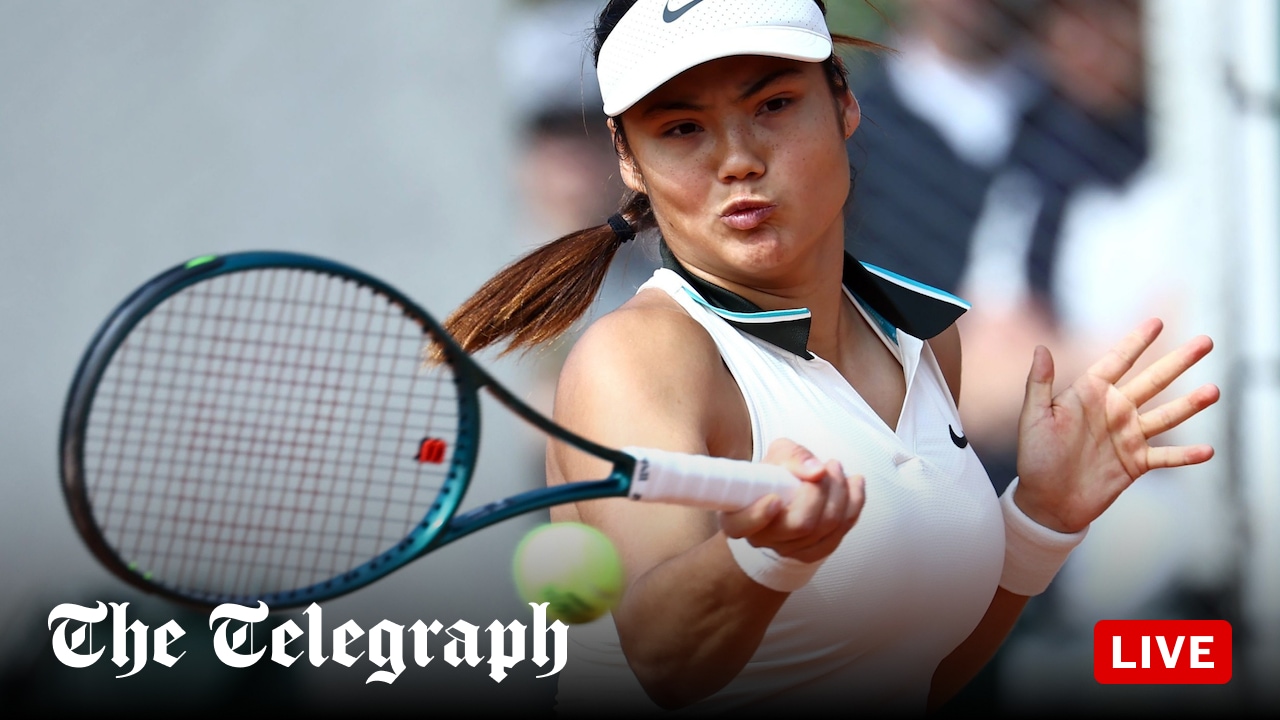

Wang Xinyu Vs Emma Raducanu French Open Live Updates And Results

May 26, 2025

Wang Xinyu Vs Emma Raducanu French Open Live Updates And Results

May 26, 2025