Proposed Swiss Capital Rules Deal A Blow To UBS's Financial Stability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Proposed Swiss Capital Rules Deal a Blow to UBS's Financial Stability

UBS, the newly merged giant of Swiss banking, faces significant headwinds following the proposal of new capital rules by Swiss regulators. The proposed changes, aimed at bolstering the stability of the Swiss financial system, are viewed by analysts as a substantial setback for UBS's financial stability and its post-Credit Suisse merger integration strategy. This development sends ripples through the global financial markets, raising concerns about the broader impact on systemic risk and regulatory oversight.

The Swiss Financial Market Supervisory Authority (FINMA) is pushing for stricter capital requirements for systemically important banks, a direct response to the turbulent events surrounding Credit Suisse's collapse and subsequent takeover by UBS. While intended to prevent future banking crises, these stricter rules could significantly impact UBS's profitability and ability to execute its planned restructuring.

<h3>Increased Capital Requirements: A Major Hurdle for UBS</h3>

The proposed rules include a significant increase in the capital buffer that UBS must maintain, exceeding the already stringent Basel III accords. This translates to a larger amount of capital – a substantial portion of its assets – that UBS must hold in reserve, limiting its capacity for lending, investment, and shareholder returns. This is particularly challenging given the considerable integration costs and potential losses associated with absorbing Credit Suisse's assets and liabilities.

The increased capital requirements are not merely a matter of increased regulatory burden; they represent a fundamental shift in the risk assessment of UBS's operations. The regulators are clearly prioritizing systemic stability over individual bank profitability, a move that reflects the global anxieties surrounding the fragility of the financial system.

<h3>Impact on UBS's Restructuring and Future Growth</h3>

The new capital rules add considerable complexity to UBS's already ambitious restructuring plan. The integration of Credit Suisse's sprawling operations is a monumental task, requiring significant investment and operational streamlining. The added financial constraint imposed by the higher capital requirements could hamper these efforts, potentially delaying cost-cutting measures and extending the timeline for achieving profitability targets.

- Reduced Lending Capacity: Higher capital requirements directly limit UBS's ability to lend, potentially impacting its market share and revenue generation in crucial sectors.

- Delayed Investment: The need to bolster capital reserves may force UBS to postpone or scale back planned investments in technology upgrades, expansion into new markets, and talent acquisition.

- Lower Shareholder Returns: With a larger portion of its capital tied up in reserves, UBS may be forced to reduce dividend payouts and share buybacks, disappointing investors.

<h3>Wider Implications for the Swiss and Global Financial Systems</h3>

The proposed changes are not isolated to UBS. They signify a broader trend toward stricter regulations for systemically important banks globally. This move reflects a growing awareness of the interconnectedness of the financial system and the potential for contagion effects stemming from the failure of a major institution. The implications extend beyond Switzerland, influencing regulatory discussions and capital requirements in other major financial hubs worldwide. This heightened scrutiny underscores the need for greater transparency and robust risk management practices within the banking sector.

Conclusion: The proposed Swiss capital rules represent a significant challenge for UBS, potentially jeopardizing its financial stability and hindering its post-merger integration plans. While the intention is to safeguard the Swiss financial system, the impact on UBS’s operational capacity and future growth warrants careful consideration. The situation highlights the evolving regulatory landscape for global systemically important banks and underscores the ongoing need for robust risk management and regulatory oversight. Further developments in this evolving situation will be closely watched by investors and financial analysts globally.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Proposed Swiss Capital Rules Deal A Blow To UBS's Financial Stability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

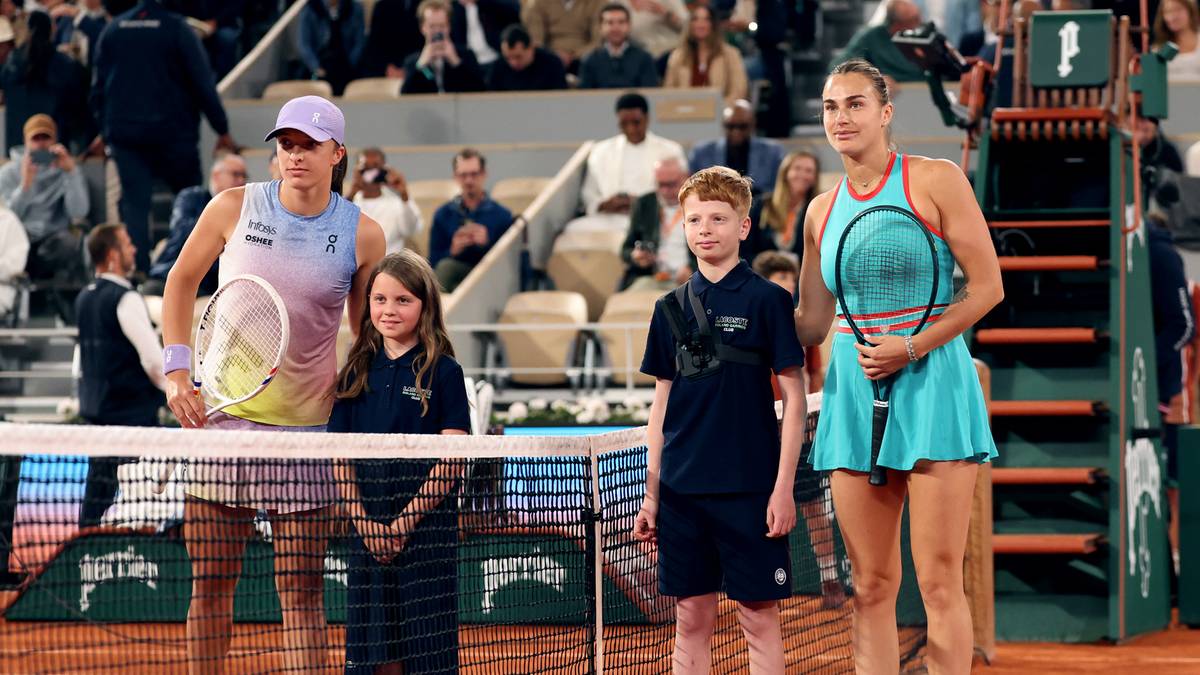

Roland Garros 2024 Swiatek Sabalenka Transmisja Live I Wyniki Online

Jun 06, 2025

Roland Garros 2024 Swiatek Sabalenka Transmisja Live I Wyniki Online

Jun 06, 2025 -

Expert Horse Racing Picks Chris The Bear Fallicas Predictions For The 2025 Belmont Stakes

Jun 06, 2025

Expert Horse Racing Picks Chris The Bear Fallicas Predictions For The 2025 Belmont Stakes

Jun 06, 2025 -

Controversy At Track Event Fan Duels Response To Bettors Behavior Towards Gabby Thomas

Jun 06, 2025

Controversy At Track Event Fan Duels Response To Bettors Behavior Towards Gabby Thomas

Jun 06, 2025 -

2025 Green Bay Packers Predicting Wins Losses And Divisional Showdowns

Jun 06, 2025

2025 Green Bay Packers Predicting Wins Losses And Divisional Showdowns

Jun 06, 2025 -

Why Ibms Stock Price Is Falling Behind The Market

Jun 06, 2025

Why Ibms Stock Price Is Falling Behind The Market

Jun 06, 2025