Prediction Platform Polymarket Weighs Its Own Stablecoin: Implications For The Crypto Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Prediction Platform Polymarket Weighs its Own Stablecoin: Implications for the Crypto Market

The decentralized prediction market platform, Polymarket, is exploring the launch of its own stablecoin, sending ripples through the cryptocurrency community. This move has significant implications for the broader crypto market, potentially impacting trading volume, liquidity, and the overall adoption of stablecoins. But what exactly does this mean, and what are the potential consequences?

Polymarket's Ambitious Gamble:

Polymarket, known for its unique approach to prediction markets and its focus on transparency, is venturing into a competitive arena dominated by established players like Tether (USDT) and USD Coin (USDC). The platform's foray into stablecoin issuance aims to enhance its existing ecosystem, offering users a smoother and more integrated trading experience. By creating its own stablecoin, Polymarket hopes to reduce reliance on external stablecoins and potentially improve transaction speeds and fees within its platform.

Potential Benefits and Challenges:

The launch of a Polymarket-branded stablecoin could bring several advantages:

- Increased Liquidity: A dedicated stablecoin could significantly boost liquidity within Polymarket's prediction markets, facilitating faster and more efficient trading.

- Reduced Dependence on External Stablecoins: This reduces the platform's vulnerability to the volatility and potential risks associated with other stablecoins.

- Enhanced User Experience: A seamless integration with the platform could streamline the user experience, making it more attractive to newcomers and seasoned traders alike.

- New Revenue Streams: The issuance and management of a stablecoin could open up new revenue streams for Polymarket.

However, significant challenges also lie ahead:

- Regulatory Hurdles: The regulatory landscape for stablecoins is constantly evolving and highly complex. Navigating these complexities will be crucial for Polymarket's success. Compliance with regulations like those recently proposed by the US Securities and Exchange Commission (SEC) will be paramount.

- Maintaining Peg Stability: Maintaining the 1:1 peg to the US dollar is the cornerstone of any successful stablecoin. Polymarket will need robust mechanisms to ensure the stability of its coin and prevent significant price fluctuations.

- Competition: The stablecoin market is intensely competitive, with several established players holding significant market share. Polymarket will need a compelling value proposition to attract users and differentiate itself from the competition.

- Security Risks: Like all cryptocurrencies, stablecoins are vulnerable to hacking and other security threats. Polymarket will need to invest heavily in robust security measures to protect its users' assets.

Implications for the Broader Crypto Market:

Polymarket's move could influence the broader crypto market in several ways:

- Increased Competition: The introduction of a new stablecoin increases competition within the market, potentially leading to innovation and improvements in existing stablecoin technologies.

- Market Fragmentation: The proliferation of stablecoins could lead to market fragmentation, potentially making it more difficult for users to navigate the ecosystem.

- Enhanced Innovation: The increased competition could drive innovation in stablecoin technologies, leading to the development of more efficient and secure stablecoins.

Conclusion:

Polymarket's exploration of its own stablecoin is a significant development with far-reaching implications for the cryptocurrency market. While the potential benefits are considerable, the challenges are substantial. The success of this venture will depend heavily on Polymarket's ability to navigate the regulatory landscape, maintain peg stability, and compete effectively in a crowded market. The coming months will be crucial in determining the impact of this ambitious undertaking. We will continue to monitor developments and provide updates as they emerge. Stay tuned for further analysis and insights into the evolving landscape of stablecoins and decentralized prediction markets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Prediction Platform Polymarket Weighs Its Own Stablecoin: Implications For The Crypto Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

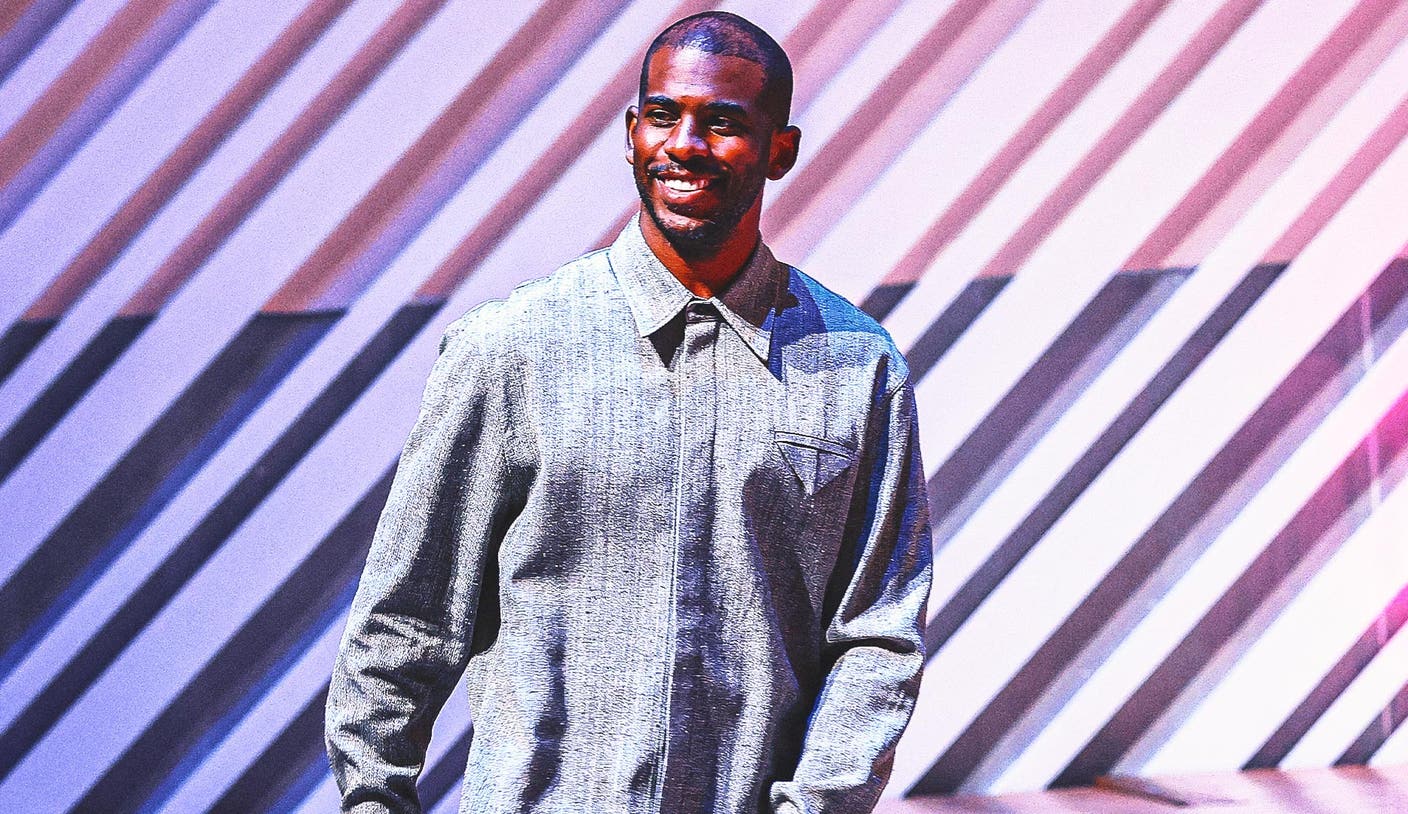

Chris Pauls Nba Return Clippers Reunion For Season 21

Jul 24, 2025

Chris Pauls Nba Return Clippers Reunion For Season 21

Jul 24, 2025 -

Gma Vs Cbs Mornings Todays Ratings Showdown

Jul 24, 2025

Gma Vs Cbs Mornings Todays Ratings Showdown

Jul 24, 2025 -

Your Guide To The Best Gma Deals And Steals Home And Kitchen Edition

Jul 24, 2025

Your Guide To The Best Gma Deals And Steals Home And Kitchen Edition

Jul 24, 2025 -

Save Big Gmas Home And Kitchen Deals And Steals Revealed

Jul 24, 2025

Save Big Gmas Home And Kitchen Deals And Steals Revealed

Jul 24, 2025 -

Behind The Scenes Harrison Fords Emotional Final Day Filming Shrinking Season 3

Jul 24, 2025

Behind The Scenes Harrison Fords Emotional Final Day Filming Shrinking Season 3

Jul 24, 2025

Latest Posts

-

On The Bubble Which Nfl Teams Are Most Likely To Secure A 2023 Postseason Spot

Jul 26, 2025

On The Bubble Which Nfl Teams Are Most Likely To Secure A 2023 Postseason Spot

Jul 26, 2025 -

Espn Report Jonathan Kuminga In No Hurry To Sign With Golden State

Jul 26, 2025

Espn Report Jonathan Kuminga In No Hurry To Sign With Golden State

Jul 26, 2025 -

Detroit Lions O Line A Year Of Regression From Elite To Work In Progress

Jul 26, 2025

Detroit Lions O Line A Year Of Regression From Elite To Work In Progress

Jul 26, 2025 -

Mookie Betts Injury Update Dodgers Stars Status Uncertain For Boston Series

Jul 26, 2025

Mookie Betts Injury Update Dodgers Stars Status Uncertain For Boston Series

Jul 26, 2025 -

Dolphins Matos Recovering Well From Training Camp Setback

Jul 26, 2025

Dolphins Matos Recovering Well From Training Camp Setback

Jul 26, 2025