Pre-Earnings Options Trading: A Practical Guide For Broadcom Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Pre-Earnings Options Trading: A Practical Guide for Broadcom Investors

Broadcom (AVGO) is a tech giant, and its earnings reports significantly impact its stock price. For investors looking to potentially capitalize on this volatility, pre-earnings options trading presents a compelling, albeit risky, opportunity. This guide provides a practical overview of pre-earnings options strategies for Broadcom investors, focusing on risk management and informed decision-making. Disclaimer: Options trading involves substantial risk and may not be suitable for all investors.

Understanding the Volatility Around Broadcom Earnings

Broadcom's earnings announcements are typically major market events. The company's performance in the semiconductor and infrastructure software sectors influences investor sentiment, leading to potentially significant price swings in the days surrounding the release. This heightened volatility is precisely what makes pre-earnings options trading attractive, but also incredibly risky. Successful traders understand this volatility and plan accordingly.

Popular Pre-Earnings Options Strategies for AVGO

Several strategies exist for navigating the pre-earnings period. Here are a few popular choices, each with its own risk/reward profile:

-

Long Calls: This bullish strategy involves purchasing call options, betting on a price increase above the strike price before the earnings announcement. The potential profit is substantial, but the risk is limited to the premium paid. However, if the price falls, the entire premium is lost.

-

Long Puts: This bearish strategy is the opposite of long calls. You purchase put options, anticipating a price decline below the strike price. Profit potential is significant if the price falls, but the entire premium is lost if the price rises.

-

Straddles and Strangles: These strategies involve buying both a call and a put option with the same expiration date. A straddle uses options with the same strike price (at the money), while a strangle uses options with different strike prices (out of the money). These are neutral strategies, profiting from significant price movement in either direction, but losing money if the price remains relatively stable.

-

Iron Condors and Iron Butterflies: These are more complex, defined-risk strategies that profit from limited price movement. They limit potential losses while capping potential gains. These are suitable for investors comfortable with more intricate options trading.

Risk Management: The Cornerstone of Pre-Earnings Trading

Successfully navigating pre-earnings options trading requires meticulous risk management. Consider these key points:

- Define your risk tolerance: Before entering any trade, determine how much you're willing to lose. Never invest more than you can afford to lose.

- Analyze Broadcom's fundamentals: Don't rely solely on technical analysis. Thoroughly research Broadcom's financial reports, industry trends, and analyst predictions. Understanding the company's prospects is crucial.

- Manage position size: Don't put all your eggs in one basket. Diversify your portfolio and avoid over-leveraging.

- Use stop-loss orders: These orders automatically sell your position when the price reaches a predetermined level, limiting potential losses.

- Understand implied volatility: Implied volatility (IV) reflects market expectations of future price fluctuations. Higher IV typically means higher option premiums, increasing the cost of your trades.

Resources for Broadcom Investors

Staying informed is paramount for successful options trading. Consider utilizing these resources:

- Broadcom Investor Relations: The official website provides financial reports, press releases, and SEC filings.

- Financial News Websites: Stay updated on market news and analyst opinions from reputable sources like Bloomberg, Reuters, and the Financial Times.

- Options Trading Platforms: Many platforms offer educational resources and tools to help you understand options trading.

Conclusion: Weighing the Risks and Rewards

Pre-earnings options trading on Broadcom can be lucrative, but it's crucial to approach it with a well-defined strategy and a strong understanding of risk management. By thoroughly researching Broadcom's fundamentals, understanding the various options strategies, and managing your risk effectively, you can increase your chances of success. Remember to always consult with a financial advisor before making any investment decisions. This article is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Pre-Earnings Options Trading: A Practical Guide For Broadcom Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pre Earnings Broadcom Options Trading Risk Management And Potential Returns

Jun 06, 2025

Pre Earnings Broadcom Options Trading Risk Management And Potential Returns

Jun 06, 2025 -

Packers 2025 A Comprehensive Game By Game Prediction And Nfc North Showdown

Jun 06, 2025

Packers 2025 A Comprehensive Game By Game Prediction And Nfc North Showdown

Jun 06, 2025 -

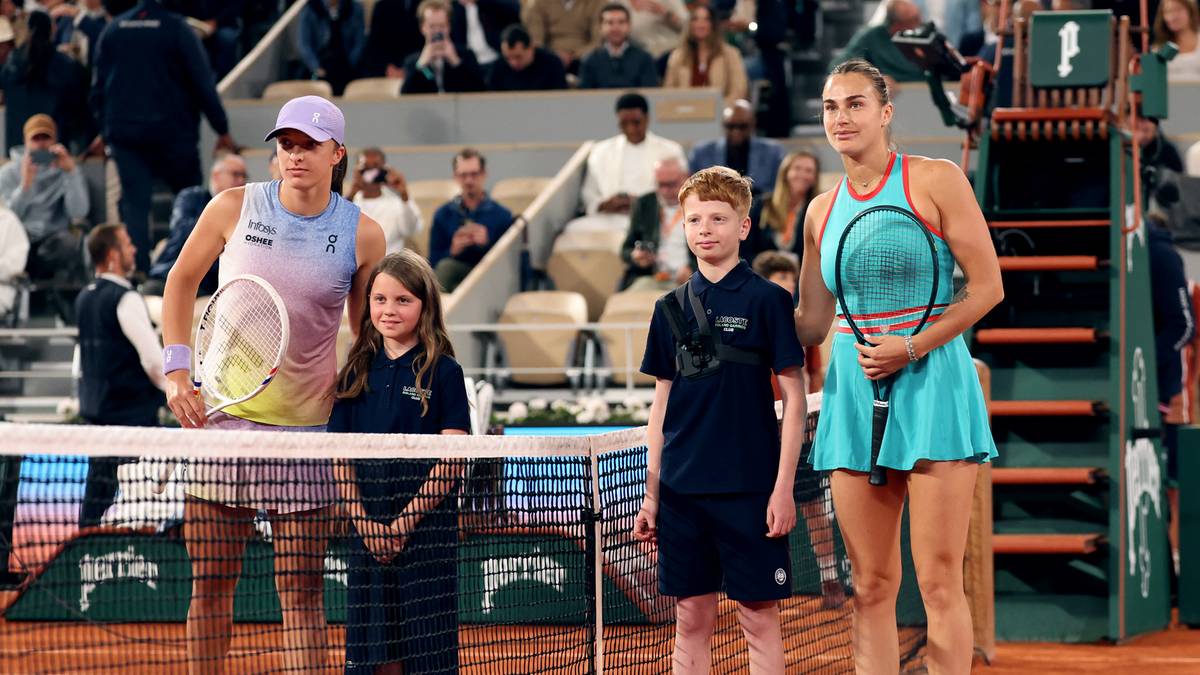

Roland Garros Swiatek Sabalenka Wynik Meczu I Relacja Live Online

Jun 06, 2025

Roland Garros Swiatek Sabalenka Wynik Meczu I Relacja Live Online

Jun 06, 2025 -

Expanding Scandal Additional Sexual Misconduct Allegations Filed Against Ex Indiana Sports Doctor

Jun 06, 2025

Expanding Scandal Additional Sexual Misconduct Allegations Filed Against Ex Indiana Sports Doctor

Jun 06, 2025 -

Texas Defeats Texas Tech In Wcws Game 1 Atwoods Stellar Pitching Seals Victory

Jun 06, 2025

Texas Defeats Texas Tech In Wcws Game 1 Atwoods Stellar Pitching Seals Victory

Jun 06, 2025