Post-Earnings: Broadcom Stock Price Predictions From Top Traders

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Post-Earnings: Broadcom Stock Price Predictions from Top Traders

Broadcom (AVGO) recently released its earnings report, sending ripples through the financial world. Investors are now scrambling to understand what this means for the future and, crucially, the stock price. This article dives into the post-earnings analysis from top traders, offering insights into their Broadcom stock price predictions and the reasoning behind their forecasts. We'll examine both bullish and bearish perspectives to provide a comprehensive overview.

Broadcom's Q[Quarter] Earnings Report: A Quick Recap

Before we delve into the predictions, let's briefly review the key takeaways from Broadcom's latest earnings report. [Insert concise summary of the earnings report, including key figures like EPS, revenue, and guidance. Link to the official Broadcom earnings release here. Example: "Broadcom exceeded analysts' expectations, reporting an EPS of $X.XX, exceeding the projected $X.XX. Revenue also came in higher than anticipated at $Y billion, compared to the projected $Z billion. However, the company's guidance for the next quarter was slightly below expectations."] This mixed performance has created a climate of uncertainty, leading to diverse opinions among market analysts.

Bullish Predictions: Why Some See a Bright Future for AVGO

Several prominent traders remain bullish on Broadcom's prospects. Their optimism often stems from [mention specific reasons, for example, strong long-term growth in the semiconductor industry, Broadcom's strategic acquisitions, positive outlook in key markets like 5G and AI, or a belief that the current dip is a buying opportunity].

- Analyst A's Prediction: [Quote analyst's prediction and briefly explain their reasoning. Include a link to their analysis if available. Example: "Analyst A at [Investment Firm] predicts a price target of $XXX within the next 12 months, citing Broadcom's strong market position in the infrastructure software market as a key driver." ]

- Analyst B's Prediction: [Repeat the above structure for another bullish analyst.]

Bearish Predictions: Concerns and Cautious Outlooks

Conversely, some traders express caution regarding Broadcom's future performance. Their bearish sentiment is often rooted in [mention specific concerns, for example, macroeconomic headwinds, potential competition, concerns about the company's guidance, or valuation concerns].

- Analyst C's Prediction: [Quote analyst's prediction and briefly explain their reasoning. Include a link to their analysis if available. Example: "Analyst C at [Investment Firm] holds a more conservative view, suggesting a price target of $YYY, highlighting concerns about potential supply chain disruptions."]

- Analyst D's Prediction: [Repeat the above structure for another bearish analyst.]

Factors Influencing Broadcom Stock Price:

Several key factors will significantly influence Broadcom's stock price in the coming months:

- Macroeconomic Conditions: Global economic uncertainty and inflation remain significant risks.

- Industry Trends: The semiconductor industry's overall performance will play a crucial role.

- Competitive Landscape: Competition from other chipmakers could impact Broadcom's market share.

- Technological Advancements: Broadcom's ability to innovate and adapt to new technologies will be vital.

Conclusion: Navigating Uncertainty

The post-earnings analysis of Broadcom reveals a divergence of opinions among top traders. While some are optimistic about the company's future growth potential, others express caution due to various market factors. Investors should carefully consider these diverse perspectives and conduct their own thorough research before making any investment decisions. Remember that stock market predictions are inherently uncertain, and past performance is not indicative of future results.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

(Optional CTA): Stay updated on the latest market analysis by subscribing to our newsletter [link to newsletter signup].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Post-Earnings: Broadcom Stock Price Predictions From Top Traders. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Teyana Taylors New Video A Steamy Kiss With Aaron Pierre Ignites Romance Rumors

Jun 06, 2025

Teyana Taylors New Video A Steamy Kiss With Aaron Pierre Ignites Romance Rumors

Jun 06, 2025 -

Karl Anthony Towns Injury Update Sources Detail Knee And Finger Treatment

Jun 06, 2025

Karl Anthony Towns Injury Update Sources Detail Knee And Finger Treatment

Jun 06, 2025 -

Nfl News Rashod Bateman And The Ravens Agree To Long Term Deal

Jun 06, 2025

Nfl News Rashod Bateman And The Ravens Agree To Long Term Deal

Jun 06, 2025 -

Boston Police Officer Faces No Blowback After Tense Karen Read Trial Exchange

Jun 06, 2025

Boston Police Officer Faces No Blowback After Tense Karen Read Trial Exchange

Jun 06, 2025 -

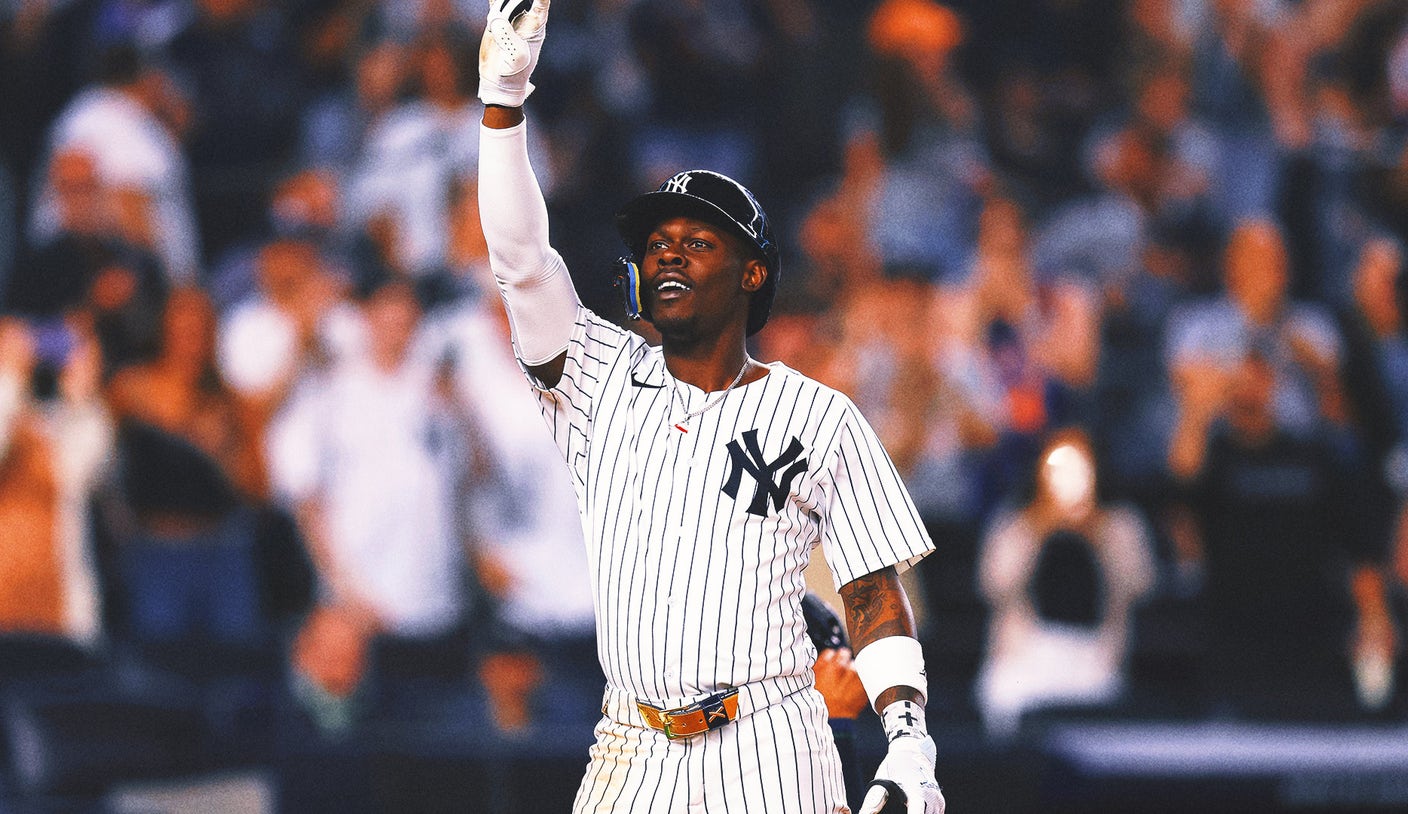

Injury Comeback Game Winning Home Run Chisholm Jr Leads Yankees To Victory

Jun 06, 2025

Injury Comeback Game Winning Home Run Chisholm Jr Leads Yankees To Victory

Jun 06, 2025