Over $5 Billion Pours Into Bitcoin ETFs: A Look At The Bold Investment Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Pours into Bitcoin ETFs: A Look at the Bold Investment Strategies

The cryptocurrency market is buzzing with excitement as over $5 billion has flooded into Bitcoin exchange-traded funds (ETFs) in recent weeks. This massive influx of capital signifies a significant shift in institutional investor sentiment, marking a potential turning point for Bitcoin's mainstream adoption. But what's driving this surge, and what bold investment strategies are behind this unprecedented inflow? Let's delve into the details.

The Rise of Bitcoin ETFs: A Gateway for Institutional Investors

The approval of the first Bitcoin futures ETF in the US in October 2021 opened the floodgates for institutional investment. Previously, direct exposure to Bitcoin was complex and often involved navigating the less regulated world of cryptocurrency exchanges. ETFs, however, offer a familiar and regulated pathway for large financial institutions to gain exposure to Bitcoin's price movements without the complexities of directly holding the asset. This accessibility is a key factor driving the current surge in investment.

What's Fueling the $5 Billion+ Investment Boom?

Several factors contribute to this record-breaking investment:

- Increased Regulatory Clarity: While regulatory uncertainty still exists, the gradual clarification of rules surrounding cryptocurrencies in major markets is boosting investor confidence. This makes Bitcoin ETFs a more attractive, less risky investment option.

- Inflation Hedge Potential: With persistent inflation in many parts of the world, investors are seeking alternative assets to preserve their purchasing power. Bitcoin, often touted as a "digital gold," is seen by some as a hedge against inflation.

- Institutional Adoption: The participation of major asset managers and financial institutions in the ETF market signals a growing acceptance of Bitcoin as a legitimate asset class. This legitimization effect further encourages other investors to jump on board.

- Spot Bitcoin ETF Anticipation: The ongoing debate and potential approval of a spot Bitcoin ETF in the US are also contributing to the excitement. A spot ETF, which directly holds Bitcoin, could unlock even greater institutional investment.

Bold Investment Strategies Unveiled:

The massive investment isn't just a matter of buying and holding. Sophisticated strategies are being employed:

- Dollar-Cost Averaging (DCA): Many institutions are likely using DCA, a strategy that involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates risk by averaging out the cost per Bitcoin.

- Hedging Strategies: Some investors may be using Bitcoin ETFs as a hedge against potential downturns in traditional markets, diversifying their portfolios and reducing overall risk.

- Index Funds and Multi-Asset Portfolios: The integration of Bitcoin ETFs into broader index funds and multi-asset portfolios signifies its growing acceptance as a core component of diversified investment strategies.

The Future of Bitcoin ETFs and Institutional Investment:

The recent surge in investment into Bitcoin ETFs is a strong indication of growing institutional interest in the cryptocurrency market. While volatility remains a characteristic of Bitcoin, the increasing regulatory clarity and the accessibility offered by ETFs are paving the way for more widespread adoption. The potential approval of a spot Bitcoin ETF could further amplify this trend, potentially leading to even greater capital inflows in the future.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risk, and you should conduct thorough research and consult with a financial advisor before making any investment decisions.

Keywords: Bitcoin ETF, Bitcoin Exchange Traded Fund, Cryptocurrency Investment, Institutional Investors, Bitcoin Price, Spot Bitcoin ETF, Inflation Hedge, Regulatory Clarity, Investment Strategies, Dollar-Cost Averaging, Crypto Market

Call to Action (subtle): Stay informed about the latest developments in the cryptocurrency market by following reputable news sources and conducting your own research.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Pours Into Bitcoin ETFs: A Look At The Bold Investment Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jamie Lee Curtis Defends Lindsay Lohan Shes Always Been Real With Me

May 20, 2025

Jamie Lee Curtis Defends Lindsay Lohan Shes Always Been Real With Me

May 20, 2025 -

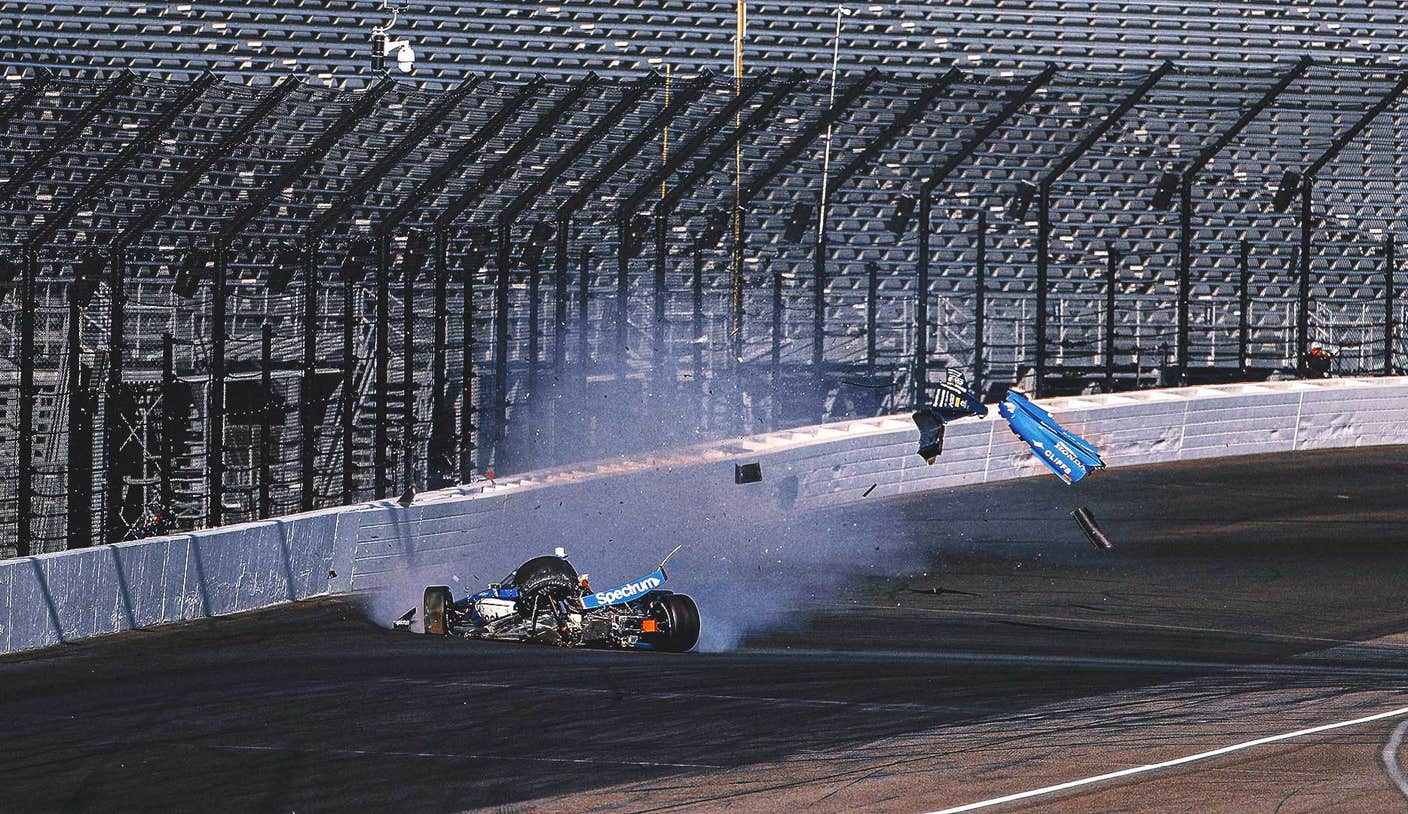

Multiple Car Pile Ups Shadow Indy 500 Preparations

May 20, 2025

Multiple Car Pile Ups Shadow Indy 500 Preparations

May 20, 2025 -

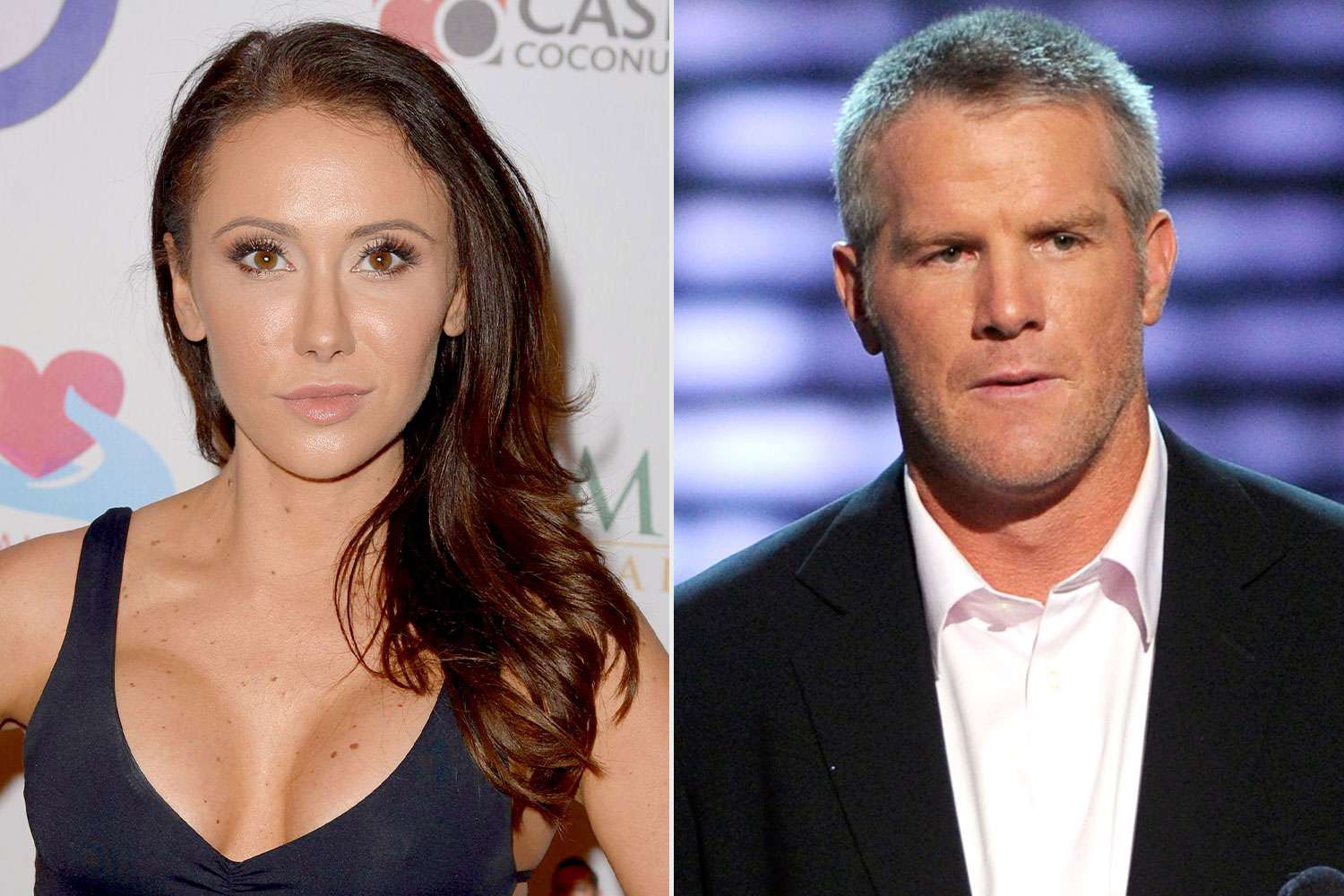

Jenn Sterger Details The Emotional Toll Of The Brett Favre Sexting Scandal

May 20, 2025

Jenn Sterger Details The Emotional Toll Of The Brett Favre Sexting Scandal

May 20, 2025 -

Todays Mlb Walk Off Wagers Expert Predictions For White Sox Cubs And Red Sox Braves Games

May 20, 2025

Todays Mlb Walk Off Wagers Expert Predictions For White Sox Cubs And Red Sox Braves Games

May 20, 2025 -

From On Field Collapse To Hospital Discharge Christen Presss Recovery Journey

May 20, 2025

From On Field Collapse To Hospital Discharge Christen Presss Recovery Journey

May 20, 2025