Over $5 Billion Invested In Bitcoin ETFs: Driving The Market Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Invested in Bitcoin ETFs: Driving the Market Surge?

The cryptocurrency market is buzzing, and a significant factor driving the recent surge in Bitcoin's price is the massive influx of investment into Bitcoin exchange-traded funds (ETFs). With over $5 billion now invested in these funds, the question on everyone's mind is: Is this sustained investment truly fueling the market's upward trajectory, or is it just a temporary phenomenon?

The launch of the first Bitcoin ETF in the US marked a watershed moment for the cryptocurrency industry. Previously, institutional investors faced significant hurdles to accessing the Bitcoin market directly. ETFs, however, provide a regulated and accessible pathway, attracting a wave of traditionally risk-averse investors. This influx of capital has demonstrably increased liquidity and trading volume, contributing to a more stable and mature market.

The Impact of Institutional Investment

The $5 billion figure represents a substantial commitment from institutional investors, pension funds, and high-net-worth individuals who previously viewed Bitcoin with skepticism. This signifies a growing acceptance of Bitcoin as a legitimate asset class, moving beyond the speculative image it once held. The increased institutional participation is stabilizing the market, reducing volatility compared to previous years.

This shift is not just about the sheer volume of money; it's about the type of money. Institutional investors bring with them sophisticated risk management strategies and a longer-term investment horizon, fostering greater market stability. This contrasts with the often short-term, highly speculative trading that characterized earlier phases of the Bitcoin market.

Factors Beyond ETF Investment

While ETF investment is a crucial factor, it's not the sole driver of the current market surge. Several other elements contribute to the overall positive sentiment:

- Macroeconomic conditions: Concerns about inflation and the performance of traditional markets have pushed investors towards alternative assets like Bitcoin.

- Technological advancements: Developments in the Bitcoin ecosystem, such as the Lightning Network improving transaction speeds and reducing fees, contribute to increased adoption.

- Regulatory clarity (in certain jurisdictions): Increasingly clear regulatory frameworks in some regions are fostering greater confidence and attracting more investors.

Looking Ahead: Sustainability and Volatility

The long-term sustainability of this market surge remains to be seen. While the $5 billion invested in Bitcoin ETFs is a significant milestone, the cryptocurrency market is inherently volatile. Geopolitical events, regulatory changes, and technological developments can all significantly impact Bitcoin's price.

However, the sustained interest from institutional investors through ETFs suggests a growing maturity and acceptance of Bitcoin within the broader financial landscape. This trend, combined with ongoing technological improvements, suggests a potentially bright future for Bitcoin, albeit one that will likely continue to experience periods of both growth and correction.

Call to Action: Stay informed about the evolving cryptocurrency market by following reputable news sources and conducting your own thorough research before making any investment decisions. Remember that all investments carry inherent risk. Consult with a financial advisor before investing in cryptocurrencies or any other asset.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Invested In Bitcoin ETFs: Driving The Market Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

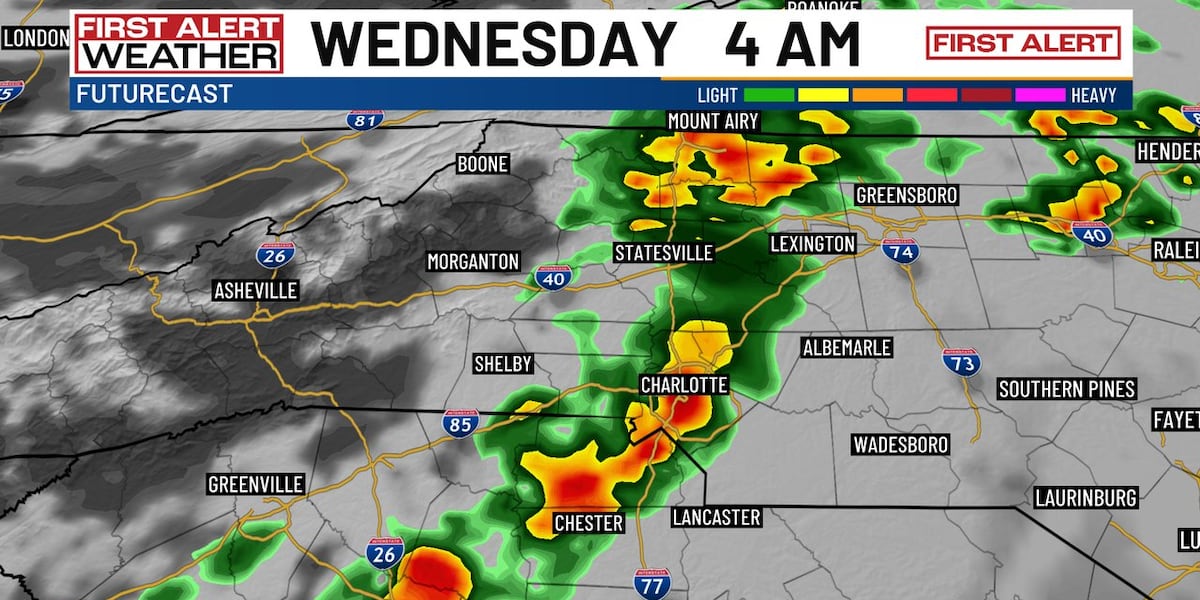

Colder Weather Ahead Expect Rain Through The Week

May 21, 2025

Colder Weather Ahead Expect Rain Through The Week

May 21, 2025 -

Tush Push Ban Update Nfl Owners Set To Review Rule Changes Playoff Format And Flag Football

May 21, 2025

Tush Push Ban Update Nfl Owners Set To Review Rule Changes Playoff Format And Flag Football

May 21, 2025 -

Ubisoft Milan Expanding Team For Upcoming Rayman Project

May 21, 2025

Ubisoft Milan Expanding Team For Upcoming Rayman Project

May 21, 2025 -

Overnight Storm Threat For Charlotte Prepare For Cooler Temperatures

May 21, 2025

Overnight Storm Threat For Charlotte Prepare For Cooler Temperatures

May 21, 2025 -

Juvenile Delinquency Church Break In And Sanitation Violation

May 21, 2025

Juvenile Delinquency Church Break In And Sanitation Violation

May 21, 2025