Over $5 Billion Invested In Bitcoin ETFs: A Sign Of Market Confidence?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Invested in Bitcoin ETFs: A Sign of Market Confidence?

The cryptocurrency market has witnessed a surge in institutional investment, with over $5 billion now flowing into Bitcoin exchange-traded funds (ETFs). This significant influx of capital raises a crucial question: is this a genuine indicator of growing market confidence in Bitcoin, or simply a fleeting trend?

The recent approval of several Bitcoin ETFs in the United States has undoubtedly played a pivotal role in this investment boom. These ETFs offer investors a regulated and convenient way to gain exposure to Bitcoin without needing to navigate the complexities of directly purchasing and storing the cryptocurrency. This accessibility has opened the doors for a wider range of investors, including institutional players previously hesitant to enter the volatile crypto market.

What's driving this investment surge?

Several factors contribute to the current wave of Bitcoin ETF investment:

-

Increased Regulatory Clarity: The approval of Bitcoin ETFs signifies a growing acceptance of cryptocurrencies by regulatory bodies. This reduced regulatory uncertainty encourages institutional investors, known for their risk-averse nature, to allocate funds to Bitcoin.

-

Inflation Hedge: With persistent inflation concerns globally, investors are seeking alternative assets to protect their portfolios. Bitcoin, with its limited supply and decentralized nature, is viewed by many as a potential hedge against inflation. (External Link)

-

Institutional Adoption: The growing adoption of Bitcoin by major corporations and financial institutions further bolsters investor confidence. This legitimizes Bitcoin as a viable asset class and encourages further investment.

-

Technological Advancements: Ongoing developments in the Bitcoin ecosystem, such as the Lightning Network improving transaction speed and reducing fees, enhance Bitcoin's utility and appeal.

Is this sustainable?

While the current investment surge is undeniably impressive, it's crucial to maintain a balanced perspective. The cryptocurrency market remains inherently volatile, susceptible to price swings driven by various factors, including regulatory changes, market sentiment, and technological developments.

Furthermore, the relatively small number of approved Bitcoin ETFs compared to the vast traditional ETF market means this growth, while significant, still represents a fraction of the overall investment landscape.

Looking Ahead:

The over $5 billion invested in Bitcoin ETFs signals a significant shift in the perception of Bitcoin as an asset class. However, whether this represents sustained market confidence remains to be seen. Continued regulatory clarity, technological advancements, and broader institutional adoption will be key determinants of Bitcoin's long-term trajectory. The coming months will be crucial in assessing the sustainability of this investment trend and its impact on the broader cryptocurrency market.

Call to Action: Stay informed about the latest developments in the cryptocurrency market by regularly checking reputable news sources and financial publications. Remember to conduct thorough research and only invest what you can afford to lose.

Keywords: Bitcoin ETF, Bitcoin Exchange Traded Fund, Cryptocurrency Investment, Bitcoin Price, Institutional Investment, Market Confidence, Regulatory Clarity, Inflation Hedge, Cryptocurrency Regulation, Bitcoin Adoption, Cryptocurrency Market Volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Invested In Bitcoin ETFs: A Sign Of Market Confidence?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

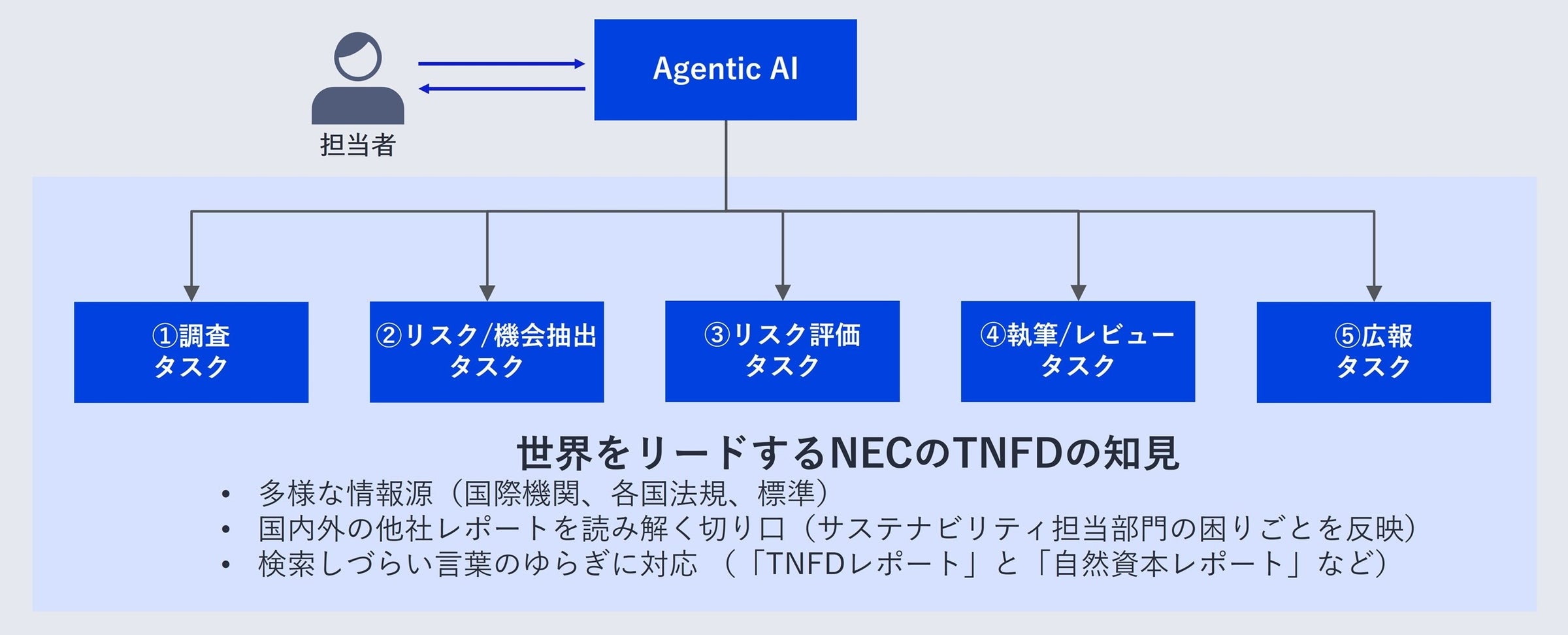

Tnfd Nec Ai

May 21, 2025

Tnfd Nec Ai

May 21, 2025 -

Ellen De Generes Returns To Social Media After Loss Delighting Fans

May 21, 2025

Ellen De Generes Returns To Social Media After Loss Delighting Fans

May 21, 2025 -

Rain Likely All Week As Temperatures Drop

May 21, 2025

Rain Likely All Week As Temperatures Drop

May 21, 2025 -

Analyzing The Odds Nfls Wild Card Contenders And Their Path To The 2023 Playoffs

May 21, 2025

Analyzing The Odds Nfls Wild Card Contenders And Their Path To The 2023 Playoffs

May 21, 2025 -

Ganassi Slams Penske Nascar Needs Stricter Enforcement Of Rules

May 21, 2025

Ganassi Slams Penske Nascar Needs Stricter Enforcement Of Rules

May 21, 2025