One Rate Cut In 2025: Fed's Outlook Impacts US Treasury Yield Curve

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut in 2025: Fed's Outlook Impacts US Treasury Yield Curve

The Federal Reserve's (Fed) latest projections have sent ripples through the financial markets, with the central bank hinting at just one interest rate cut in 2025. This cautious outlook has significantly impacted the US Treasury yield curve, a key indicator of future economic growth and inflation expectations. The implications are far-reaching, affecting everything from mortgage rates to corporate borrowing costs.

A Shift in Expectations:

For months, market analysts anticipated a more aggressive series of rate cuts as the Fed battled inflation. However, the recent projections paint a different picture. The Fed's dot plot, which illustrates individual policymakers' rate expectations, now suggests a stubbornly persistent inflation rate, necessitating a slower pace of monetary easing. This shift reflects the Fed's ongoing assessment of economic data and its commitment to bringing inflation down to its 2% target.

The Impact on the Treasury Yield Curve:

The yield curve, which plots the yields of Treasury bonds with different maturities, is highly sensitive to interest rate expectations. The Fed's projection of only one rate cut in 2025 has steepened the curve, indicating a widening gap between short-term and long-term yields. This steepening reflects the market's belief that interest rates will remain higher for longer, impacting borrowing costs across the economy.

What does this mean for investors?

- Higher borrowing costs: Businesses and consumers alike should prepare for potentially higher borrowing costs in the coming year. This could dampen economic growth and lead to reduced investment.

- Increased uncertainty: The revised forecast introduces significant uncertainty into the market. Investors will need to carefully assess their risk tolerance and adjust their portfolios accordingly.

- Potential for volatility: The yield curve's reaction highlights the potential for increased market volatility in the near future. Sudden shifts in economic data or Fed communication could trigger further price swings.

Analyzing the Long-Term Implications:

The Fed's decision is a calculated risk. While a slower pace of rate cuts could help avoid a potential economic slowdown, it also risks prolonging inflation if the economy proves more resilient than anticipated. Economists and analysts are closely watching key economic indicators like inflation data, employment figures, and consumer spending to gauge the effectiveness of the Fed's approach. Further analysis is needed to determine the long-term effects of this more conservative approach to monetary policy.

Looking Ahead:

The coming months will be crucial in determining the accuracy of the Fed's projections. Market participants will closely scrutinize economic data releases and statements from Fed officials for any signs of a shift in policy. The future trajectory of the yield curve and its implications for the broader economy remain highly uncertain, making ongoing monitoring essential.

Keywords: Federal Reserve, Fed, interest rates, rate cut, US Treasury yield curve, inflation, monetary policy, economic growth, bond yields, market volatility, investment, borrowing costs, economic outlook, dot plot.

Related Articles: (This section would contain links to other relevant articles on your website, for example: articles about inflation, previous Fed decisions, or analyses of the bond market.)

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut In 2025: Fed's Outlook Impacts US Treasury Yield Curve. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Peaky Blinders Creator Reveals Plans For New Series With Key Departure

May 20, 2025

Peaky Blinders Creator Reveals Plans For New Series With Key Departure

May 20, 2025 -

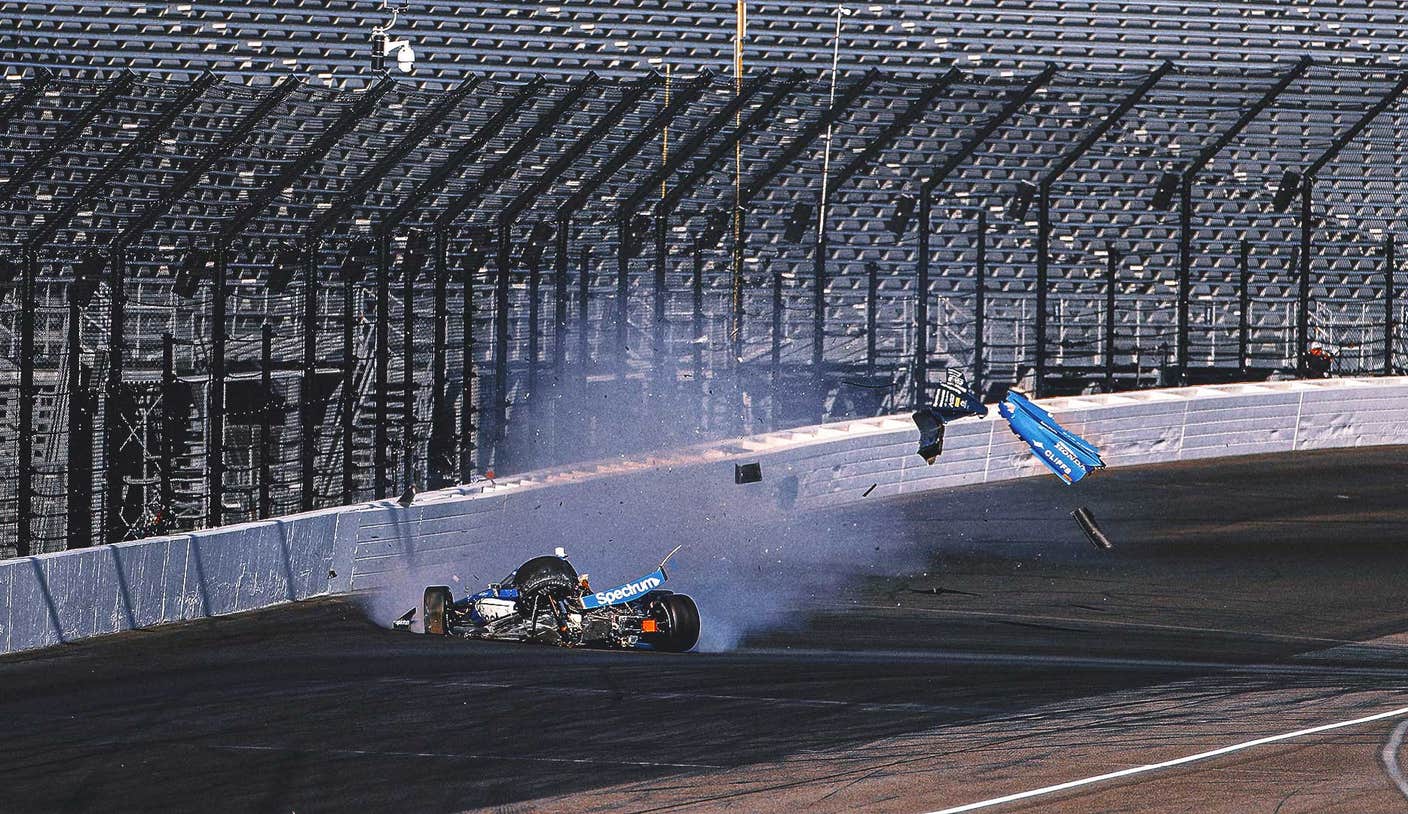

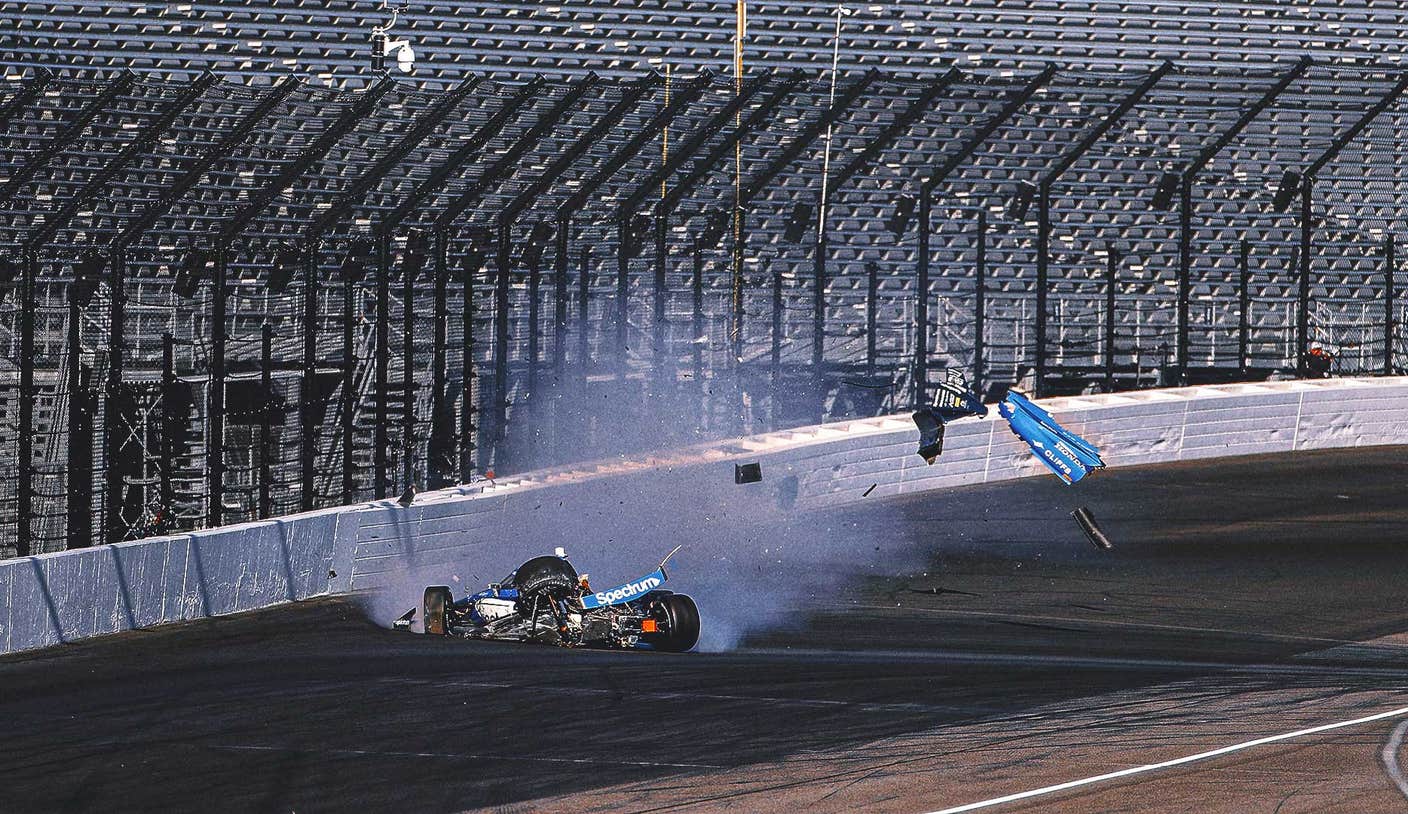

Crash Chaos Indy 500 Practice Turns Dangerous

May 20, 2025

Crash Chaos Indy 500 Practice Turns Dangerous

May 20, 2025 -

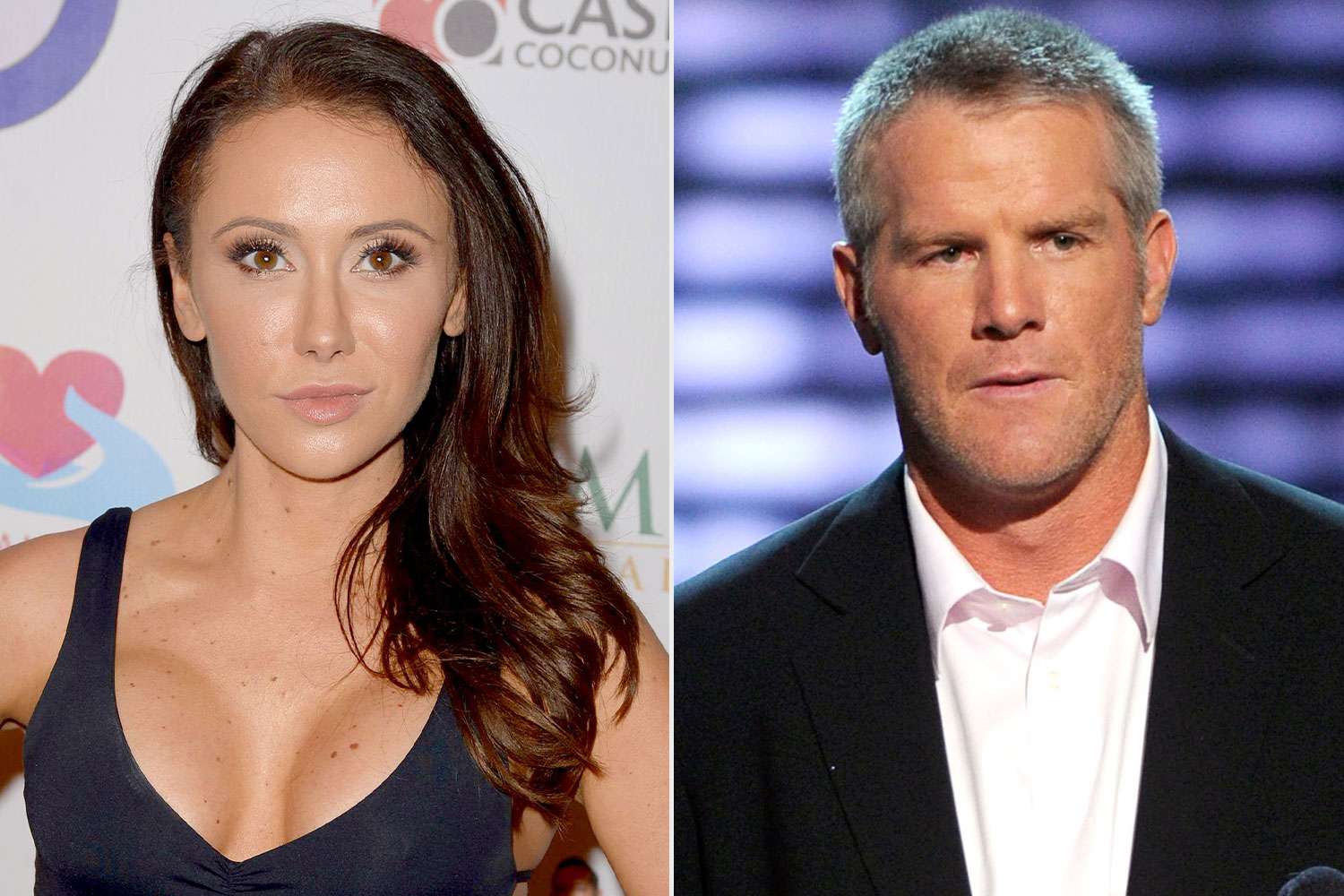

Jenn Stergers Account Of The Brett Favre Scandal A Story Of Neglect And Betrayal

May 20, 2025

Jenn Stergers Account Of The Brett Favre Scandal A Story Of Neglect And Betrayal

May 20, 2025 -

Multiple Wrecks Rock Indy 500 Practice

May 20, 2025

Multiple Wrecks Rock Indy 500 Practice

May 20, 2025 -

Lawmakers Draft Bill To Regulate Pet Cremation Following Recent Scandal

May 20, 2025

Lawmakers Draft Bill To Regulate Pet Cremation Following Recent Scandal

May 20, 2025