One Rate Cut In 2025? Fed's Outlook Impacts U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut in 2025? Fed's Outlook Impacts U.S. Treasury Yields

The Federal Reserve's surprisingly hawkish projections have sent ripples through the financial markets, significantly impacting U.S. Treasury yields. While the central bank held interest rates steady at its July meeting, its updated economic projections hint at a potential single interest rate cut in 2025, a far more restrained outlook than many analysts predicted. This shift in perspective has led to a noticeable increase in Treasury yields, reflecting investor sentiment and expectations for future monetary policy.

The Fed's Hawkish Pivot and its Implications

The Fed's dot plot, which illustrates individual policymakers' interest rate expectations, showed a significant upward revision. This suggests a stronger belief among Fed officials that interest rates will remain higher for longer to combat stubbornly high inflation. The projected single rate cut in 2025 contrasts sharply with market expectations of multiple rate cuts throughout the year and into 2024. This divergence highlights the ongoing uncertainty surrounding the inflation outlook and the Fed's commitment to achieving its 2% inflation target.

The decision to hold rates steady in July, coupled with the hawkish projections, signals a cautious approach. The Fed is clearly prioritizing inflation control, even at the risk of slowing economic growth. This strategy reflects the ongoing debate about the balance between fighting inflation and avoiding a recession.

Impact on U.S. Treasury Yields

The more hawkish-than-expected outlook has directly influenced U.S. Treasury yields. Longer-term yields, particularly those on 10-year and 30-year Treasuries, have risen significantly since the Fed's announcement. This is because investors are now anticipating higher interest rates for a longer period, making existing bonds less attractive and pushing yields upward. This increase in yields has implications for borrowing costs for businesses and consumers alike.

What this Means for Investors

The shift in the Fed's outlook presents a complex picture for investors. Higher Treasury yields offer increased returns for bondholders, but also reflect a less optimistic economic outlook. The increased uncertainty surrounding inflation and future monetary policy makes strategic asset allocation more critical than ever.

- Bond investors: Should consider the implications of higher yields on their portfolios and potentially adjust their investment strategies accordingly. A diversified approach may be beneficial to mitigate risk.

- Stock investors: Need to assess the impact of higher interest rates on corporate profitability and overall market valuations. Sectors sensitive to interest rate changes, such as real estate and technology, may experience increased volatility.

Looking Ahead: Uncertainty Remains

The Fed's projections are not set in stone. The path of interest rates will depend significantly on incoming economic data, including inflation readings and employment figures. Any unexpected surge in inflation or continued strength in the labor market could prompt the Fed to maintain a tighter monetary policy for longer. Conversely, signs of weakening economic growth could lead to a reassessment of the rate cut timeline.

The evolving economic landscape underscores the importance of staying informed. Regularly monitoring economic indicators and the Fed's communications is crucial for making informed investment decisions. Consult with a financial advisor for personalized guidance tailored to your specific circumstances.

Keywords: Federal Reserve, Fed, interest rates, rate cut, U.S. Treasury yields, Treasury bonds, inflation, monetary policy, economic outlook, investment strategy, bond market, stock market, economic data.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut In 2025? Fed's Outlook Impacts U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

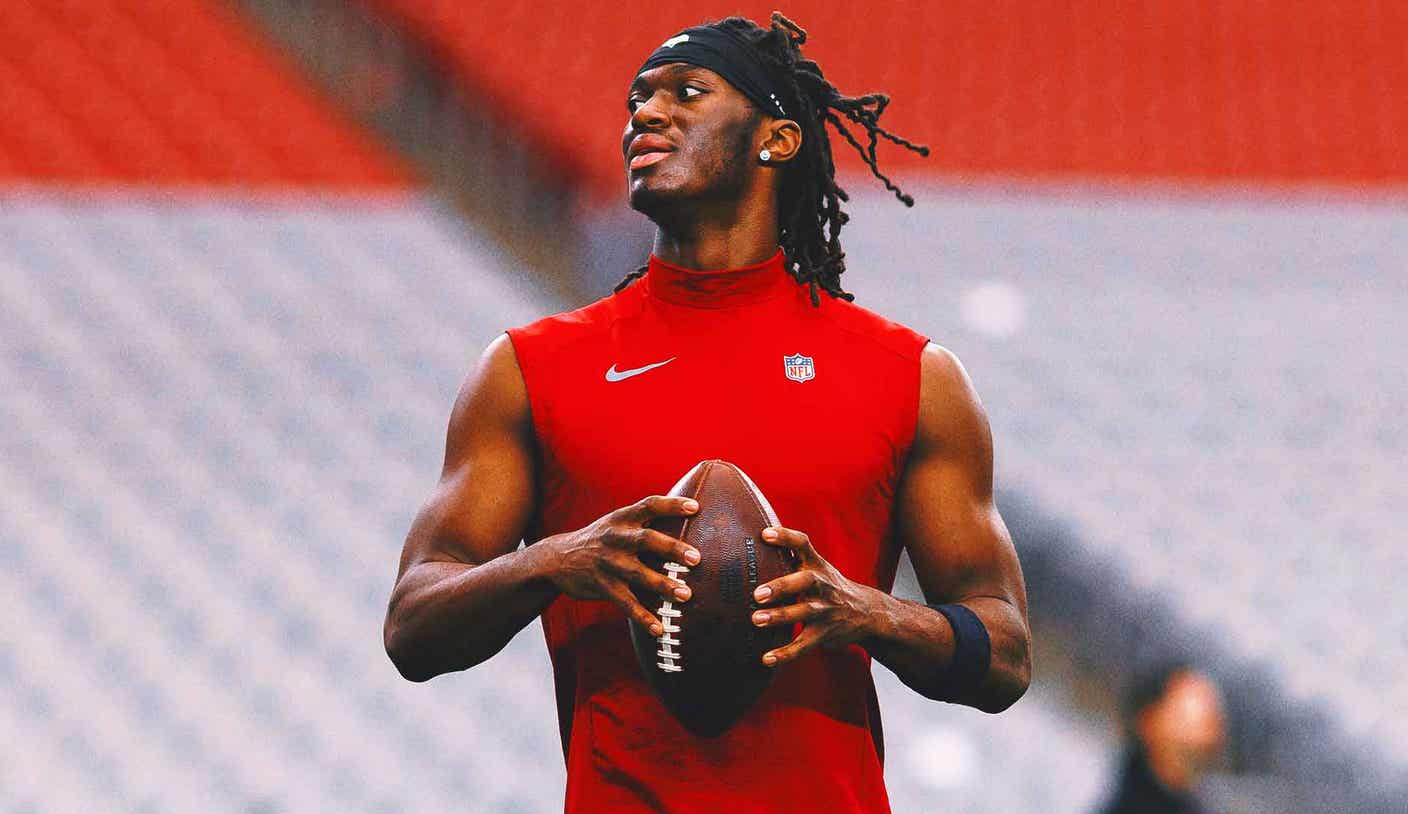

Increased Strength Elevated Expectations Marvin Harrison Jr S Path To A Breakout Year

May 21, 2025

Increased Strength Elevated Expectations Marvin Harrison Jr S Path To A Breakout Year

May 21, 2025 -

Teens Defecate And Urinate On Santa Rosa Church Floors Police Investigation Underway

May 21, 2025

Teens Defecate And Urinate On Santa Rosa Church Floors Police Investigation Underway

May 21, 2025 -

Three Year 63 M Deal Fred Warner Extends With The 49ers

May 21, 2025

Three Year 63 M Deal Fred Warner Extends With The 49ers

May 21, 2025 -

Colder Weather Arrives Expect Rain Throughout The Week

May 21, 2025

Colder Weather Arrives Expect Rain Throughout The Week

May 21, 2025 -

Get Master Of Ceremony Warbonds In Helldivers 2 Starting May 15th

May 21, 2025

Get Master Of Ceremony Warbonds In Helldivers 2 Starting May 15th

May 21, 2025