One Rate Cut In 2025: Fed's Outlook Impacts Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut in 2025: Fed's Outlook Impacts Treasury Yields

The Federal Reserve's (Fed) latest projections sent ripples through the financial markets, with a forecast of just one interest rate cut in 2025 significantly impacting Treasury yields. This more hawkish-than-expected stance surprised many analysts who anticipated a more aggressive easing of monetary policy next year. The implications are far-reaching, affecting everything from borrowing costs for consumers and businesses to the performance of various investment assets.

The Fed's Dot Plot and Market Reaction:

The Fed's "dot plot," which illustrates individual policymakers' interest rate projections, showed a median expectation of a single 25-basis-point rate cut in 2025. This contrasts sharply with previous forecasts and market expectations that predicted multiple rate cuts to combat potential economic slowdown. The immediate market reaction was a sharp increase in Treasury yields, reflecting investors' revised expectations for future interest rates. The yield on the benchmark 10-year Treasury note, a key indicator of borrowing costs, climbed noticeably following the announcement.

Why the Shift in Outlook?

The Fed's revised outlook is largely attributed to the persistent strength of the US economy. Despite several interest rate hikes aimed at curbing inflation, the labor market remains robust, and inflation, while cooling, is still above the Fed's 2% target. This resilience has led policymakers to believe that further rate cuts are not immediately necessary, and that a more gradual approach to monetary easing is warranted.

Implications for Investors and Borrowers:

This shift in the Fed's outlook has several key implications:

- Higher Borrowing Costs: Higher Treasury yields generally translate to higher borrowing costs for businesses and consumers. This could potentially dampen economic growth, as businesses may postpone investment and consumers may reduce spending.

- Impact on Investment Strategies: Investors are now reassessing their portfolios, considering the implications for various asset classes. Higher yields on government bonds may make them more attractive relative to other investments, potentially impacting the stock market and other riskier assets.

- Uncertainty Remains: The Fed's projection is just that – a projection. Unforeseen economic events could easily alter the course of monetary policy. The ongoing geopolitical situation, potential energy price shocks, and the evolving nature of inflation all contribute to significant uncertainty.

What to Watch For:

Going forward, investors and economists will closely monitor several key economic indicators, including:

- Inflation data: Further declines in inflation will be crucial in validating the Fed's more hawkish stance.

- Employment figures: Any signs of weakening in the labor market could lead to a reevaluation of the Fed's projections.

- GDP growth: Sustained economic growth will reinforce the current outlook, while a significant slowdown could trigger a reconsideration of future rate cuts.

Conclusion:

The Fed's forecast of only one rate cut in 2025 represents a significant shift in monetary policy expectations. This has had a noticeable impact on Treasury yields and will likely influence a broad range of economic activity. The situation remains fluid, however, and continued monitoring of key economic indicators is essential for investors and businesses alike. Understanding the complexities of the evolving economic landscape is crucial for navigating the challenges and opportunities ahead. Stay informed and adapt your strategies accordingly. For more in-depth analysis on interest rates and the economy, explore resources from reputable financial news outlets and economic research institutions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut In 2025: Fed's Outlook Impacts Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Schwarber Reaches 300 Home Runs With Epic 466 Foot Blast

May 21, 2025

Schwarber Reaches 300 Home Runs With Epic 466 Foot Blast

May 21, 2025 -

Trumps Waning Influence Putins Actions Speak Louder Than Words

May 21, 2025

Trumps Waning Influence Putins Actions Speak Louder Than Words

May 21, 2025 -

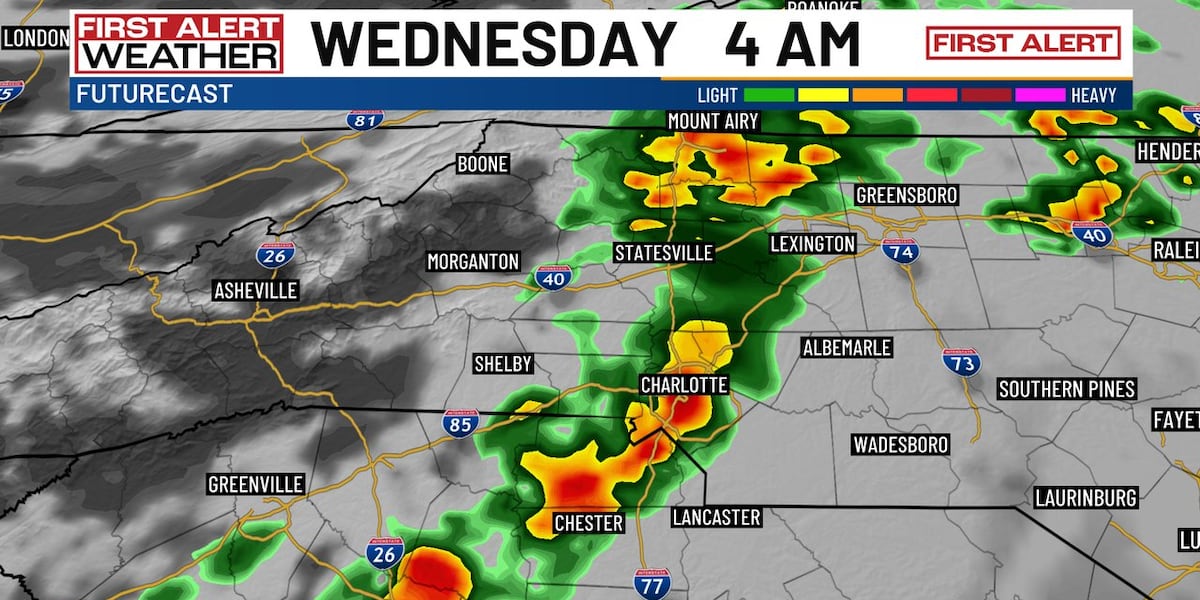

Severe Storms Predicted For Charlotte Tonight Prepare For Cooler Temperatures

May 21, 2025

Severe Storms Predicted For Charlotte Tonight Prepare For Cooler Temperatures

May 21, 2025 -

Playoff Aspirations Referee Rooneys Fight Back After A High Stick Injury

May 21, 2025

Playoff Aspirations Referee Rooneys Fight Back After A High Stick Injury

May 21, 2025 -

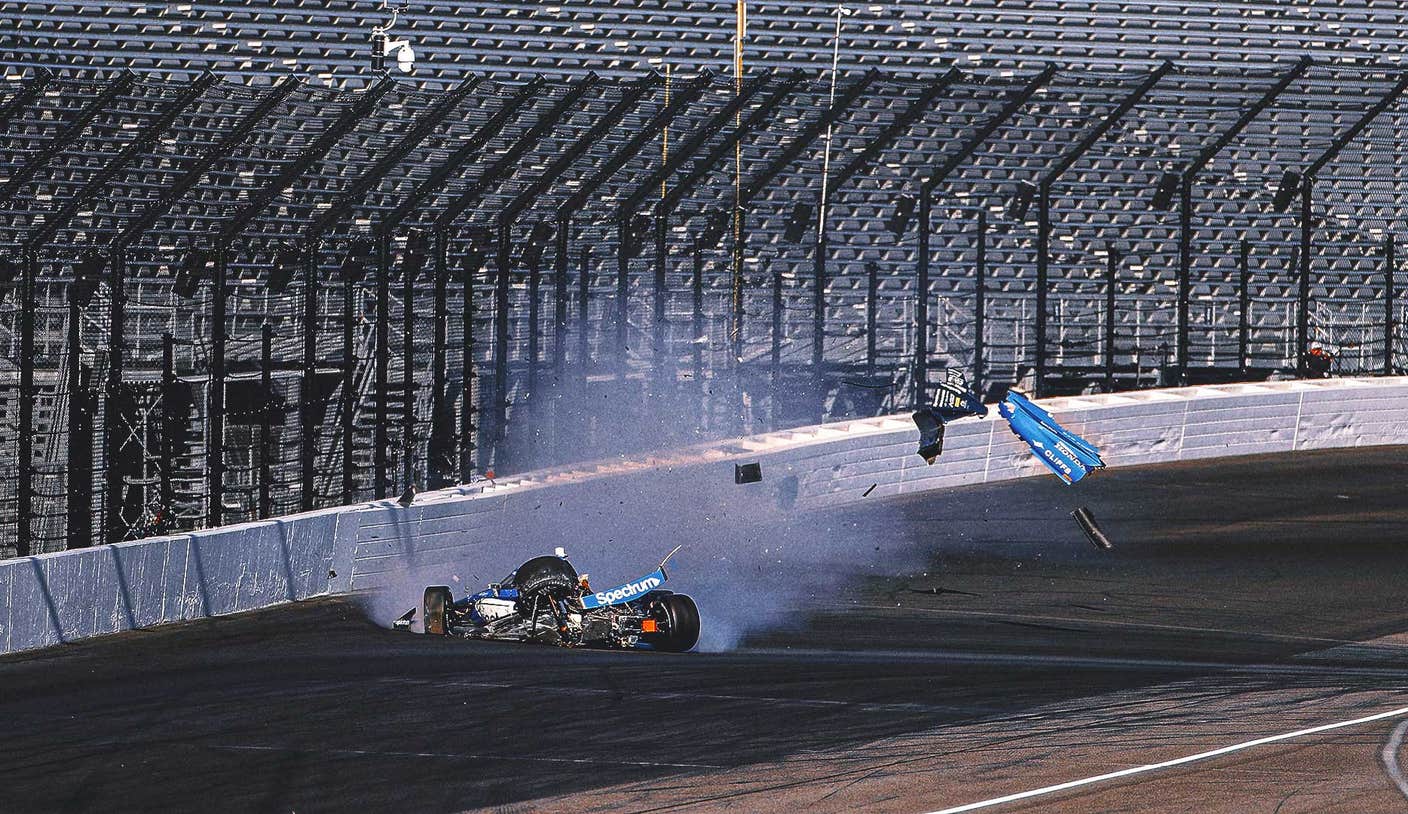

Indy 500 Several Accidents During Pre Race Preparations

May 21, 2025

Indy 500 Several Accidents During Pre Race Preparations

May 21, 2025