Nvidia Q2 Earnings Preview: Increased Bullish Targets & Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nvidia Q2 Earnings Preview: Increased Bullish Targets & Expectations Soar

Nvidia's Q2 2024 earnings announcement is looming, and the anticipation is palpable. Analysts are significantly raising their bullish targets, driven by the overwhelming demand for AI chips and the company's dominant position in the burgeoning artificial intelligence market. This preview delves into the key factors driving the increased optimism and what investors can expect from Nvidia's upcoming report.

The AI Boom Fuels Explosive Growth Projections

The meteoric rise of generative AI has catapulted Nvidia to the forefront of the tech world. Their high-performance GPUs, particularly the H100 and A100 series, are essential for training and running large language models (LLMs) – the very foundation of AI advancements. This unprecedented demand has led to a massive surge in revenue projections for Q2.

Several leading financial institutions have substantially increased their price targets for Nvidia stock. For example, [insert source and specific increase percentage here], reflecting the widespread belief in Nvidia's continued dominance and robust growth trajectory. This surge in confidence is fueled by:

-

Strong Data Center Revenue: The data center segment is expected to be the primary driver of growth, fueled by AI-related demand from cloud providers, research institutions, and enterprise clients. Analysts predict a significant year-over-year increase in this sector.

-

Gaming Segment Stability: While the gaming market remains somewhat volatile, Nvidia's strong brand recognition and high-performance GPUs continue to maintain a considerable market share. This segment, while not expected to be the primary growth engine, is anticipated to contribute positively to overall earnings.

-

Automotive and Professional Visualization Growth: Nvidia's presence in the automotive sector, particularly in autonomous driving technology, is also gaining momentum. Similarly, their professional visualization solutions continue to see steady demand. These segments, while smaller than data centers and gaming, are contributing to the overall positive outlook.

Potential Challenges and Considerations

Despite the overwhelmingly positive outlook, investors should be aware of potential headwinds:

-

Supply Chain Constraints: While Nvidia has made significant strides in addressing supply chain challenges, potential disruptions could still impact production and delivery timelines.

-

Competition: While Nvidia currently holds a commanding market share, increased competition from AMD and other players in the AI chip market is a factor to consider.

-

Geopolitical Risks: Global macroeconomic conditions and geopolitical uncertainties could influence demand and investor sentiment.

What to Expect from the Q2 Earnings Report

Investors should closely monitor the following key metrics during the earnings call:

- Data Center Revenue Growth: The percentage increase in data center revenue will be a critical indicator of Nvidia's performance and future prospects.

- Gross Margins: Maintaining healthy gross margins amid increased demand and potential supply chain pressures is crucial.

- Guidance for Q3 and beyond: Nvidia's outlook for the remainder of the year will be closely scrutinized by investors.

Conclusion: A Bullish Outlook, but with Cautious Optimism

The consensus among analysts is overwhelmingly bullish regarding Nvidia's Q2 earnings. The company's dominant position in the AI revolution is undeniable. However, investors should approach the results with cautious optimism, acknowledging potential challenges and carefully considering the various factors that could influence the company's performance. The upcoming earnings call will undoubtedly provide crucial insights into Nvidia's future trajectory and its ongoing impact on the AI landscape. Stay tuned for updates and in-depth analysis following the official announcement.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nvidia Q2 Earnings Preview: Increased Bullish Targets & Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lions Roster Shakeup Hendon Hookers Arrival And The Latest Cuts

Aug 26, 2025

Lions Roster Shakeup Hendon Hookers Arrival And The Latest Cuts

Aug 26, 2025 -

Howell Traded Analyzing The Vikings 2025 Qb Moves And Free Agency Impact

Aug 26, 2025

Howell Traded Analyzing The Vikings 2025 Qb Moves And Free Agency Impact

Aug 26, 2025 -

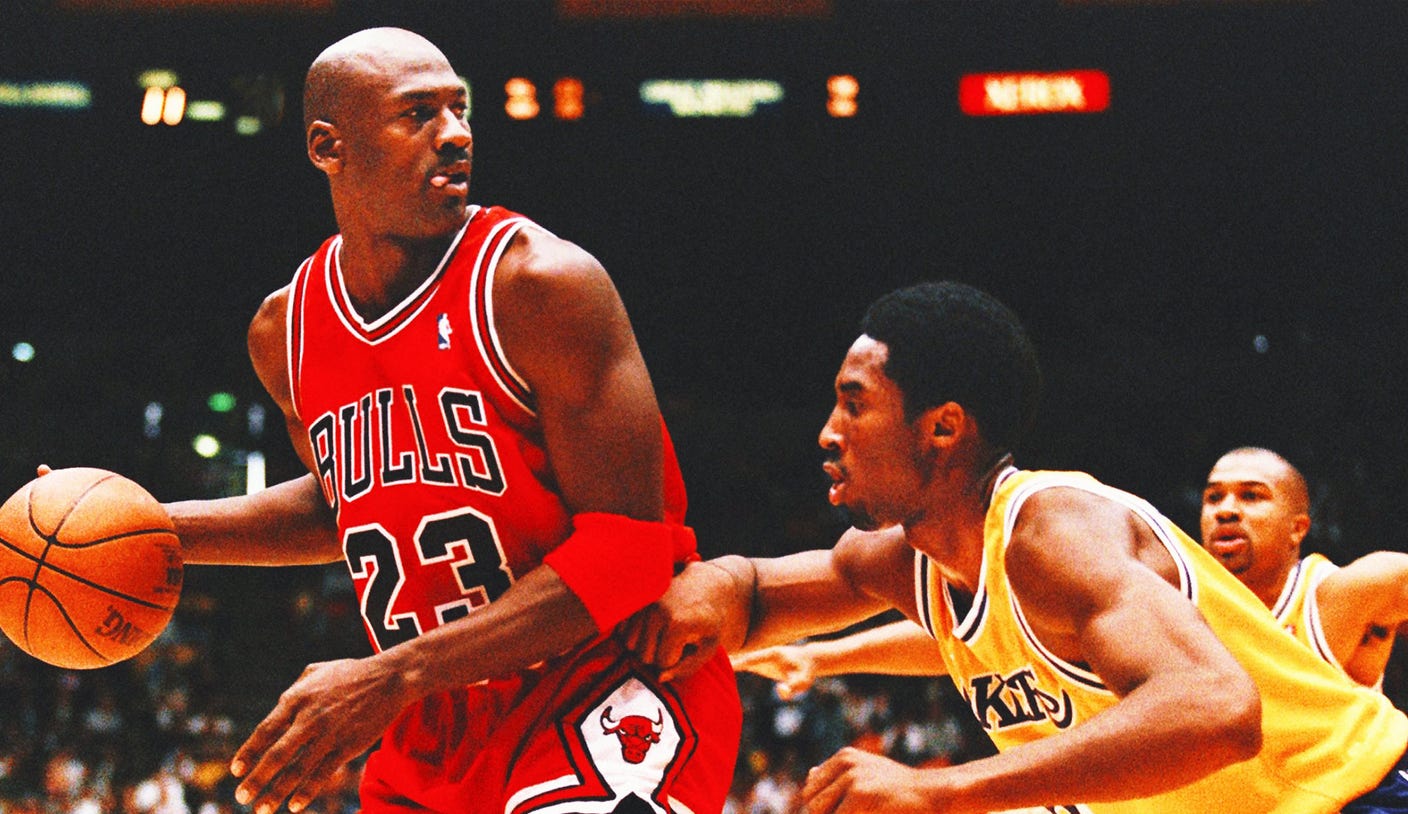

Rare Michael Jordan And Kobe Bryant Logoman Card Sells For A Stunning 12 9 Million

Aug 26, 2025

Rare Michael Jordan And Kobe Bryant Logoman Card Sells For A Stunning 12 9 Million

Aug 26, 2025 -

2025 Nfl Cuts Tracking The Latest Roster Moves Sanders Among Released Players

Aug 26, 2025

2025 Nfl Cuts Tracking The Latest Roster Moves Sanders Among Released Players

Aug 26, 2025 -

Shedeur Sanders Faces Roster Battle Browns Expectations And His Performance

Aug 26, 2025

Shedeur Sanders Faces Roster Battle Browns Expectations And His Performance

Aug 26, 2025

Latest Posts

-

Washington Commanders Waive Wide Receiver Gallup After Return From Injury

Aug 26, 2025

Washington Commanders Waive Wide Receiver Gallup After Return From Injury

Aug 26, 2025 -

Hendon Hooker To The Lions Latest Reports And Analysis

Aug 26, 2025

Hendon Hooker To The Lions Latest Reports And Analysis

Aug 26, 2025 -

Buccaneers Cut Shilo Sanders A Key 2025 Nfl Roster Move Following Ejection

Aug 26, 2025

Buccaneers Cut Shilo Sanders A Key 2025 Nfl Roster Move Following Ejection

Aug 26, 2025 -

Espn Vikings Eagles Trade Shakes Up Nfl Landscape Wentz Howell Involved

Aug 26, 2025

Espn Vikings Eagles Trade Shakes Up Nfl Landscape Wentz Howell Involved

Aug 26, 2025 -

Adam Schefters Fantasy Football Sleepers And Value Picks Espn

Aug 26, 2025

Adam Schefters Fantasy Football Sleepers And Value Picks Espn

Aug 26, 2025