Nio Stock Price Prediction And Buy Recommendation For 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio Stock Price Prediction and Buy Recommendation for 2024: Is Now the Time to Invest?

The electric vehicle (EV) market is booming, and Nio (NIO) is a key player vying for a significant share. But with market volatility and a complex global economic landscape, many investors are wondering: is Nio stock a buy in 2024? This article delves into Nio's current performance, future prospects, and offers a considered price prediction, along with a buy recommendation analysis.

Nio's Recent Performance and Challenges:

Nio's stock price has experienced significant fluctuations in recent years. While the company has shown impressive growth in vehicle deliveries and technological advancements, it has also faced headwinds. These challenges include:

- Intense Competition: The EV market is increasingly crowded, with established players like Tesla and a wave of new entrants constantly innovating. This fierce competition puts pressure on pricing and market share.

- Supply Chain Disruptions: Global supply chain issues, particularly concerning battery components, have impacted Nio's production capacity and delivery timelines.

- Economic Uncertainty: Global economic slowdowns can significantly affect consumer spending on luxury goods like electric vehicles, impacting Nio's sales figures.

Nio's Strengths and Growth Potential:

Despite these challenges, Nio possesses several key strengths that suggest strong growth potential in 2024 and beyond:

- Technological Innovation: Nio is known for its advanced battery technology, including battery swap technology which offers a significant advantage over competitors. This innovation is key to attracting environmentally conscious consumers.

- Expanding Market Presence: Nio is aggressively expanding its market presence both domestically in China and internationally, tapping into new customer bases and revenue streams.

- Government Support: China's government is actively promoting the adoption of electric vehicles, providing significant support to domestic EV manufacturers like Nio. This supportive regulatory environment is a major advantage.

- Brand Loyalty: Nio has cultivated a strong brand image and a loyal customer base, crucial for long-term sustainability.

Nio Stock Price Prediction 2024:

Predicting stock prices with certainty is impossible. However, based on Nio's current performance, future growth projections, and market analysis, several reputable financial analysts offer varying predictions. While specific numbers vary widely, a conservative estimate points towards a potential range of $15 to $25 per share by the end of 2024, depending on various market factors and the company's execution of its strategic plans. This prediction should be considered speculative and is not financial advice. Always conduct thorough research before making any investment decisions.

Buy Recommendation Analysis:

Should you buy Nio stock in 2024? The answer is nuanced and depends on your risk tolerance and investment strategy. For long-term investors with a higher risk tolerance, Nio presents a compelling opportunity. The company's innovative technology, expanding market reach, and supportive regulatory environment offer significant upside potential.

However, investors should be prepared for potential volatility. The EV market remains highly competitive, and unforeseen challenges could impact Nio's performance. Diversification is crucial, and investing in Nio should be part of a broader investment portfolio.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you could lose money. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Further Research:

For more detailed financial information about Nio, you can refer to resources like the company's investor relations website, reputable financial news sources like the , and financial analysis platforms like . Staying updated on market trends and company news is essential for informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nio Stock Price Prediction And Buy Recommendation For 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Get Ready American Idol Season 24 Brings Exciting Changes

May 27, 2025

Get Ready American Idol Season 24 Brings Exciting Changes

May 27, 2025 -

French Open Day 2 2025 Live Scores Match Results And Key Moments

May 27, 2025

French Open Day 2 2025 Live Scores Match Results And Key Moments

May 27, 2025 -

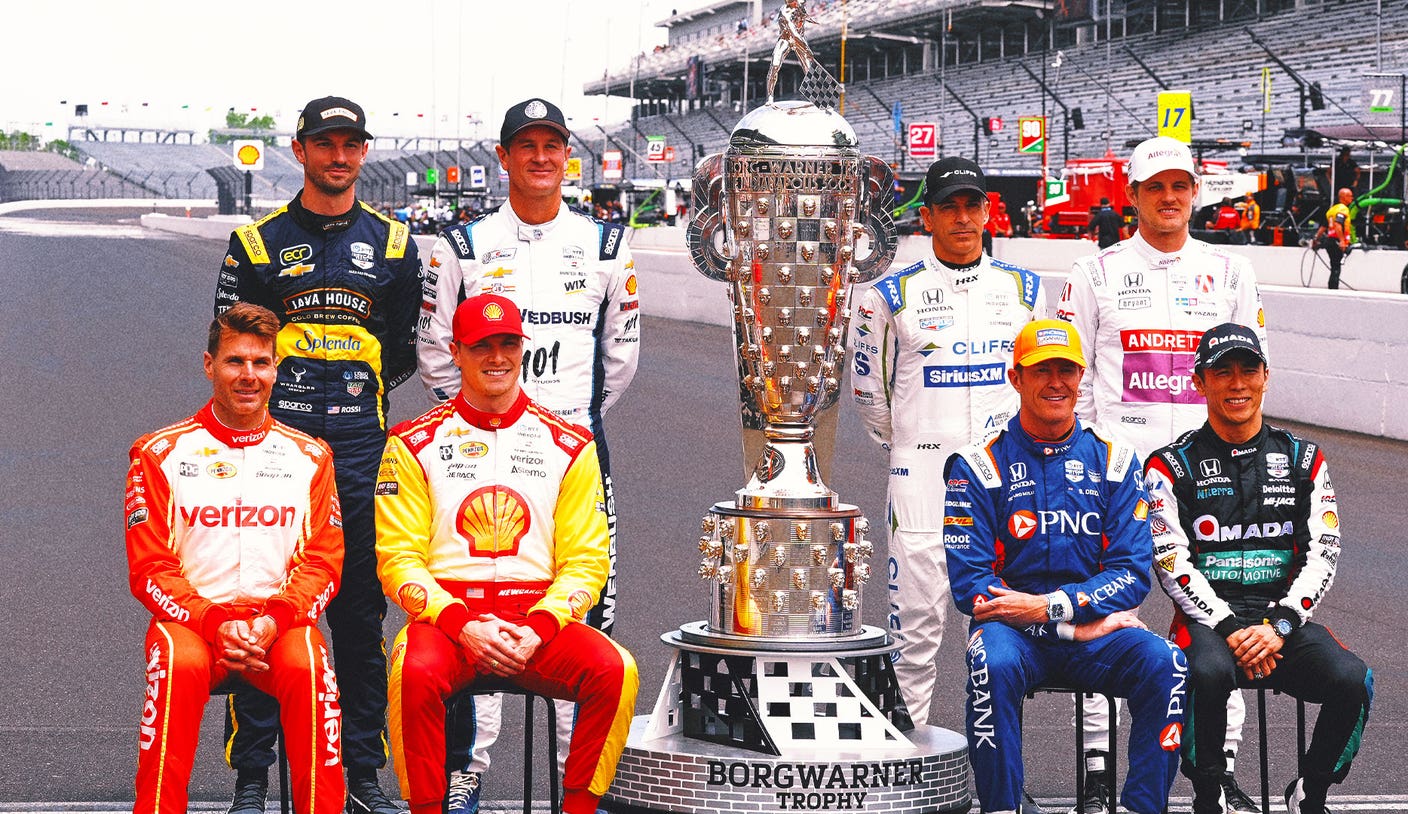

Will The Indy 500 Borg Warner Trophy Need An Expansion A Look At Its Future

May 27, 2025

Will The Indy 500 Borg Warner Trophy Need An Expansion A Look At Its Future

May 27, 2025 -

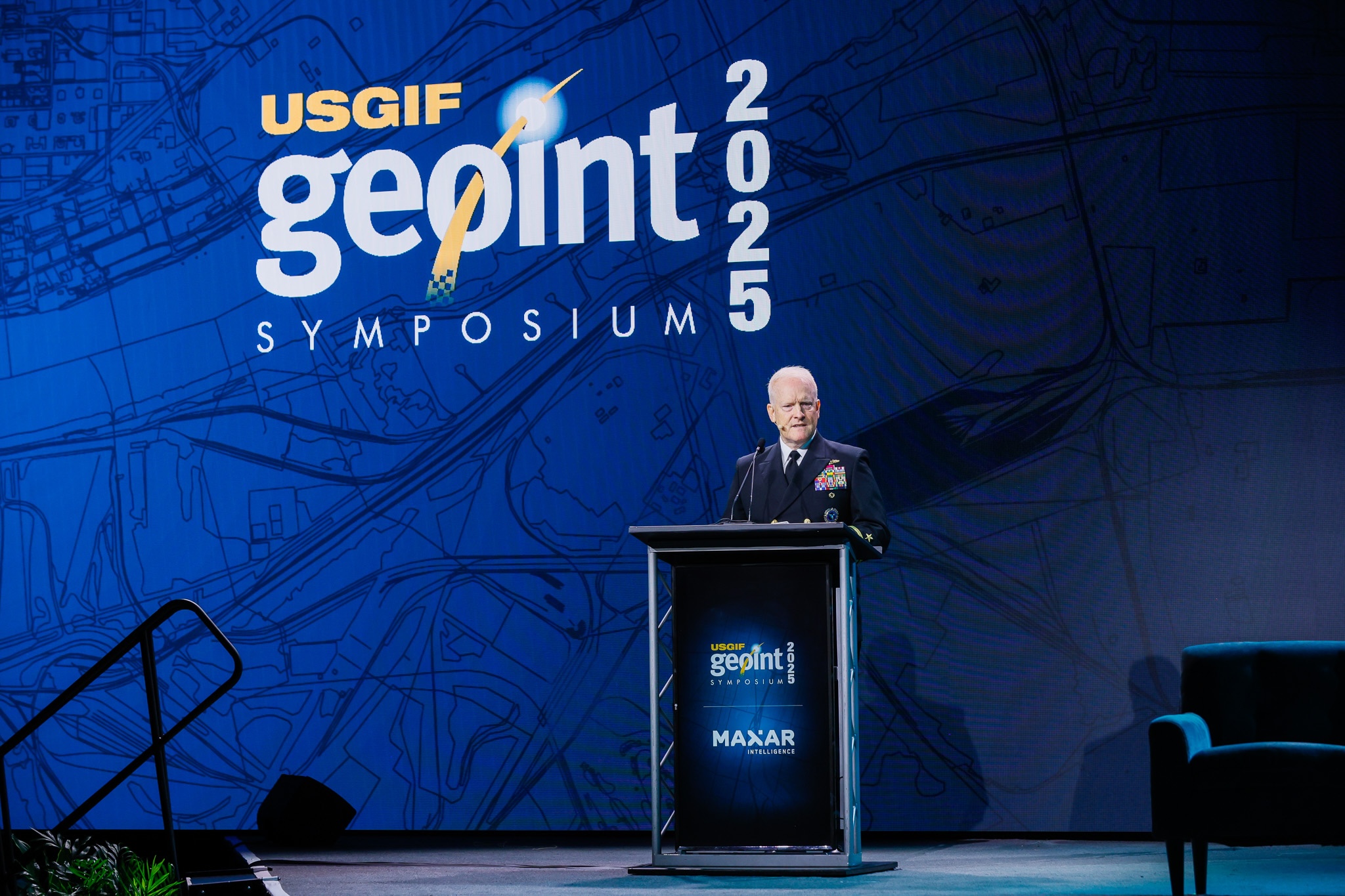

Pentagon Expands Project Maven With Increased Palantir Ai Funding

May 27, 2025

Pentagon Expands Project Maven With Increased Palantir Ai Funding

May 27, 2025 -

Emlyat Nfs Gyr Amdadgran Nwjwan Tbryzy Az Dl Dywar Byrwn Kshydh Shd

May 27, 2025

Emlyat Nfs Gyr Amdadgran Nwjwan Tbryzy Az Dl Dywar Byrwn Kshydh Shd

May 27, 2025