Navigating Broadcom Earnings: A Practical Options Trading Approach

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Navigating Broadcom Earnings: A Practical Options Trading Approach

Broadcom (AVGO) earnings season is upon us, and for options traders, this presents both significant opportunity and considerable risk. The semiconductor giant's performance heavily influences the broader tech sector, making its earnings reports a market-moving event. This article outlines a practical approach to navigating Broadcom's earnings announcement using options strategies, emphasizing risk management and informed decision-making.

Understanding the Volatility:

Broadcom's stock price often experiences significant swings following earnings releases. This volatility is the lifeblood of options trading, offering the potential for substantial profits. However, it also increases the risk of substantial losses. Analyzing historical price movements post-earnings is crucial. Consider examining AVGO's price action around previous earnings announcements to gauge the typical volatility range. Charting tools and financial news websites offer historical data to support this analysis. Understanding the magnitude of potential price fluctuations is paramount before engaging in any options trading strategy.

Strategies for Approaching Broadcom Earnings:

Several options strategies can be employed, each carrying its own risk-reward profile. Here are a few popular choices:

1. Iron Condors: This strategy is popular for its defined risk profile. It involves selling four options (one call and one put at a higher strike price, and one call and one put at a lower strike price), profiting from the limited price movement around the earnings announcement. The maximum profit is capped, but losses are also limited. This is a conservative approach suitable for traders seeking lower risk.

2. Straddles/Strangles: These strategies are employed when expecting significant price movement in either direction. A straddle involves buying one call and one put with the same strike price and expiration date, while a strangle uses different strike prices (the strangle usually provides a lower upfront cost). These strategies profit from high volatility but can result in significant losses if the price movement is less than anticipated.

3. Calendar Spreads: This strategy takes advantage of time decay (theta). A calendar spread involves buying and selling options contracts with the same strike price but different expiration dates. It's a strategy suitable for traders who believe volatility will decrease after the earnings release.

Managing Risk Effectively:

Regardless of the chosen strategy, robust risk management is non-negotiable:

- Define your risk tolerance: Before placing any trade, determine the maximum amount you are willing to lose. Never invest more than you can afford to lose.

- Position sizing: Don't put all your eggs in one basket. Diversify your portfolio and avoid overly concentrating your positions in a single trade.

- Monitor your positions: Actively track your positions in real-time, especially during the volatile period surrounding earnings announcements.

- Consider stop-loss orders: These orders automatically sell your positions when the price reaches a predetermined level, limiting potential losses.

Beyond the Technicals:

While technical analysis and historical data are crucial, it's essential to consider fundamental factors. Thoroughly review Broadcom's pre-earnings announcements, analyst estimates, and any significant news impacting the company. Websites like the provide access to crucial financial filings.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Options trading involves substantial risk and may not be suitable for all investors. Consult with a qualified financial advisor before making any investment decisions.

Call to Action: Stay informed about Broadcom's earnings by following reputable financial news sources and conducting your own thorough research. Remember to prioritize risk management in all your trading endeavors.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Navigating Broadcom Earnings: A Practical Options Trading Approach. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

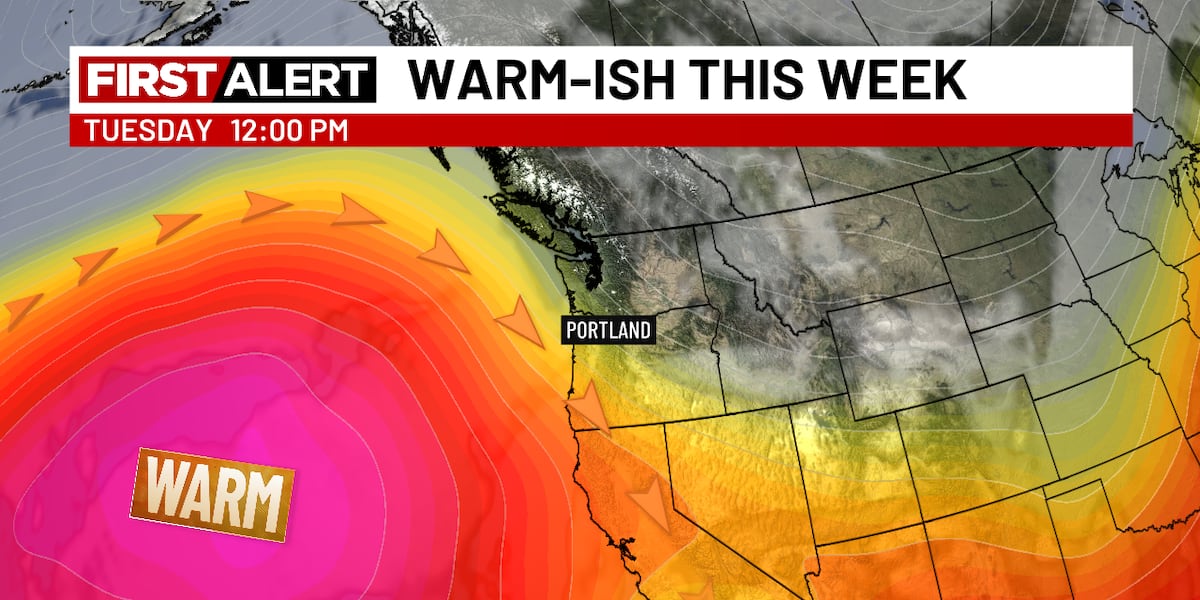

June Starts Warm Sunny And Dry Weather Forecast

Jun 05, 2025

June Starts Warm Sunny And Dry Weather Forecast

Jun 05, 2025 -

Chisholm Jr S Injury Comeback Sparks Yankees Win

Jun 05, 2025

Chisholm Jr S Injury Comeback Sparks Yankees Win

Jun 05, 2025 -

Grace Potter Reflects Soundbites From An Interview About Her Previously Unreleased Album

Jun 05, 2025

Grace Potter Reflects Soundbites From An Interview About Her Previously Unreleased Album

Jun 05, 2025 -

Billionaire Buffetts Strategic Shift Reducing Bank Of America Stake Loading Up On Consumer Staple

Jun 05, 2025

Billionaire Buffetts Strategic Shift Reducing Bank Of America Stake Loading Up On Consumer Staple

Jun 05, 2025 -

Key Witness Testimony Did Plow Driver See Anything In Snow During Boston Police Death Investigation

Jun 05, 2025

Key Witness Testimony Did Plow Driver See Anything In Snow During Boston Police Death Investigation

Jun 05, 2025