Nasdaq 100's All-Time High Remains Elusive: Impact Of US-China Deal And Rate Cut Odds

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nasdaq 100's All-Time High Remains Elusive: US-China Deal and Rate Cut Odds Weigh In

The Nasdaq 100, a tech-heavy index representing some of the world's most innovative companies, continues its flirtation with all-time highs, yet remains tantalizingly out of reach. While strong earnings reports and optimistic forecasts fuel upward momentum, several significant factors – notably the evolving US-China trade relationship and the anticipated Federal Reserve interest rate decisions – are casting a shadow over the index's immediate future. Will the Nasdaq 100 finally break through its previous peak, or are headwinds too strong to overcome?

The Tug-of-War: Positive Earnings vs. Macroeconomic Uncertainty

Recent earnings reports from major tech giants have been largely positive, boosting investor confidence and pushing the Nasdaq 100 higher. Strong performance from companies like Microsoft, Apple, and Amazon, fueled by robust demand and innovative product launches, has been a key driver of growth. However, this positive sentiment is tempered by several looming macroeconomic concerns.

US-China Trade Relations: A Looming Threat?

The ongoing US-China trade negotiations continue to be a source of significant volatility for global markets. While a "phase one" deal has been reached, lingering uncertainties about future tariffs and trade restrictions create a climate of uncertainty. This uncertainty can deter investors from committing large sums of capital to the stock market, potentially hindering the Nasdaq 100's ascent to new highs. Any escalation of trade tensions could trigger a significant market correction, impacting the tech sector disproportionately. For more on the latest developments, check out the .

Federal Reserve Rate Cuts: A Double-Edged Sword

The anticipation of potential Federal Reserve interest rate cuts is another crucial factor influencing the Nasdaq 100's trajectory. While lower interest rates could stimulate economic growth and boost investor confidence, leading to higher stock prices, there are potential downsides. Some analysts warn that repeated rate cuts could signal underlying economic weakness, potentially undermining investor sentiment in the long run. The market is keenly watching the Fed's next move, which could significantly impact the Nasdaq 100's performance in the coming months. Learn more about the Federal Reserve's monetary policy on their .

What Lies Ahead for the Nasdaq 100?

The path to a new all-time high for the Nasdaq 100 remains uncertain. While strong corporate earnings provide a bullish narrative, the macroeconomic headwinds posed by US-China trade relations and the Federal Reserve's monetary policy decisions present significant challenges.

Key Factors to Watch:

- Further developments in US-China trade negotiations: Any significant breakthroughs or escalations will dramatically affect market sentiment.

- The Federal Reserve's future interest rate decisions: The timing and magnitude of rate cuts will significantly impact investor confidence.

- Corporate earnings reports: Continued strong performance from leading tech companies will be crucial for sustaining upward momentum.

- Geopolitical risks: Global instability can trigger market volatility and impact investor sentiment.

Conclusion:

The Nasdaq 100's journey to an all-time high is a complex interplay of positive corporate performance and significant macroeconomic uncertainties. Investors should carefully consider these factors before making any investment decisions. Staying informed about the latest developments in US-China trade, the Federal Reserve's monetary policy, and corporate earnings is crucial for navigating the current market landscape. Monitoring key economic indicators and following reputable financial news sources can help investors make more informed choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nasdaq 100's All-Time High Remains Elusive: Impact Of US-China Deal And Rate Cut Odds. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Caitlin Clarks Injury Update Timeline For Return After Quad Strain

Jun 12, 2025

Caitlin Clarks Injury Update Timeline For Return After Quad Strain

Jun 12, 2025 -

2025 Nba Mock Draft Breakdown Evaluating Top Prospects And Team Needs

Jun 12, 2025

2025 Nba Mock Draft Breakdown Evaluating Top Prospects And Team Needs

Jun 12, 2025 -

On The Bubble The Nfls Most Promising Fringe Playoff Contenders For 2023

Jun 12, 2025

On The Bubble The Nfls Most Promising Fringe Playoff Contenders For 2023

Jun 12, 2025 -

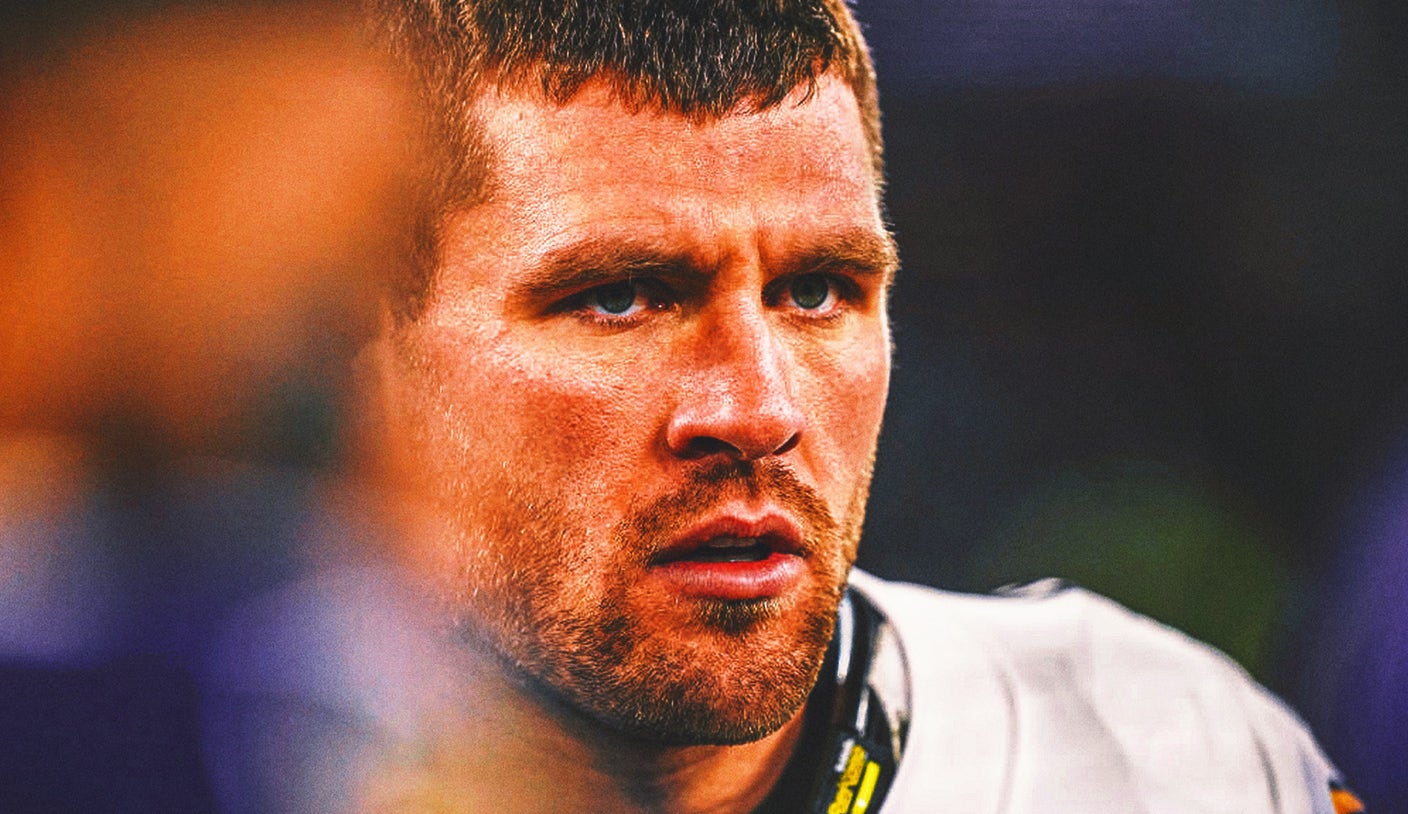

Analyzing The 2025 Nfl Defensive Player Of The Year Odds After T J Watt Holdout

Jun 12, 2025

Analyzing The 2025 Nfl Defensive Player Of The Year Odds After T J Watt Holdout

Jun 12, 2025 -

Unlikely Sight Pope Leo Xiii Sports White Sox Hat During Vatican Event

Jun 12, 2025

Unlikely Sight Pope Leo Xiii Sports White Sox Hat During Vatican Event

Jun 12, 2025