Nasdaq 100's All-Time High Remains Elusive After US-China Agreement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nasdaq 100's All-Time High Remains Elusive After US-China Agreement: A Cautious Market

The Nasdaq 100, a technology-heavy index, continues its flirtation with all-time highs, but a decisive breakthrough remains elusive even after the recent US-China "phase one" trade deal. While the agreement brought a temporary reprieve from escalating trade tensions, investor sentiment remains cautious, suggesting a more complex picture than a simple "deal-driven" rally.

This hesitancy is understandable. While the trade deal eased some immediate concerns, significant long-term uncertainties persist. The agreement addresses some, but not all, of the trade disputes, leaving the potential for future friction. Furthermore, broader macroeconomic factors, including global growth concerns and geopolitical instability, continue to weigh on investor confidence.

What's Holding the Nasdaq 100 Back?

Several factors contribute to the Nasdaq 100's struggle to reach new all-time highs:

-

Valuation Concerns: Many tech giants within the Nasdaq 100 are already trading at high valuations. Investors are increasingly questioning whether these valuations are sustainable, given potential economic slowdowns. This leads to profit-taking and a reluctance to aggressively push the index higher.

-

Geopolitical Risks: While the US-China trade deal eased tensions, other geopolitical uncertainties remain. These include ongoing conflicts in the Middle East and concerns about global political stability, which can significantly impact investor risk appetite.

-

Interest Rate Expectations: The Federal Reserve's monetary policy continues to be a significant factor. While interest rate cuts have supported the market, the potential for further cuts or changes in monetary policy remains a source of uncertainty. This uncertainty can lead investors to take a more cautious approach.

The Impact of the US-China Trade Deal:

The "phase one" agreement undoubtedly provided a short-term boost to market sentiment. It reduced immediate trade-related anxieties and offered a degree of predictability. However, its long-term impact is still unfolding. The deal primarily focuses on increased Chinese purchases of US goods and services, intellectual property protection, and currency manipulation. However, significant issues remain unaddressed, leaving room for future disagreements.

Looking Ahead: What to Expect from the Nasdaq 100

Predicting the future trajectory of the Nasdaq 100 is challenging, even for seasoned market analysts. The index's performance will likely depend on a complex interplay of factors, including:

-

Corporate Earnings: Strong earnings reports from major tech companies could fuel further gains. Conversely, disappointing earnings could trigger a significant sell-off.

-

Global Economic Growth: The health of the global economy will be crucial. A slowdown in global growth could negatively impact tech companies' prospects, putting downward pressure on the Nasdaq 100.

-

Further Trade Developments: Any escalation of trade tensions between the US and China, or other major trading partners, could significantly impact market sentiment and the Nasdaq 100's performance.

Conclusion:

The Nasdaq 100's struggle to reach new highs highlights the intricate relationship between market sentiment, geopolitical stability, and macroeconomic conditions. While the US-China trade deal offered a temporary respite, fundamental uncertainties persist. Investors should remain cautious and diversify their portfolios to mitigate risk. The coming months will be critical in determining whether the index can finally break through to record territory or if further consolidation is in store. Stay tuned for further updates and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nasdaq 100's All-Time High Remains Elusive After US-China Agreement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Duke And Texas Face Off In Inaugural Jim Valvano Award Event

Jun 11, 2025

Duke And Texas Face Off In Inaugural Jim Valvano Award Event

Jun 11, 2025 -

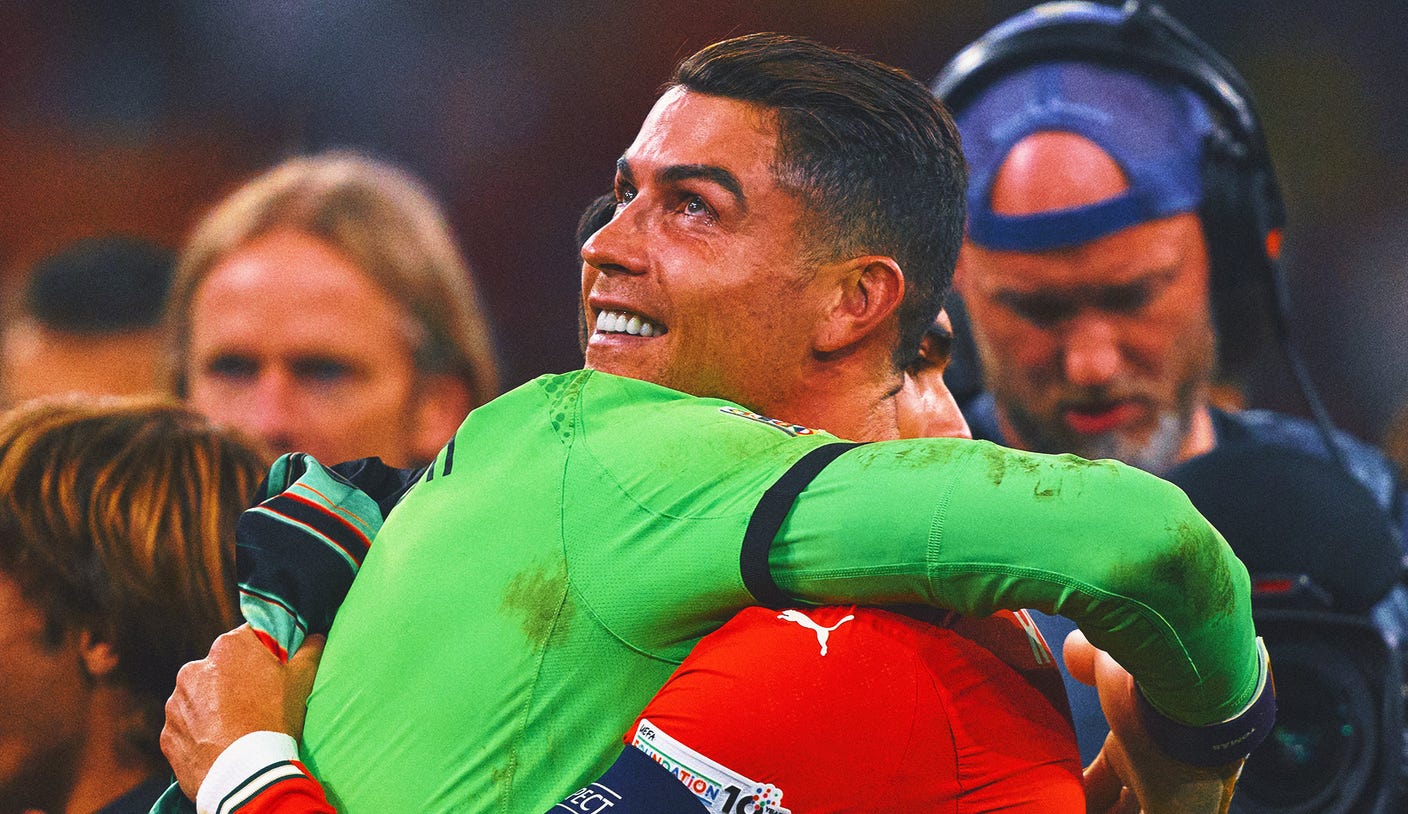

Cristiano Ronaldo Remains Defiant Club Future Unchanged After Portugals Success

Jun 11, 2025

Cristiano Ronaldo Remains Defiant Club Future Unchanged After Portugals Success

Jun 11, 2025 -

Cristiano Ronaldo Remains Unfazed Club Future Update After Portugals Win

Jun 11, 2025

Cristiano Ronaldo Remains Unfazed Club Future Update After Portugals Win

Jun 11, 2025 -

Cam Ward Jaxson Dart And The 2025 Rookie Qbs Defining And Measuring Success

Jun 11, 2025

Cam Ward Jaxson Dart And The 2025 Rookie Qbs Defining And Measuring Success

Jun 11, 2025 -

World Cup Legacy Koemans Past Meets Present In Malta Reunion

Jun 11, 2025

World Cup Legacy Koemans Past Meets Present In Malta Reunion

Jun 11, 2025