Nasdaq 100 Stalls Below Record High Despite US-China Deal, Rate Cut Bets Rise

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nasdaq 100 Stalls Below Record High Despite US-China Deal, Rate Cut Bets Rise

The Nasdaq 100 index ended its trading session on [Date] slightly below its record high, despite a tentative US-China trade deal and growing expectations of a Federal Reserve interest rate cut. This unexpected plateau has sparked debate among market analysts, highlighting the complex interplay of geopolitical factors and monetary policy expectations impacting the tech-heavy index.

US-China Trade Deal: A Mixed Blessing?

While the "phase one" trade deal between the US and China offered a momentary reprieve from escalating trade tensions, its impact on the Nasdaq 100 proved less significant than initially anticipated. While some analysts viewed the deal as a positive sign for long-term economic growth, others pointed out its limited scope and the lingering uncertainty surrounding future trade negotiations. This ambiguity likely contributed to investor hesitancy, preventing a sustained push towards new record highs. The deal, while welcome, failed to address many core issues, leaving a sense of cautious optimism rather than outright euphoria in the market.

Rate Cut Bets Intensify: A Double-Edged Sword?

The increasing likelihood of a Federal Reserve interest rate cut further complicated the market's reaction. While lower interest rates are generally seen as positive for growth stocks like those heavily represented in the Nasdaq 100, the anticipation itself can be a double-edged sword. Some investors believe a rate cut signals weakening economic conditions, potentially impacting corporate earnings and dampening future growth prospects. This conflicting sentiment added to the market's indecisiveness. The [mention specific economic indicator, e.g., recent inflation data] further fueled speculation about a potential rate cut.

Sector-Specific Performance:

The performance of individual sectors within the Nasdaq 100 also contributed to its inability to break through the record high. While certain segments, like [mention specific high-performing sector, e.g., cloud computing], showed robust growth, others faced headwinds. [Mention specific underperforming sector, e.g., semiconductor] companies experienced a slowdown, partially attributed to [mention reason, e.g., global chip supply chain issues]. This uneven performance across sectors underscores the inherent volatility within the index.

What's Next for the Nasdaq 100?

The near-term outlook for the Nasdaq 100 remains uncertain. Much depends on the following factors:

- Further developments in US-China trade relations: Any escalation or unexpected breakthroughs in negotiations could significantly impact market sentiment.

- The Federal Reserve's policy decisions: The timing and magnitude of any rate cuts will heavily influence investor confidence.

- Corporate earnings reports: Strong earnings reports from major Nasdaq 100 companies could provide the impetus for a renewed upward trajectory.

- Global economic growth: A slowdown in global economic growth could weigh heavily on tech stocks, impacting the Nasdaq 100.

Conclusion:

The Nasdaq 100's failure to surpass its record high despite positive news underscores the complexities of the current market environment. Investors are grappling with conflicting signals, weighing the benefits of a tentative trade deal against concerns about slowing economic growth and potential monetary policy adjustments. The coming weeks will be crucial in determining the future direction of this tech-heavy index. Keep an eye on key economic indicators and corporate earnings reports for further insights. Learn more about [link to related article on economic indicators or Fed policy].

Keywords: Nasdaq 100, record high, US-China trade deal, interest rate cut, Federal Reserve, tech stocks, market analysis, economic indicators, stock market, investment, trading

Note: Remember to replace bracketed information with specific, up-to-date data. Adding charts and graphs would further enhance the article's visual appeal and readability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nasdaq 100 Stalls Below Record High Despite US-China Deal, Rate Cut Bets Rise. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Legendary Comedian Jerry Seinfeld To Perform In Indianapolis

Jun 12, 2025

Legendary Comedian Jerry Seinfeld To Perform In Indianapolis

Jun 12, 2025 -

Allie Quigley Announces Retirement From Wnba After Stellar Career

Jun 12, 2025

Allie Quigley Announces Retirement From Wnba After Stellar Career

Jun 12, 2025 -

After 15 Seasons Allie Quigley Officially Retires From The Wnba

Jun 12, 2025

After 15 Seasons Allie Quigley Officially Retires From The Wnba

Jun 12, 2025 -

Marines Deployed Ongoing Protests Across The Us Live News Coverage

Jun 12, 2025

Marines Deployed Ongoing Protests Across The Us Live News Coverage

Jun 12, 2025 -

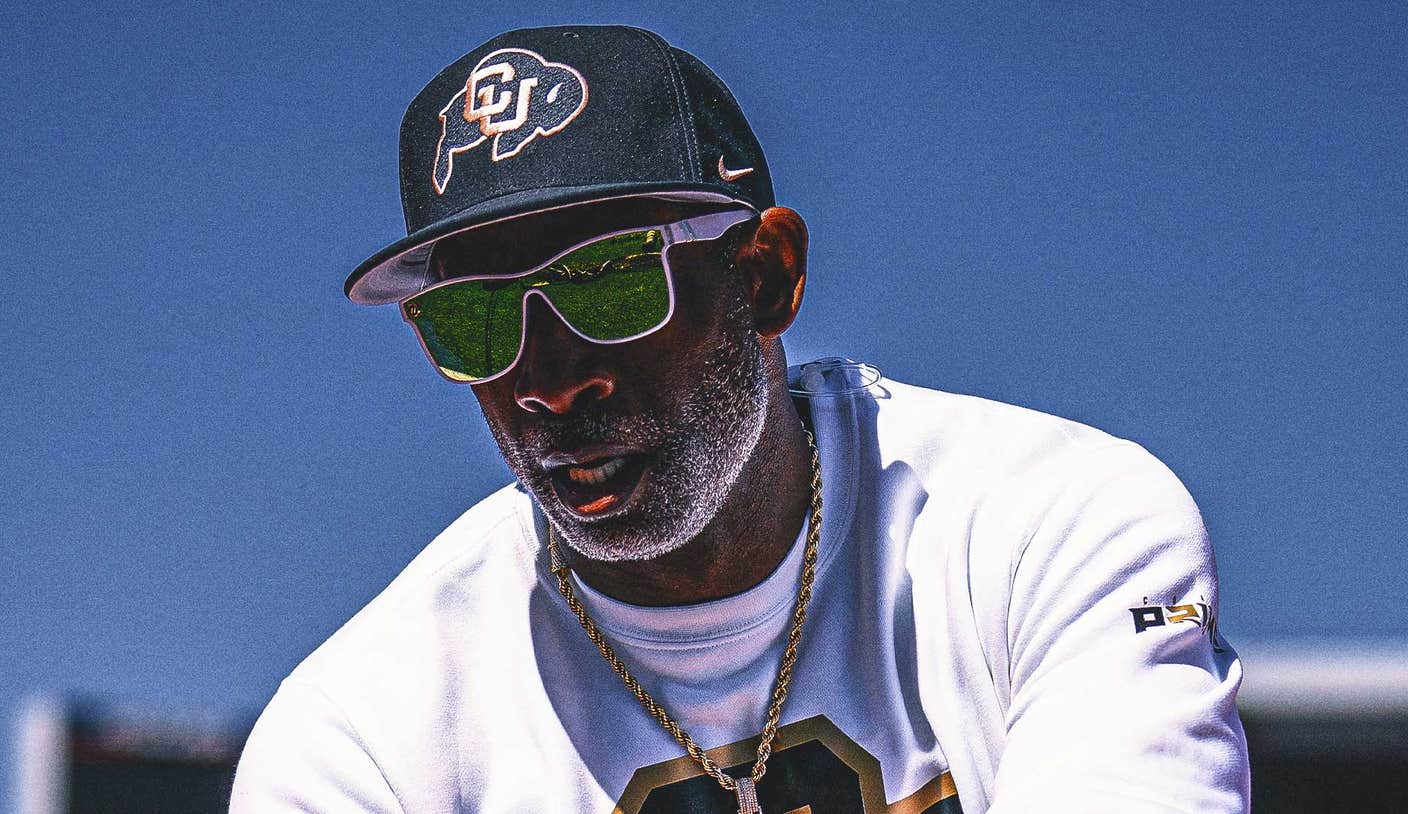

Deion Sanders Health Concerns Colorado Football Program Awaits Coachs Return

Jun 12, 2025

Deion Sanders Health Concerns Colorado Football Program Awaits Coachs Return

Jun 12, 2025