Nasdaq 100 Retreats After Trade Truce, Increased Odds Of Fed Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nasdaq 100 Retreats Despite Trade Truce, as Fed Rate Cut Expectations Rise

The Nasdaq 100 experienced a pullback on [Date], despite a tentative trade truce between the US and China, as investors increasingly anticipate a Federal Reserve interest rate cut. This retreat highlights the complex interplay between geopolitical uncertainty and monetary policy expectations impacting the tech-heavy index.

While the initial market reaction to the trade developments was positive, the gains proved short-lived. The renewed focus shifted to the growing likelihood of a rate reduction by the Federal Reserve, a move aimed at bolstering economic growth and mitigating the potential impact of the ongoing trade war.

The Trade Truce: A Temporary Calm?

The recent pause in the escalating US-China trade war, marked by a temporary halt to further tariff increases, provided a brief respite for markets. However, the underlying issues remain unresolved, leaving investors cautious. The agreement, while offering a short-term reprieve, lacks the concrete details needed to inspire sustained confidence. Many analysts remain skeptical about the long-term implications, viewing it as a temporary postponement rather than a comprehensive resolution. [Link to relevant news source about the trade truce]

Fed Rate Cut: A Pivotal Factor

The anticipation of a Fed rate cut is significantly influencing market sentiment. Economic indicators, including slowing manufacturing growth and muted inflation, are fueling expectations that the central bank will lower interest rates to stimulate economic activity. This expectation, while potentially positive for growth stocks like those heavily represented in the Nasdaq 100, also reflects concerns about the broader economic outlook. The uncertainty surrounding the timing and magnitude of the rate cut is contributing to market volatility.

Nasdaq 100: A Vulnerable Sector?

The Nasdaq 100, heavily weighted with technology companies, is particularly sensitive to interest rate changes. Higher interest rates typically lead to lower valuations for growth stocks, as investors seek higher yields in fixed-income markets. Conversely, lower rates can boost valuations, but the current situation is nuanced. While a rate cut is anticipated, the underlying economic uncertainty is tempering the enthusiasm.

What to Watch For:

- Further developments in US-China trade negotiations: Any significant breakthroughs or setbacks will significantly impact market sentiment.

- Upcoming economic data releases: Key economic indicators will provide further insight into the health of the US economy and influence Fed policy decisions.

- The Federal Reserve's next policy announcement: The timing and magnitude of any rate cut will be crucial for market direction.

Conclusion:

The Nasdaq 100's recent retreat underscores the delicate balance between geopolitical developments and monetary policy. While a trade truce offers temporary relief, the looming possibility of a Fed rate cut, coupled with ongoing economic uncertainty, continues to drive market volatility. Investors should remain vigilant and carefully monitor developments in both trade negotiations and monetary policy. The coming weeks will be crucial in determining the future trajectory of the Nasdaq 100 and broader markets. Stay informed and consider seeking advice from a qualified financial advisor before making any investment decisions.

(Optional CTA): Stay updated on the latest market news by subscribing to our newsletter [Link to newsletter signup].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nasdaq 100 Retreats After Trade Truce, Increased Odds Of Fed Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

White House Praises Los Angeles Events

Jun 12, 2025

White House Praises Los Angeles Events

Jun 12, 2025 -

Generation Next How A Young Nascar Driver Is Dividing Fans

Jun 12, 2025

Generation Next How A Young Nascar Driver Is Dividing Fans

Jun 12, 2025 -

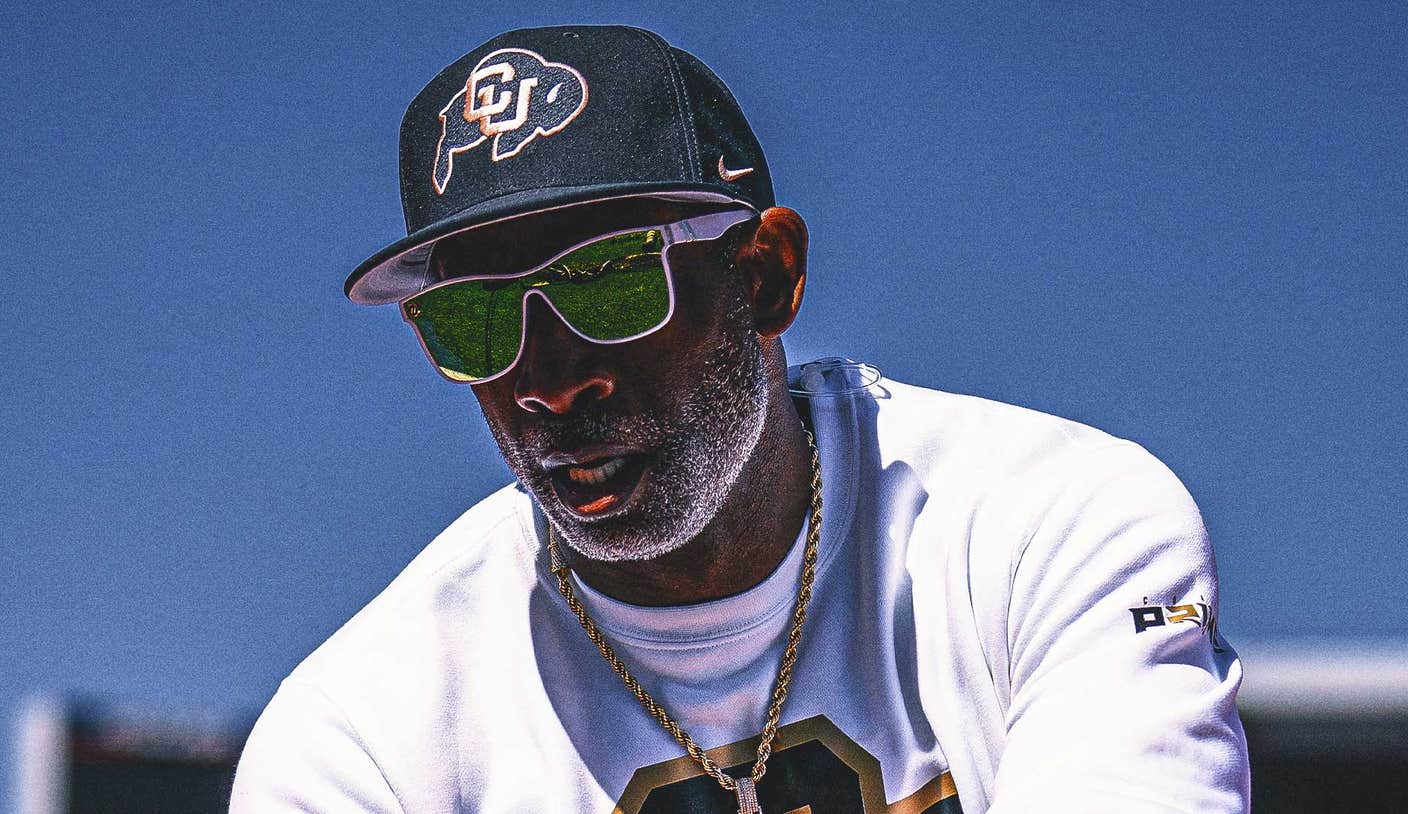

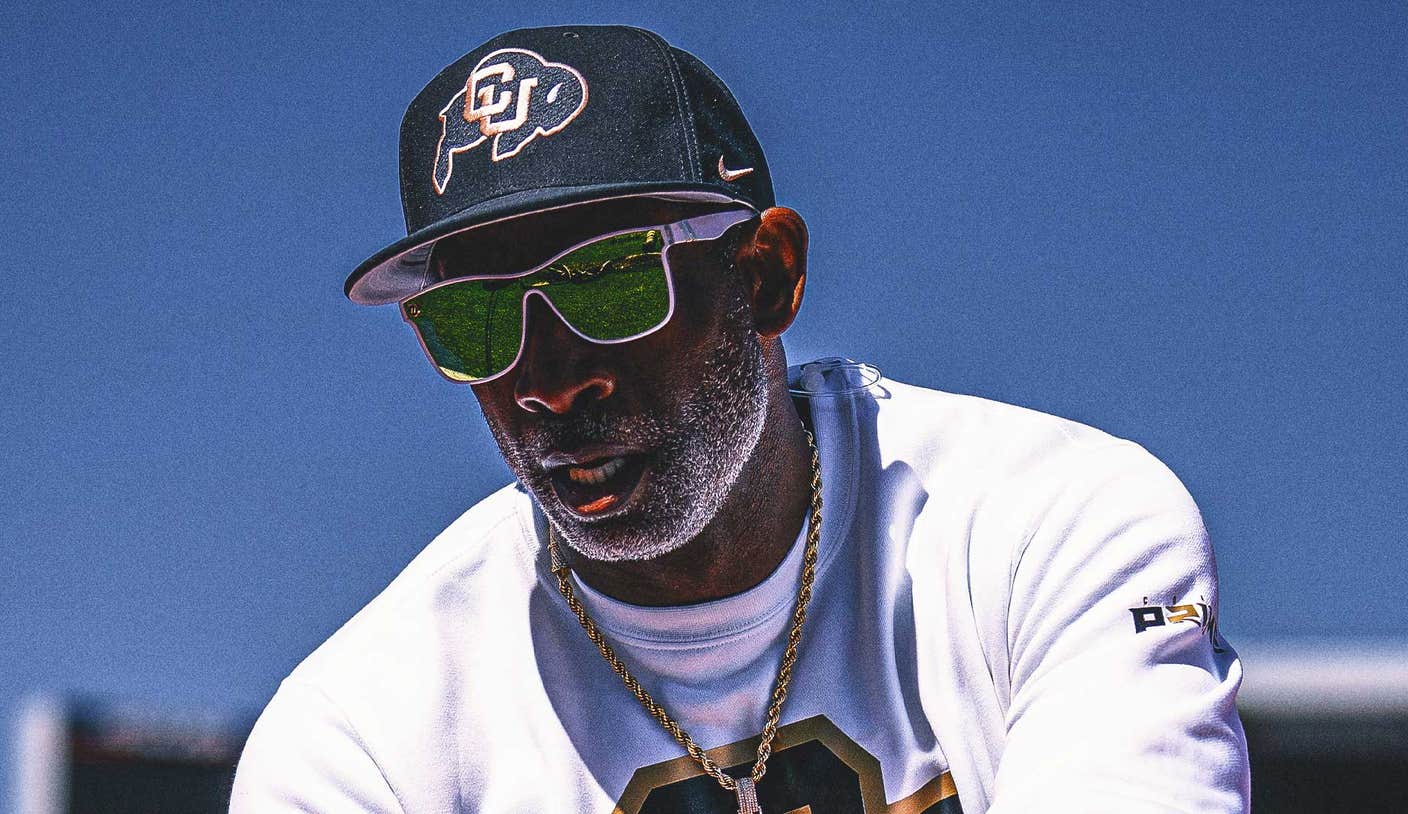

Deion Sanders Health Concerns Colorado Football Program Awaits Coachs Return

Jun 12, 2025

Deion Sanders Health Concerns Colorado Football Program Awaits Coachs Return

Jun 12, 2025 -

Washington Commanders Noah Brown Injured Removed From Practice

Jun 12, 2025

Washington Commanders Noah Brown Injured Removed From Practice

Jun 12, 2025 -

Deion Sanders Health Scare Colorado Program Awaits Coachs Return

Jun 12, 2025

Deion Sanders Health Scare Colorado Program Awaits Coachs Return

Jun 12, 2025