Nasdaq 100 Retreats After Trade Deal; Increased Odds Of Fed Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nasdaq 100 Retreats After Trade Deal; Increased Odds of Fed Rate Cut

The Nasdaq 100 experienced a significant retreat following the announcement of a seemingly positive trade deal, highlighting the complex interplay between geopolitical events and market sentiment. The dip, coupled with a surge in expectations for a Federal Reserve interest rate cut, underscores a growing unease amongst investors regarding the overall economic outlook.

The initial reaction to the trade deal was largely positive, with some analysts suggesting it would alleviate some of the uncertainty plaguing global markets. However, this optimism quickly faded as investors focused on the potential long-term implications and the ongoing challenges facing the tech sector. The Nasdaq 100, heavily weighted with technology giants, bore the brunt of this shift in sentiment.

What Drove the Nasdaq 100 Decline?

Several factors contributed to the Nasdaq 100's retreat:

- Trade Deal Uncertainty: While the trade deal aimed to de-escalate tensions, lingering uncertainties regarding its implementation and long-term effectiveness weighed heavily on investor confidence. The details remained unclear to many, prompting caution.

- Economic Slowdown Fears: Concerns about a potential global economic slowdown persisted, fueled by weakening manufacturing data and softening consumer spending in key markets. These concerns are particularly relevant to the tech sector, which is often highly sensitive to economic cycles.

- Interest Rate Expectations: The increased probability of a Federal Reserve rate cut significantly impacted investor sentiment. While a rate cut might stimulate economic growth, it also suggests the central bank's concern about the economy's health, adding to the overall feeling of uncertainty. [Link to relevant Fed statement]

- Sector-Specific Headwinds: The tech sector itself faces specific headwinds, including increased regulatory scrutiny, competition, and slowing growth in some key segments. These factors further exacerbated the negative sentiment impacting the Nasdaq 100.

Increased Odds of a Fed Rate Cut: A Double-Edged Sword

The market’s pricing in of a higher probability of a Fed rate cut reflects a growing belief that the central bank needs to intervene to support economic growth. While this might provide a short-term boost to certain sectors, it also highlights underlying concerns about the economy's resilience. A rate cut could potentially weaken the dollar, impacting global trade and further complicating the economic landscape. [Link to article discussing potential impacts of a rate cut].

What Lies Ahead for the Nasdaq 100?

The future trajectory of the Nasdaq 100 remains uncertain. The market's reaction to the trade deal and the anticipated Fed rate cut underscores the inherent volatility and sensitivity of the tech sector to both global and domestic economic factors. Investors will be closely monitoring economic data, central bank announcements, and geopolitical developments for clues regarding the market's future direction. Continued uncertainty could lead to further market fluctuations.

Looking Forward: Navigating Market Volatility

The current market climate necessitates a cautious approach. Investors should carefully assess their risk tolerance and diversify their portfolios to mitigate potential losses. Staying informed about economic developments and geopolitical events is crucial for making informed investment decisions. Consult with a qualified financial advisor to discuss your specific investment strategy and risk management plan.

Keywords: Nasdaq 100, Trade Deal, Fed Rate Cut, Interest Rates, Economic Slowdown, Market Volatility, Tech Sector, Investment Strategy, Risk Management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nasdaq 100 Retreats After Trade Deal; Increased Odds Of Fed Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nationwide Protests Intensify Marines On High Alert In La Ongoing Updates

Jun 12, 2025

Nationwide Protests Intensify Marines On High Alert In La Ongoing Updates

Jun 12, 2025 -

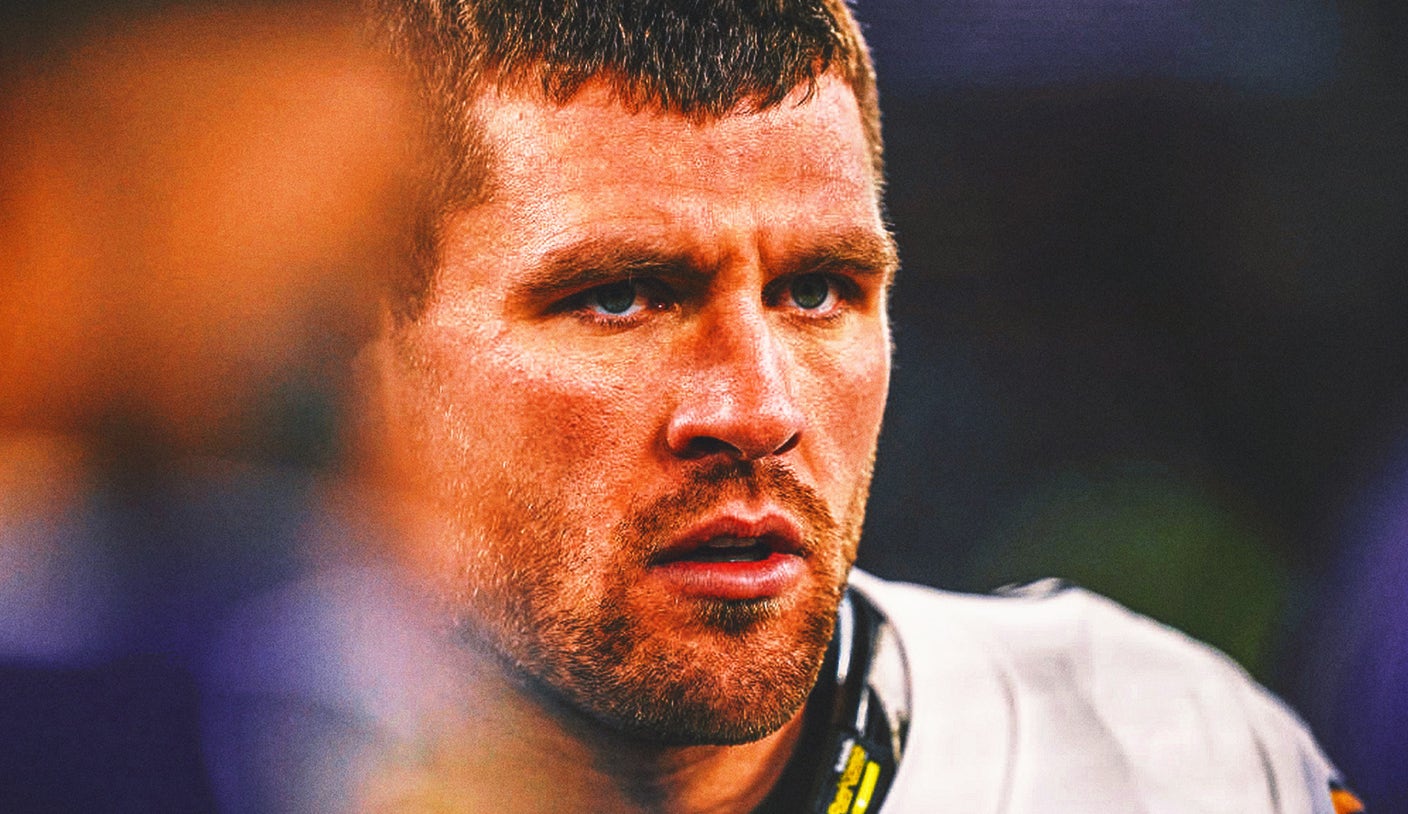

Nfl 2025 Defensive Player Of The Year Odds Shift After T J Watt Holdout

Jun 12, 2025

Nfl 2025 Defensive Player Of The Year Odds Shift After T J Watt Holdout

Jun 12, 2025 -

Contract Disputes Dominate Watt And Mc Laurin Lead Nfl Minicamp Holdouts

Jun 12, 2025

Contract Disputes Dominate Watt And Mc Laurin Lead Nfl Minicamp Holdouts

Jun 12, 2025 -

Birdsong Vs Senzatela Colorado Rockies Game 68 Matchup Breakdown

Jun 12, 2025

Birdsong Vs Senzatela Colorado Rockies Game 68 Matchup Breakdown

Jun 12, 2025 -

Michigans Nascar Driver Polarizing Talent Or Reckless Risk

Jun 12, 2025

Michigans Nascar Driver Polarizing Talent Or Reckless Risk

Jun 12, 2025