Nasdaq 100 Rejected At All-Time High: Impact Of US-China Trade Deal And Interest Rate Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nasdaq 100 Rejected at All-Time High: Trade Deal Uncertainty and Interest Rate Cuts Weigh In

The Nasdaq 100's recent rejection at its all-time high has sent ripples through the financial markets, sparking debate about the underlying causes. While the index's impressive run-up had been fueled by strong tech earnings and anticipation of further interest rate cuts, the recent stall suggests a more complex picture, heavily influenced by the ongoing US-China trade negotiations and lingering concerns about global economic growth.

The All-Time High and the Subsequent Pullback:

The Nasdaq 100, a technology-heavy index comprising 100 of the largest non-financial companies listed on the Nasdaq Stock Market, recently hit an all-time high. However, this peak was short-lived, with a subsequent pullback raising questions about the sustainability of the rally. This rejection at the high marks a significant shift in market sentiment, prompting analysts to reassess their forecasts.

Impact of the US-China Trade Deal (or Lack Thereof):

The protracted US-China trade war remains a significant headwind for global markets. While the "Phase One" trade deal offered some respite, ongoing uncertainty and the threat of further tariffs continue to weigh on investor confidence. The lack of substantial progress beyond Phase One and the continued imposition of tariffs on certain goods directly impact the profitability of many technology companies listed on the Nasdaq 100, leading to market volatility. This uncertainty makes long-term investment planning more challenging, contributing to the recent pullback. Learn more about the intricacies of the US-China trade relationship by reading .

Interest Rate Cuts: A Double-Edged Sword:

The Federal Reserve's interest rate cuts, intended to stimulate economic growth, have had a mixed impact. While lower interest rates can boost borrowing and investment, they also carry risks. Some argue that excessively low rates can fuel asset bubbles and ultimately lead to instability. The effectiveness of rate cuts in boosting economic growth in the face of trade uncertainties remains a topic of considerable debate among economists. Further, the market may already have priced in the anticipated rate cuts, leading to a sell-off once the expected action is taken.

Other Contributing Factors:

Beyond the trade war and interest rates, several other factors could be contributing to the Nasdaq 100's recent performance:

- Valuation Concerns: Some analysts argue that certain technology stocks within the Nasdaq 100 are overvalued, creating a vulnerability to profit-taking.

- Geopolitical Risks: Global geopolitical tensions, from Brexit to Middle East conflicts, also add to market uncertainty.

- Earnings Season: Disappointing earnings reports from key tech companies could further dampen investor sentiment.

What's Next for the Nasdaq 100?

Predicting the future direction of the Nasdaq 100 is challenging. The index's performance will likely hinge on several key factors, including:

- Resolution (or escalation) of the US-China trade dispute.

- The effectiveness of further monetary policy easing.

- The overall health of the global economy.

- Corporate earnings reports.

Investors should carefully monitor these developments and adjust their portfolios accordingly. Diversification remains crucial in navigating the current market volatility.

Call to Action: Stay informed about market trends by following reputable financial news sources and consulting with a qualified financial advisor before making any investment decisions. Understanding the interplay between global economic factors and the performance of specific indices like the Nasdaq 100 is vital for informed investment strategies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nasdaq 100 Rejected At All-Time High: Impact Of US-China Trade Deal And Interest Rate Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

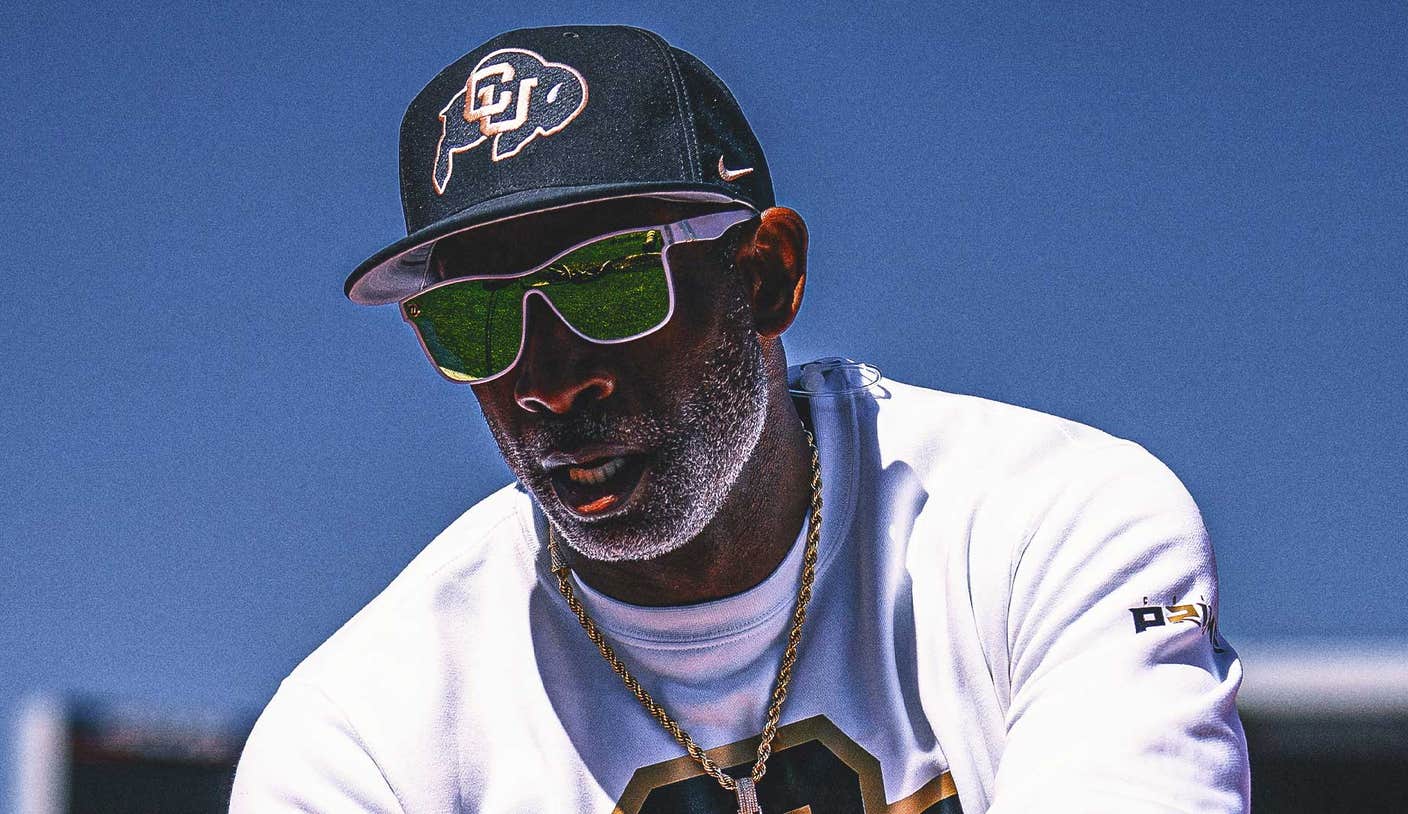

Deion Sanders Illness Colorado Football Program Update

Jun 12, 2025

Deion Sanders Illness Colorado Football Program Update

Jun 12, 2025 -

Sole Phillie Expected In Nl All Star Starting Lineup Who Is It

Jun 12, 2025

Sole Phillie Expected In Nl All Star Starting Lineup Who Is It

Jun 12, 2025 -

Brian Rolapp Top Contender For Pga Tour Ceo Position

Jun 12, 2025

Brian Rolapp Top Contender For Pga Tour Ceo Position

Jun 12, 2025 -

White House Reaction To Significant Los Angeles Events

Jun 12, 2025

White House Reaction To Significant Los Angeles Events

Jun 12, 2025 -

Phil Luzardos All Star Potential Making The Case For A Starting Role

Jun 12, 2025

Phil Luzardos All Star Potential Making The Case For A Starting Role

Jun 12, 2025