Nasdaq 100 Index: Trade Truce, Rate Cut Speculation Fail To Push To New All-Time High

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nasdaq 100 Index: Trade Truce, Rate Cut Speculation Fail to Lift to New All-Time High

The Nasdaq 100, a tech-heavy index often seen as a barometer for the overall health of the US economy, has stalled just short of hitting a new all-time high despite recent positive developments. While a tentative trade truce between the US and China and growing speculation of a Federal Reserve rate cut offered potential catalysts for growth, the index has failed to break through its previous record, leaving investors questioning the strength of the current rally.

Trade Truce Offers Limited Boost

The recent easing of trade tensions between the US and China, following months of escalating tariffs, had initially been anticipated to provide a significant boost to the Nasdaq 100. Many tech companies rely heavily on global trade, and reduced uncertainty was expected to unlock further investment. However, the impact proved more muted than many analysts had predicted. While the initial positive reaction was noticeable, sustained upward momentum quickly faded. This suggests that other factors are at play, limiting the positive influence of the trade developments.

Rate Cut Hopes Dented

The expectation of a Federal Reserve interest rate cut, aimed at stimulating economic growth, also failed to deliver the anticipated surge in the Nasdaq 100. While a rate cut could theoretically boost investor confidence and encourage borrowing, the market's reaction was underwhelming. This could be attributed to several factors, including concerns about the overall health of the global economy and the potential for unintended consequences of a rate cut. [Link to article about recent Fed statements]

What's Holding the Nasdaq 100 Back?

Several factors could explain the Nasdaq 100's inability to reach new highs:

- Valuation Concerns: Some analysts argue that the index is already overvalued, limiting further upside potential. High valuations can make investors hesitant to commit more capital, even in the face of positive news.

- Geopolitical Uncertainty: While the US-China trade situation has improved, other geopolitical risks remain, potentially dampening investor enthusiasm. [Link to article about geopolitical risks]

- Earnings Season Ahead: The upcoming earnings season could significantly influence market sentiment. Strong earnings reports could push the index higher, while disappointing results could trigger a sell-off.

- Sector-Specific Challenges: Specific challenges within the tech sector itself, such as increased regulatory scrutiny or slowing growth in certain segments, could be impacting the overall performance of the Nasdaq 100.

Looking Ahead: A Cautious Outlook

The Nasdaq 100's performance in the coming weeks will be closely watched by investors. While the potential for future growth remains, the recent lack of a significant rally suggests a more cautious outlook is warranted. The upcoming earnings season and further developments in the US-China trade relationship will likely play a crucial role in determining the index's future trajectory. Investors should monitor these developments closely and consider diversifying their portfolios to mitigate risk.

Keywords: Nasdaq 100, Nasdaq, stock market, tech stocks, trade war, US-China trade, interest rates, Federal Reserve, rate cut, economic growth, stock market analysis, investment strategy, market outlook, valuation, geopolitical risk, earnings season.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nasdaq 100 Index: Trade Truce, Rate Cut Speculation Fail To Push To New All-Time High. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

National Guard Los Angeles Recruitment Roles And Community Involvement

Jun 12, 2025

National Guard Los Angeles Recruitment Roles And Community Involvement

Jun 12, 2025 -

The Nascar Divide A 22 Year Olds Rise And The Fans Heated Reactions

Jun 12, 2025

The Nascar Divide A 22 Year Olds Rise And The Fans Heated Reactions

Jun 12, 2025 -

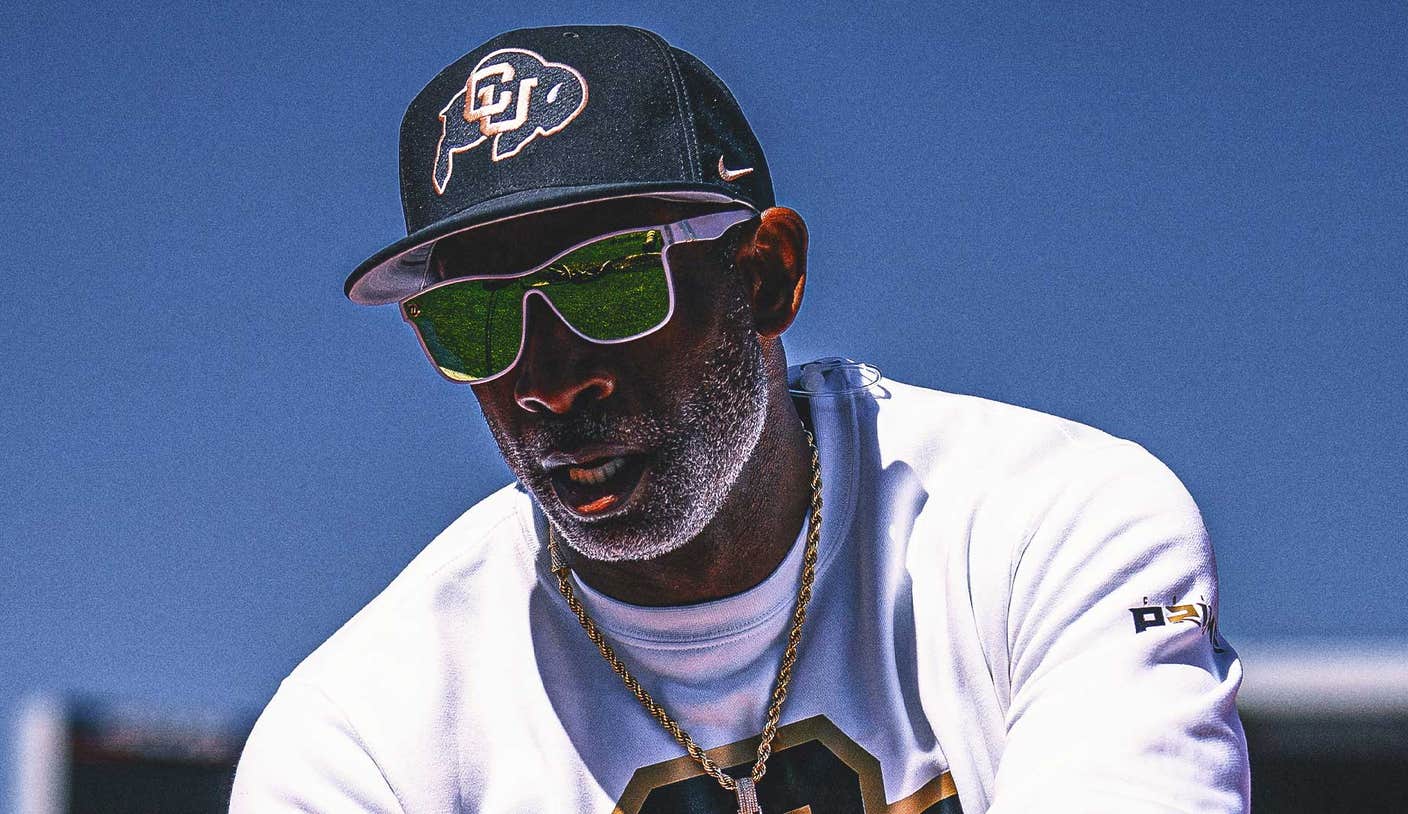

Deion Sanders Health Concerns Latest Updates From The Colorado Buffaloes

Jun 12, 2025

Deion Sanders Health Concerns Latest Updates From The Colorado Buffaloes

Jun 12, 2025 -

Predicting The 2025 Al And Nl Cy Young Can Paul Skenes Overcome A Slow Beginning

Jun 12, 2025

Predicting The 2025 Al And Nl Cy Young Can Paul Skenes Overcome A Slow Beginning

Jun 12, 2025 -

No Concerns Morris Addresses Cousins Potential Disruption Of Penix Jr

Jun 12, 2025

No Concerns Morris Addresses Cousins Potential Disruption Of Penix Jr

Jun 12, 2025