Nasdaq 100 Holds Below Record High: Impact Of US-China Deal And Rising Rate Cut Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nasdaq 100 Holds Below Record High: US-China Deal and Rate Cut Hopes Weigh In

The Nasdaq 100, a bellwether for tech giants and growth stocks, remains stubbornly below its all-time high, despite recent positive developments on the US-China trade front and growing expectations of Federal Reserve interest rate cuts. While the index has shown resilience in the face of broader economic uncertainty, several factors are preventing a decisive breakout. This leaves investors wondering: what's next for the tech-heavy index?

The Impact of a Tentative US-China Truce

The recent thawing of relations between the US and China, marked by renewed dialogue and a temporary pause in escalating tariffs, has injected a dose of optimism into global markets. This is particularly true for technology companies, many of which rely heavily on the Chinese market for both sales and manufacturing. However, the deal remains fragile, and its long-term impact remains uncertain. A full resolution to the trade war is still far from guaranteed, leaving a lingering sense of caution among investors. This uncertainty prevents a full-fledged rally in the Nasdaq 100, which is highly sensitive to geopolitical risk.

Rising Expectations of Rate Cuts: A Double-Edged Sword

The Federal Reserve's recent signaling of potential interest rate cuts has further fueled speculation about the future direction of the Nasdaq 100. Lower interest rates generally benefit growth stocks like those comprising the Nasdaq 100, as they reduce borrowing costs and boost investor confidence. However, the expectation of rate cuts also reflects concerns about slowing economic growth. This creates a paradoxical situation: while lower rates might support the market, they simultaneously underscore concerns about the underlying health of the economy. This ambiguity contributes to the index's hesitation to decisively break through its record high.

Sector-Specific Challenges within the Nasdaq 100

Beyond macroeconomic factors, the Nasdaq 100 faces internal challenges. Specific sectors within the index, such as semiconductor manufacturers and cloud computing companies, are grappling with their own set of headwinds, including supply chain disruptions and increased competition. These micro-level factors contribute to the overall market hesitancy, preventing a sustained upward surge.

What to Watch For:

- Further Developments in US-China Trade Relations: Any significant escalation or de-escalation in the trade war will significantly impact the Nasdaq 100.

- The Federal Reserve's Actions: The timing and magnitude of any rate cuts will be closely scrutinized by investors.

- Corporate Earnings Reports: Strong earnings reports from major Nasdaq 100 companies could reignite investor enthusiasm.

- Global Economic Data: Indicators of global economic growth, particularly in the US and China, will play a crucial role in shaping investor sentiment.

Conclusion: A Cautiously Optimistic Outlook

While the Nasdaq 100's failure to surpass its record high might appear discouraging, it's important to consider the complex interplay of factors at play. The tentative US-China trade deal and anticipated rate cuts offer reasons for optimism, but underlying economic uncertainties and sector-specific challenges continue to exert a dampening effect. Investors should adopt a cautiously optimistic outlook, closely monitoring the unfolding economic and geopolitical landscape for clues about the index's future trajectory. For further market analysis and investment strategies, consider consulting with a qualified financial advisor. This article should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nasdaq 100 Holds Below Record High: Impact Of US-China Deal And Rising Rate Cut Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Panthers And Defenders Shine Best Plays From The Ufl Conference Finals

Jun 12, 2025

Panthers And Defenders Shine Best Plays From The Ufl Conference Finals

Jun 12, 2025 -

Penix Jr Vs Cousins Morriss Plan For Falcons Defensive Success

Jun 12, 2025

Penix Jr Vs Cousins Morriss Plan For Falcons Defensive Success

Jun 12, 2025 -

Adobe Stocks Ai Image Generation A Creative Professionals Dilemma Nasdaq Adbe

Jun 12, 2025

Adobe Stocks Ai Image Generation A Creative Professionals Dilemma Nasdaq Adbe

Jun 12, 2025 -

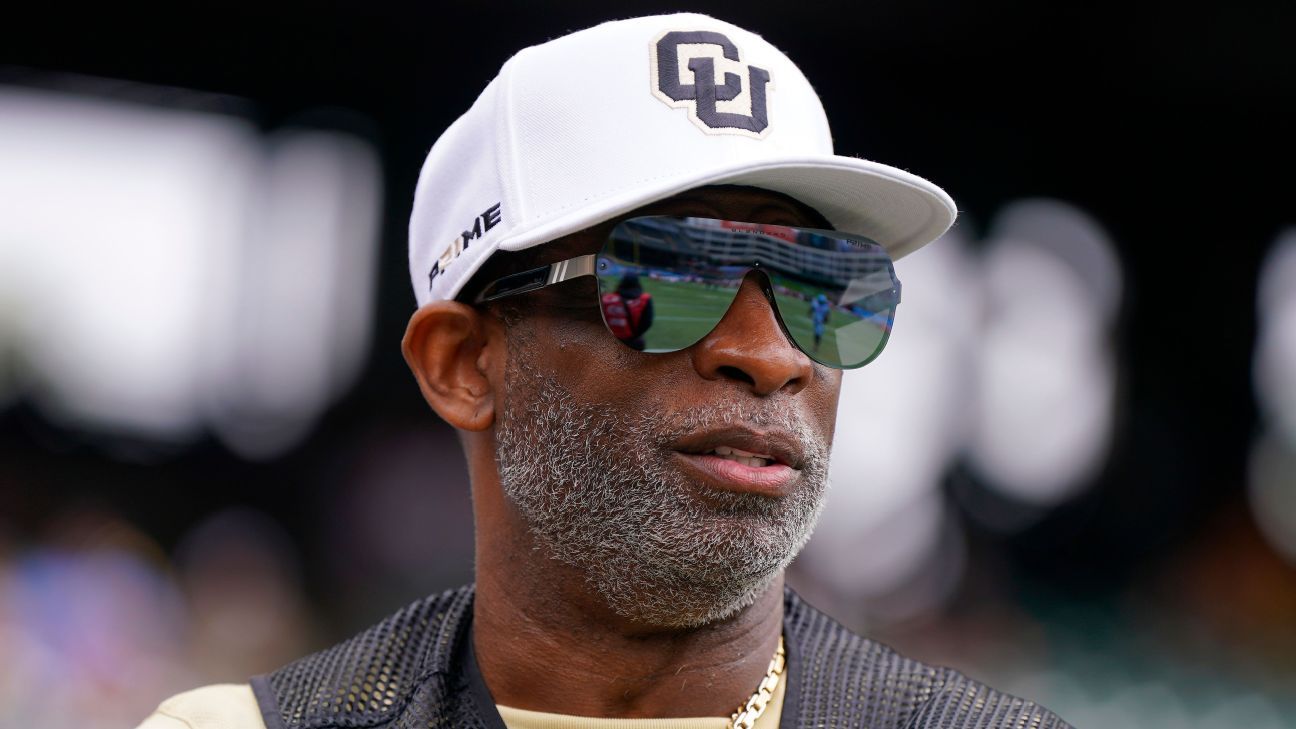

Update On Deion Sanders Condition Colorado Football Coachs Health Scare

Jun 12, 2025

Update On Deion Sanders Condition Colorado Football Coachs Health Scare

Jun 12, 2025 -

Contenders Or Pretenders Assessing Backup Qbs Playoff Potential For The 2024 Nfl Season

Jun 12, 2025

Contenders Or Pretenders Assessing Backup Qbs Playoff Potential For The 2024 Nfl Season

Jun 12, 2025