Nasdaq 100 Holds Below Record Despite US-China Trade Deal; Increased Odds Of Fed Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nasdaq 100 Stalls Below Record High Despite US-China Trade Deal, Fed Rate Cut Odds Rise

The Nasdaq 100, a technology-heavy index, ended the trading session below its record high despite the much-anticipated "phase one" trade deal between the US and China. This unexpected development, coupled with increasing expectations of a Federal Reserve interest rate cut, has sent ripples through the market, leaving investors pondering the future trajectory of tech stocks and the broader economy.

US-China Trade Deal: A Mixed Blessing?

While the phase one trade deal is undoubtedly a positive step towards de-escalating trade tensions, its impact on the Nasdaq 100 appears to be less pronounced than initially anticipated. Analysts suggest that while the deal removes some uncertainty, other factors are currently outweighing its positive influence. These include concerns about global economic growth, ongoing geopolitical risks, and the persistent strength of the US dollar.

The deal itself, while reducing some tariffs, doesn't address the core structural issues of the trade dispute. This leaves lingering uncertainty for many companies heavily reliant on international trade, impacting investor confidence and preventing a significant surge in the Nasdaq 100.

Fed Rate Cut Expectations Intensify

Adding to the complexity is the growing expectation of a Federal Reserve interest rate cut. Recent economic data, including softer-than-expected inflation and slowing manufacturing activity, has fueled speculation that the Fed will lower interest rates to stimulate economic growth. This expectation is further reinforced by comments from various Federal Reserve officials hinting at a more accommodative monetary policy. [Link to relevant Federal Reserve statement]

A rate cut could potentially boost the Nasdaq 100 by lowering borrowing costs for tech companies, encouraging investment and potentially driving up valuations. However, some analysts warn that a rate cut might also signal underlying weakness in the economy, potentially dampening overall investor enthusiasm.

What's Next for the Nasdaq 100?

The current market situation presents a complex picture. The lack of a significant rally in the Nasdaq 100 following the US-China trade deal suggests that other headwinds are currently dominating market sentiment. The increasing likelihood of a Fed rate cut introduces another layer of uncertainty, with both positive and negative implications for tech stocks.

Investors should closely monitor:

- Economic data releases: Key indicators like inflation, employment figures, and manufacturing PMI will provide further insights into the state of the economy and influence the Fed's decisions.

- Geopolitical developments: Ongoing trade tensions with other countries and global political instability can significantly impact market sentiment.

- Earnings season: Upcoming earnings reports from major tech companies will provide crucial insights into their performance and future outlook.

Navigating the Uncertainty

The current market environment calls for a cautious yet strategic approach. Investors should diversify their portfolios, carefully consider their risk tolerance, and stay informed about the latest economic and geopolitical developments. Seeking professional financial advice can also prove beneficial in navigating this period of uncertainty.

Keywords: Nasdaq 100, US-China trade deal, Federal Reserve, interest rate cut, tech stocks, economic growth, market volatility, investor confidence, geopolitical risk, economic data, earnings season.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nasdaq 100 Holds Below Record Despite US-China Trade Deal; Increased Odds Of Fed Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

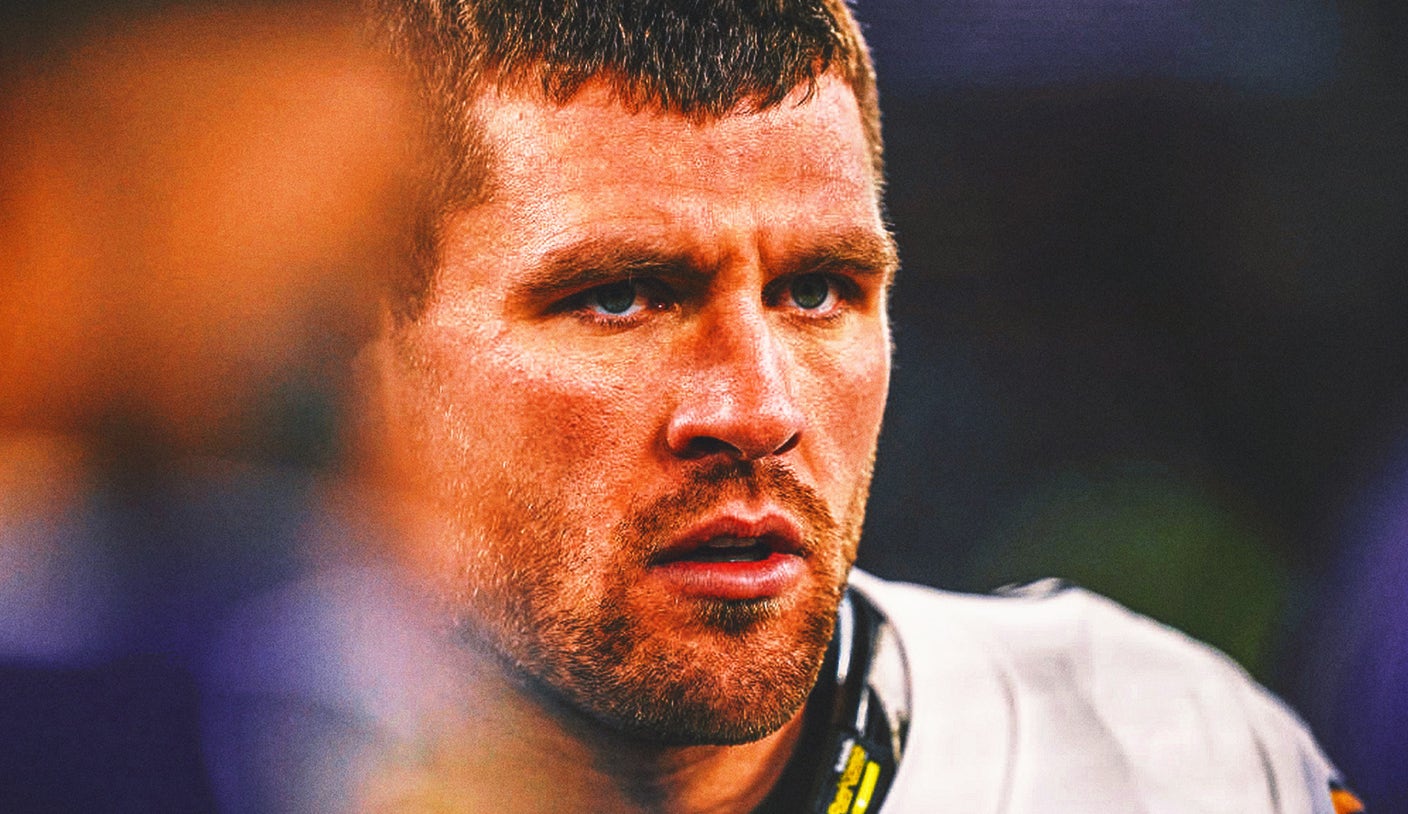

Nfl 2025 Defensive Player Of The Year Odds Shift After T J Watt Holdout

Jun 12, 2025

Nfl 2025 Defensive Player Of The Year Odds Shift After T J Watt Holdout

Jun 12, 2025 -

Ufl Conference Championship Unforgettable Plays From Panthers And Defenders

Jun 12, 2025

Ufl Conference Championship Unforgettable Plays From Panthers And Defenders

Jun 12, 2025 -

Ufl Conference Championship Panthers And Defenders Key Touchdowns

Jun 12, 2025

Ufl Conference Championship Panthers And Defenders Key Touchdowns

Jun 12, 2025 -

Rate Cut Odds Soar As Nasdaq 100 Falters Short Of All Time High After Us China Agreement

Jun 12, 2025

Rate Cut Odds Soar As Nasdaq 100 Falters Short Of All Time High After Us China Agreement

Jun 12, 2025 -

Will Caitlin Clark Play This Week Latest Update On Her Quad Strain

Jun 12, 2025

Will Caitlin Clark Play This Week Latest Update On Her Quad Strain

Jun 12, 2025