Nasdaq 100 Falters Despite Positive US-China Trade Developments; Focus Shifts To Fed Action

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nasdaq 100 Falters Despite Positive US-China Trade Developments; Focus Shifts to Federal Reserve Action

The Nasdaq 100 experienced a setback on [Date], despite encouraging news on the US-China trade front. While positive developments in the ongoing trade negotiations initially boosted investor sentiment, the index ultimately closed lower, highlighting a shift in market focus towards the upcoming Federal Reserve meeting. This leaves investors wondering what the future holds for tech stocks and the broader market.

The initial optimism stemmed from reports suggesting progress in resolving the trade dispute between the world's two largest economies. These positive signals had previously propelled the Nasdaq 100 to record highs, fueling expectations of continued growth in the tech sector. However, this bullish sentiment proved short-lived.

<h3>Why the Nasdaq 100 Stumbled</h3>

Several factors contributed to the Nasdaq 100's decline despite the positive trade news. The primary driver appears to be a renewed focus on the Federal Reserve's monetary policy decisions. Market participants are keenly anticipating the Fed's next move regarding interest rates and its overall approach to managing inflation.

-

Interest Rate Hikes: Concerns persist about the potential for further interest rate hikes by the Federal Reserve. Higher interest rates tend to dampen investor enthusiasm for growth stocks, particularly in the technology sector, as they increase borrowing costs and reduce the present value of future earnings. This is particularly relevant for companies with high valuations and significant growth expectations, many of which are represented in the Nasdaq 100.

-

Inflationary Pressures: Persistent inflationary pressures continue to cast a shadow over the market. While recent data suggests a potential cooling of inflation, uncertainty remains regarding the Fed's ability to control inflation without triggering a recession. This uncertainty contributes to market volatility.

-

Profit-Taking: After a period of strong gains, some investors may have chosen to take profits, contributing to the sell-off in the Nasdaq 100. This profit-taking behavior is a natural part of market cycles and often occurs after significant price increases.

<h3>The Federal Reserve's Influence</h3>

The Federal Reserve's actions are arguably the most significant factor influencing the Nasdaq 100's performance in the short term. The market is closely monitoring any indications of the Fed's future plans regarding interest rates and quantitative tightening. Any hint of a more aggressive stance could trigger further sell-offs in the tech sector. Conversely, a more dovish approach could offer some relief to the market. [Link to relevant Federal Reserve news/statements].

<h3>Looking Ahead: What to Expect</h3>

The outlook for the Nasdaq 100 remains uncertain. While positive trade developments offer some support, the dominant factor influencing market sentiment is the Federal Reserve's monetary policy. Investors should prepare for potential volatility in the coming weeks as the market digests the Fed's decisions and assesses their implications for the broader economy and the technology sector. Staying informed about economic indicators and the Fed's pronouncements is crucial for navigating this period of uncertainty.

Keywords: Nasdaq 100, US-China trade, Federal Reserve, interest rates, inflation, tech stocks, market volatility, economic indicators, monetary policy, stock market, investment

Related Articles: [Link to related articles on your site about the Nasdaq, interest rates, or the US-China trade situation]

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nasdaq 100 Falters Despite Positive US-China Trade Developments; Focus Shifts To Fed Action. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Panthers Vs Defenders Highlights From The Ufl Conference Championship Game

Jun 12, 2025

Panthers Vs Defenders Highlights From The Ufl Conference Championship Game

Jun 12, 2025 -

Will Caitlin Clark Return Soon Quad Injury Update And Timeline

Jun 12, 2025

Will Caitlin Clark Return Soon Quad Injury Update And Timeline

Jun 12, 2025 -

2025 Nfl Dpoy Odds Updated Predictions After T J Watt Holdout

Jun 12, 2025

2025 Nfl Dpoy Odds Updated Predictions After T J Watt Holdout

Jun 12, 2025 -

Panthers And Defenders Shine Best Plays From The Ufl Championship

Jun 12, 2025

Panthers And Defenders Shine Best Plays From The Ufl Championship

Jun 12, 2025 -

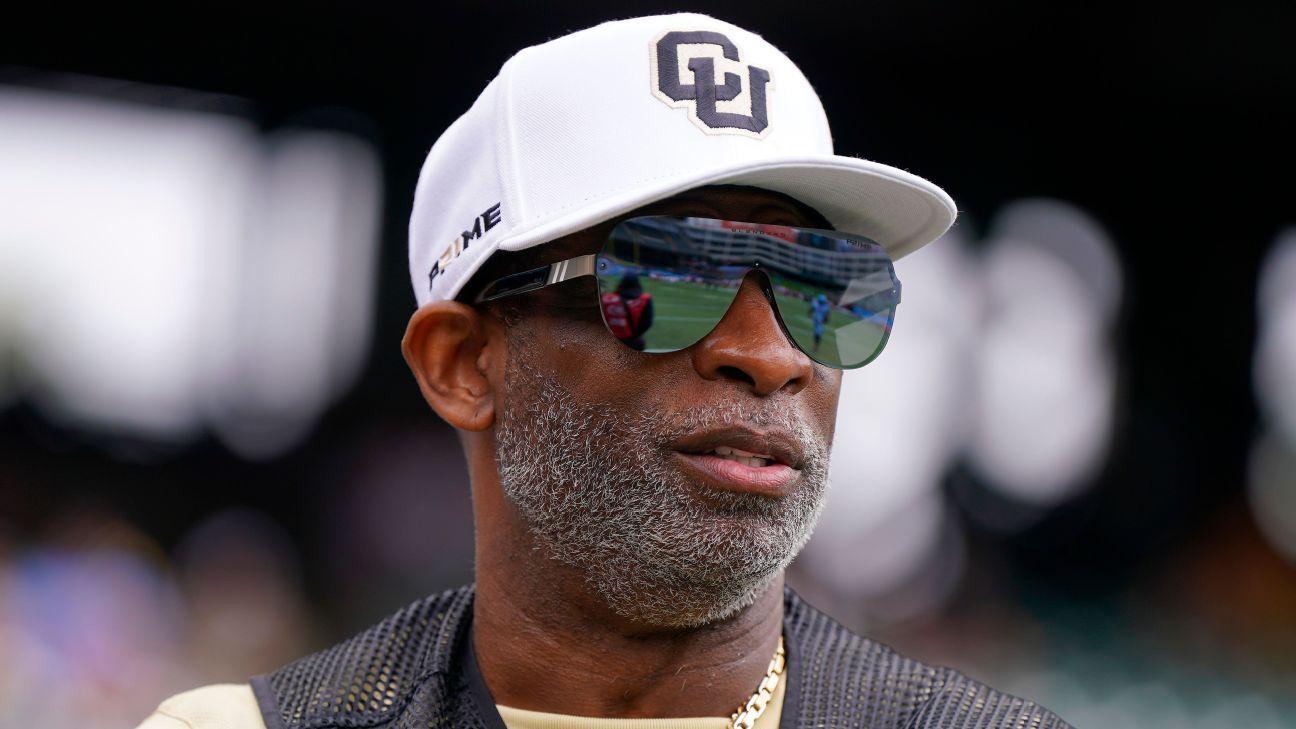

Source Colorados Deion Sanders Dealing With Serious Medical Issue

Jun 12, 2025

Source Colorados Deion Sanders Dealing With Serious Medical Issue

Jun 12, 2025