Moody's Downgrade Unfazed: Stock Market Soars, S&P 500 Leads The Charge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Unfazed: Stock Market Soars, S&P 500 Leads the Charge

The stock market defied expectations on Tuesday, surging higher despite Moody's Investors Service downgrading the credit rating of several US banks and issuing a negative outlook on the banking sector. The S&P 500 led the charge, showcasing remarkable resilience in the face of what many analysts predicted would be a significant market correction. This unexpected rally raises questions about the current state of the market and the influence of factors beyond credit ratings.

This seemingly contradictory behavior—a market rise despite a credit downgrade—highlights the complex interplay of forces driving current market dynamics. While Moody's downgrade undoubtedly added a layer of uncertainty, several other factors appear to have overshadowed its impact.

The Bullish Factors Overshadowing the Downgrade

Several key factors likely contributed to the market's impressive performance:

-

Strong Corporate Earnings: Positive second-quarter earnings reports from major corporations have continued to fuel investor optimism. Companies across various sectors are exceeding expectations, demonstrating the underlying strength of the US economy. [Link to a relevant financial news source discussing Q2 earnings].

-

Resilient Consumer Spending: Despite inflation concerns, consumer spending remains relatively robust. This signals a continued demand for goods and services, bolstering investor confidence in the long-term economic outlook. [Link to a report on consumer spending data].

-

Federal Reserve's Actions (or Inaction): The Federal Reserve's recent pause on interest rate hikes, coupled with hints of potential future rate cuts, has eased concerns about aggressive monetary tightening. This has injected a level of predictability into the market, making it less volatile. [Link to a Federal Reserve press release or relevant analysis].

-

Market Sentiment: It's impossible to ignore the psychological impact on the market. While the Moody's downgrade was significant news, the market's overall sentiment seems to be leaning towards optimism, fueled by the factors listed above. This positive sentiment can create a self-fulfilling prophecy, with investors driving prices higher regardless of negative news.

S&P 500 Takes the Lead:

The S&P 500's performance was particularly noteworthy, closing significantly higher than its previous day's value. This demonstrates the index's resilience and its ability to weather seemingly negative market events. This upward trajectory suggests that investors are betting on the continued strength of the underlying economy, outweighing concerns surrounding the banking sector's creditworthiness.

What This Means for Investors:

This unexpected market rally raises several important questions for investors. While this positive movement is encouraging, it's crucial to remember that market volatility remains a possibility. Investors should maintain a diversified portfolio and consider their individual risk tolerance before making any investment decisions. Consulting a financial advisor is always recommended, particularly during times of market uncertainty.

Looking Ahead:

The coming weeks will be crucial in determining the long-term impact of Moody's downgrade and the ongoing market rally. Closely monitoring economic indicators, corporate earnings, and Federal Reserve policy will be essential for navigating the evolving market landscape. Stay informed and make informed decisions to effectively manage your investment portfolio. [Link to a relevant financial news website or blog].

Keywords: Moody's, credit downgrade, stock market, S&P 500, stock market rally, US banks, banking sector, economic outlook, Federal Reserve, interest rates, investor confidence, market volatility, investment strategy, financial news.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Unfazed: Stock Market Soars, S&P 500 Leads The Charge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jon Jones Retirement Rumors Ignite Aspinall Fight Stalemate Adds Fuel To The Fire

May 21, 2025

Jon Jones Retirement Rumors Ignite Aspinall Fight Stalemate Adds Fuel To The Fire

May 21, 2025 -

First Month As An Nfl Rookie Challenges And Triumphs

May 21, 2025

First Month As An Nfl Rookie Challenges And Triumphs

May 21, 2025 -

May 15th Claim Master Of Ceremony Warbonds In Helldivers 2

May 21, 2025

May 15th Claim Master Of Ceremony Warbonds In Helldivers 2

May 21, 2025 -

Putin Signals Independence Trumps Diminished Role In International Affairs

May 21, 2025

Putin Signals Independence Trumps Diminished Role In International Affairs

May 21, 2025 -

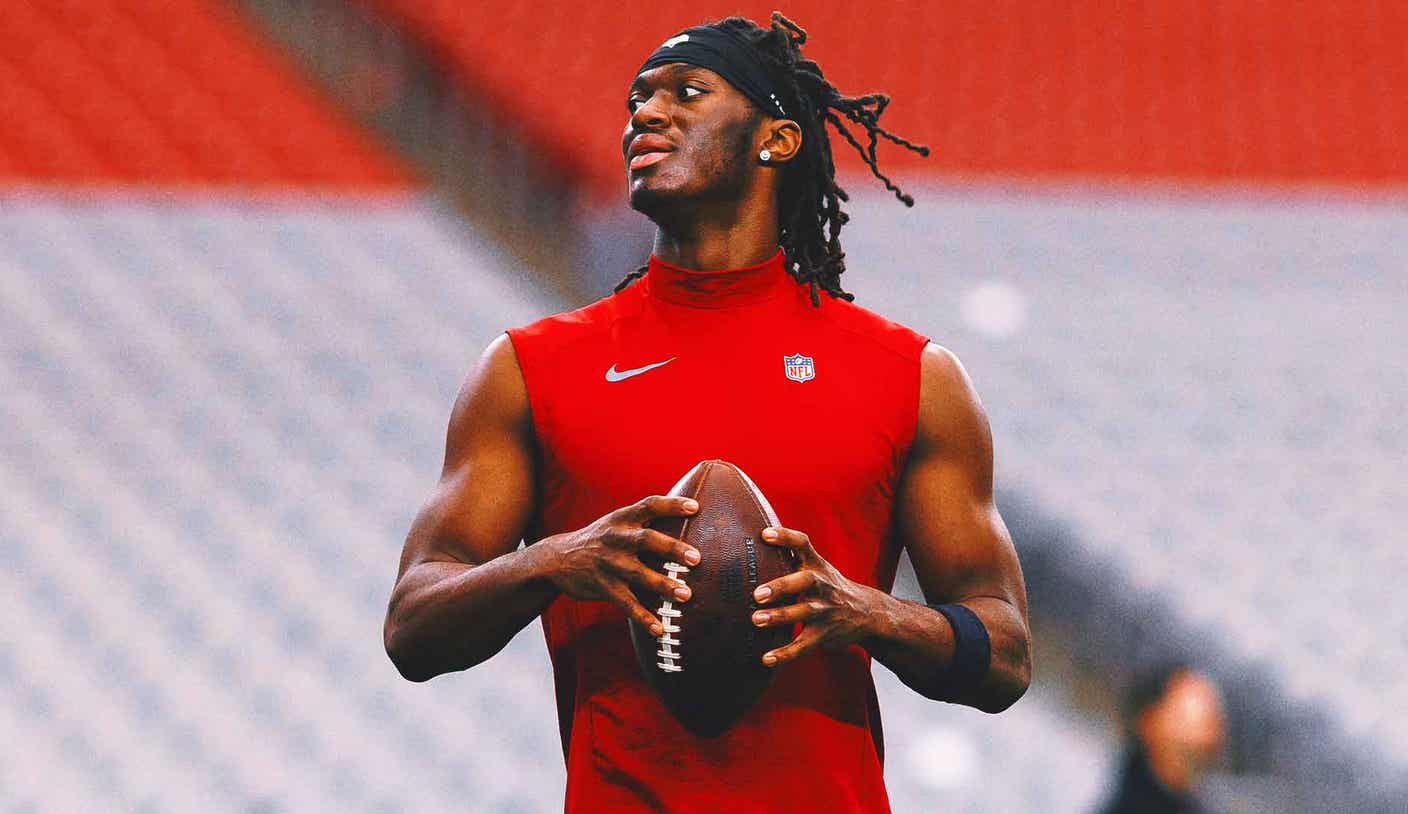

Stronger Faster Better Marvin Harrison Jr Aims For A Sophomore Surge

May 21, 2025

Stronger Faster Better Marvin Harrison Jr Aims For A Sophomore Surge

May 21, 2025