Moody's Downgrade Impact: S&P 500, Dow, And Nasdaq Rise Despite Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Impact: S&P 500, Dow, and Nasdaq Rise Despite Concerns

A surprising market reaction: Despite Moody's Investors Service downgrading 10 small and midsize US banking companies and issuing a negative outlook on the sector, the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all saw gains on Tuesday. This unexpected market response has left analysts scrambling to understand the underlying factors at play. While the downgrade certainly raises concerns about the banking sector's stability, several factors appear to have mitigated the immediate negative impact on broader market indices.

Understanding Moody's Action: Moody's cited the deteriorating credit conditions in the US banking system as the primary reason for the downgrade. The agency highlighted persistent pressure on net interest margins, increased loan delinquencies, and a potential for further economic slowdown as key contributing factors. This action follows a period of significant volatility in the banking sector, stemming from the collapse of several regional banks earlier this year. The concerns extend beyond the ten specifically downgraded banks, indicating a broader vulnerability within the financial system. You can read more about Moody's methodology and rationale on their . (Please replace with actual link if available).

<h3>Factors Contributing to the Market's Resilience</h3>

Several elements likely contributed to the market's seemingly contradictory upward trend despite the negative news from Moody's:

- Resilient Earnings Reports: Strong second-quarter earnings reports from major corporations have helped bolster investor confidence. Positive results have overshadowed concerns surrounding the banking sector, at least for the time being. Many companies exceeded expectations, demonstrating underlying economic strength despite inflationary pressures.

- Anticipation of Fed Rate Pause: The market is increasingly anticipating a pause in the Federal Reserve's interest rate hikes. This expectation, driven by recent economic data showing signs of cooling inflation, has provided a degree of optimism, outweighing the immediate impact of Moody's downgrade. The potential for a rate cut in the future further enhances this positive sentiment.

- Selective Downgrade: The downgrade focused specifically on smaller and mid-sized banks, leaving the largest institutions relatively unaffected. This targeted approach may have minimized the overall market impact, preventing a widespread panic sell-off. Many investors believe the larger banks are better positioned to weather the current economic storm.

- Short-Term Market Volatility: It's crucial to remember that daily market fluctuations are common. The gains witnessed on Tuesday could simply be a temporary respite from broader market anxieties, and the long-term consequences of Moody's action remain to be seen.

<h3>Long-Term Implications and Future Outlook</h3>

While the market reacted positively in the short term, the long-term implications of Moody's downgrade remain uncertain. The negative outlook assigned to the banking sector suggests further downgrades are possible, creating a persistent source of uncertainty. Investors should carefully monitor the following:

- Further downgrades from rating agencies: The possibility of similar actions from other rating agencies like Standard & Poor's and Fitch Ratings cannot be ignored. Any additional negative assessments could amplify market volatility.

- Economic data releases: Future economic data releases will be crucial in shaping investor sentiment. Signs of persistent inflation or a sharper economic slowdown could trigger a more pronounced negative market reaction.

- Federal Reserve policy: The Federal Reserve's upcoming decisions regarding interest rates will be closely scrutinized. Any unexpected shifts in policy could significantly impact the market's trajectory.

Conclusion: The market's reaction to Moody's downgrade underscores the complexities of financial markets. While the downgrade raises legitimate concerns about the banking sector's health, several countervailing forces, including strong corporate earnings and expectations of a Fed rate pause, contributed to the surprisingly positive market performance. However, the long-term outlook remains uncertain, and investors should maintain vigilance in monitoring key economic indicators and regulatory actions. This situation warrants continuous observation and a carefully considered investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Impact: S&P 500, Dow, And Nasdaq Rise Despite Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Schefflers Driver Pga Rules Officials Issue Non Conformance Ruling

May 20, 2025

Schefflers Driver Pga Rules Officials Issue Non Conformance Ruling

May 20, 2025 -

No Oval Experience No Problem Shwartzman Claims Indy 500 Pole

May 20, 2025

No Oval Experience No Problem Shwartzman Claims Indy 500 Pole

May 20, 2025 -

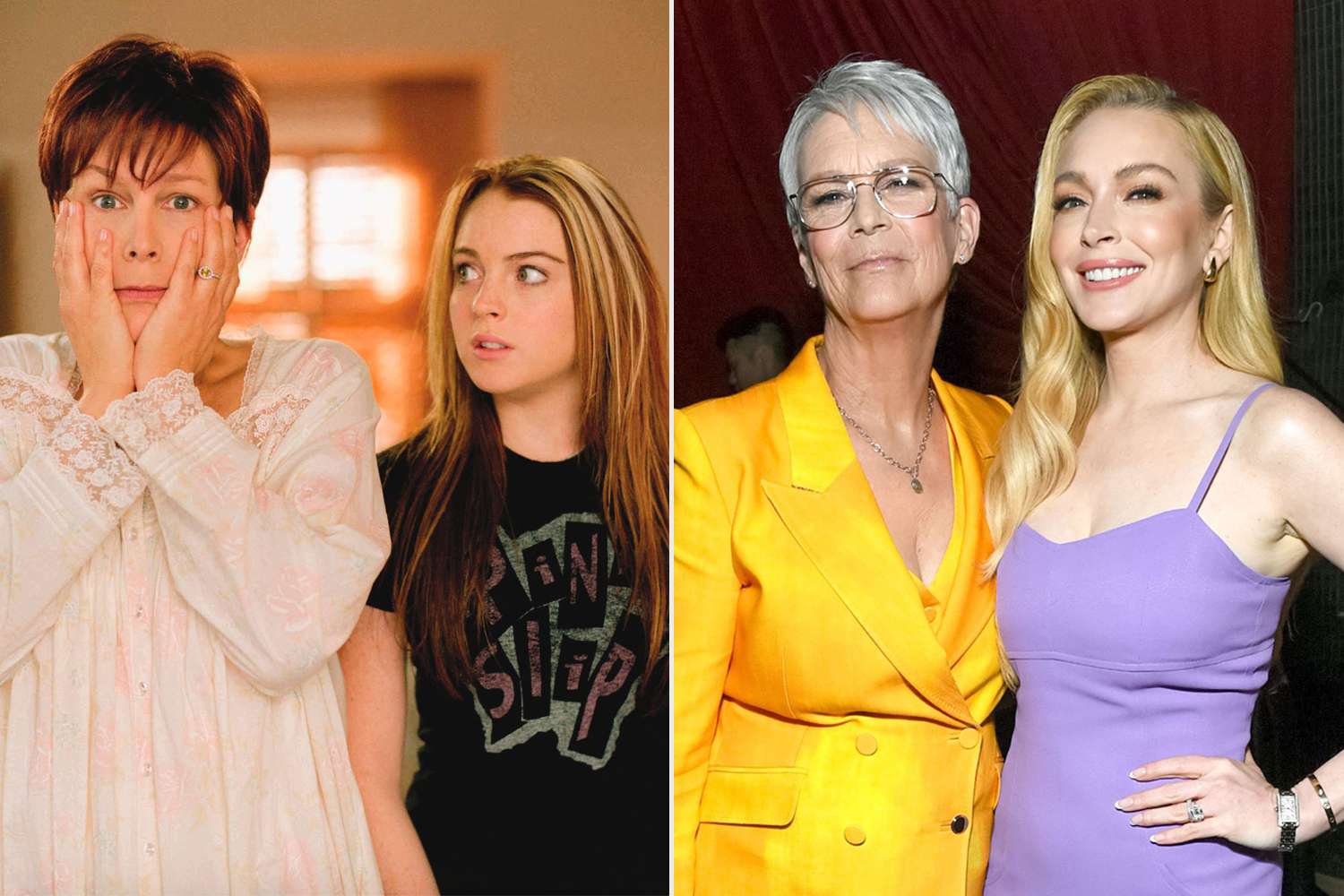

Jamie Lee Curtis Gives An Exclusive Update On Her Relationship With Lindsay Lohan After Freaky Friday

May 20, 2025

Jamie Lee Curtis Gives An Exclusive Update On Her Relationship With Lindsay Lohan After Freaky Friday

May 20, 2025 -

Fall Of Favre Director Untangling The Complex Legacy Of Brett Favre

May 20, 2025

Fall Of Favre Director Untangling The Complex Legacy Of Brett Favre

May 20, 2025 -

Jamie Lee Curtis On Lindsay Lohan A Longstanding Friendship Based On Authenticity

May 20, 2025

Jamie Lee Curtis On Lindsay Lohan A Longstanding Friendship Based On Authenticity

May 20, 2025