Moody's Downgrade Ignored: Wall Street Rallies, S&P 500, Dow, And Nasdaq Rise

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Ignored: Wall Street Rallies Defy Credit Rating Agency

Wall Street shrugged off Moody's downgrade of 10 small and midsize banking companies, staging a surprising rally that saw the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all post significant gains. The unexpected market reaction highlights the complex interplay of factors influencing investor sentiment and the potential disconnect between credit ratings and actual market performance.

The news from Moody's, announced [Insert Date of Moody's announcement], sent ripples through the financial world. The agency cited concerns about [briefly explain Moody's cited concerns, e.g., rising interest rates, potential loan losses, etc.] as the primary reasons for the downgrade. Many analysts predicted a negative market reaction, fearing a wider contagion effect on the banking sector. However, the market's response proved to be remarkably resilient.

A Bullish Market Defies Expectations

The S&P 500 closed [Insert Percentage Gain] higher, while the Dow Jones Industrial Average saw a [Insert Percentage Gain] increase. The tech-heavy Nasdaq Composite also performed strongly, gaining [Insert Percentage Gain]. This unexpected surge in stock prices suggests that investors are focusing on other positive economic indicators and potentially overlooking the short-term implications of the Moody's downgrade.

Several factors may contribute to this surprising market resilience:

- Strong Corporate Earnings: Many companies have recently reported better-than-expected earnings, bolstering investor confidence. This positive news flow may be outweighing the concerns raised by Moody's.

- Resilient Consumer Spending: Consumer spending remains relatively robust, indicating continued economic strength. This positive indicator can offset concerns about potential economic slowdowns.

- Federal Reserve's Actions: The Federal Reserve's recent pause on interest rate hikes, or indication of future pauses, might be interpreted as a sign of stability and a willingness to prevent a significant economic downturn. This could alleviate some investor anxieties.

- Selective Downgrade: The fact that Moody's downgraded only a small subset of banking institutions might have limited the overall impact on investor sentiment. The larger, more systemically important banks were not affected, reassuring investors.

Looking Ahead: Uncertainty Remains

While the immediate market reaction has been positive, the long-term implications of Moody's downgrade remain uncertain. The potential for further downgrades, or a broader economic slowdown, still poses significant risks. Investors should remain vigilant and monitor economic indicators closely.

What this means for investors: This unexpected market rally underscores the unpredictable nature of the stock market. While positive news dominates the headlines for now, it's crucial to maintain a diversified investment portfolio and a long-term perspective. Consider consulting with a financial advisor to assess your risk tolerance and make informed investment decisions.

Keywords: Moody's, Downgrade, Wall Street, Stock Market Rally, S&P 500, Dow Jones, Nasdaq, Banking Sector, Credit Rating, Economic Indicators, Investor Sentiment, Market Volatility, Investment Strategy, Financial Advice

Related Articles: (Link to relevant articles on your website, e.g., articles about previous market volatility, Federal Reserve actions, etc.)

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Ignored: Wall Street Rallies, S&P 500, Dow, And Nasdaq Rise. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Untold Controversy A J Perez Recounts Threats From Favres Team

May 20, 2025

Untold Controversy A J Perez Recounts Threats From Favres Team

May 20, 2025 -

Sotos Return To Yankee Stadium A Familiar Feeling Of Unrest

May 20, 2025

Sotos Return To Yankee Stadium A Familiar Feeling Of Unrest

May 20, 2025 -

Three Weeks Lost California Woman Recounts Survival In The Mountains

May 20, 2025

Three Weeks Lost California Woman Recounts Survival In The Mountains

May 20, 2025 -

Get Ready Helldivers 2 Masters Of Ceremony Warbonds Drop On May 15th

May 20, 2025

Get Ready Helldivers 2 Masters Of Ceremony Warbonds Drop On May 15th

May 20, 2025 -

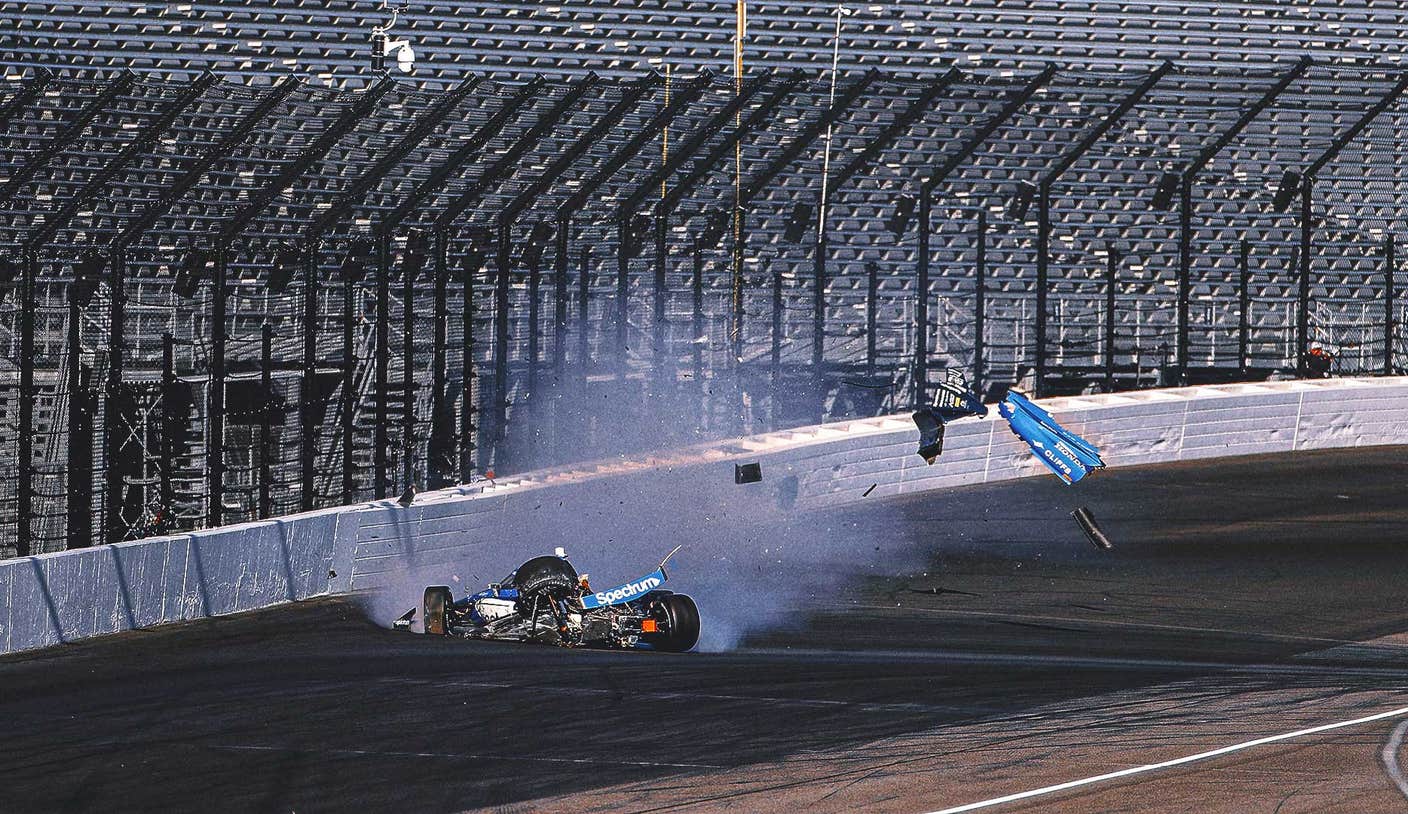

Indy 500 Practice Turns Dangerous Examining The Weekends Crashes

May 20, 2025

Indy 500 Practice Turns Dangerous Examining The Weekends Crashes

May 20, 2025