Mis-sold Car Loans Fuel Outrage: The Guardian Editorial On Needed Redress

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mis-sold Car Loans Fuel Outrage: The Guardian Demands Redress for Affected Consumers

The Guardian's recent editorial has ignited a firestorm of debate, highlighting the widespread issue of mis-sold car loans and demanding immediate redress for affected consumers. Thousands across the UK are facing financial hardship due to unfair lending practices, prompting calls for stricter regulations and increased consumer protection. This isn't just about a few isolated cases; it's a systemic problem demanding urgent attention from regulators and lenders alike.

The Scale of the Problem: More Than Just a Few Bad Apples

The editorial paints a stark picture of the predatory lending practices employed by some car finance companies. Many consumers have been unknowingly trapped in high-interest loans, often with hidden fees and complex terms and conditions designed to obfuscate the true cost of borrowing. This isn't simply a matter of misunderstanding the contract; it's a deliberate attempt to exploit vulnerable individuals. The Guardian points to several examples, highlighting cases where consumers were pressured into accepting loans with exorbitant APRs (Annual Percentage Rates) far exceeding market rates. These practices often target those with poor credit histories, leaving them with little recourse when things go wrong.

Key Issues Highlighted by The Guardian Editorial:

- Aggressive Sales Tactics: The editorial condemns the use of high-pressure sales tactics, where consumers are coerced into accepting loans without fully understanding the implications.

- Lack of Transparency: The complex and often deliberately confusing nature of loan agreements is a major concern, making it difficult for consumers to compare deals and make informed decisions.

- Inadequate Consumer Protection: The Guardian argues that current regulations are insufficient to protect consumers from predatory lenders, leaving many with little legal recourse.

- Difficulty in Securing Redress: Even when consumers manage to identify mis-selling, the process of securing redress from lenders can be incredibly difficult and time-consuming.

What Consumers Can Do:

If you suspect you've been a victim of mis-sold car finance, the first step is to carefully review your loan agreement. Look for any hidden fees, excessively high interest rates, or clauses that seem unfair. You can then:

- Contact the Financial Ombudsman Service (FOS): The FOS is an independent body that can help resolve disputes between consumers and financial services providers. [Link to FOS website]

- Seek Legal Advice: A solicitor specializing in consumer rights can advise you on your options and represent you in any legal action.

- Contact Your Lender Directly: While this may seem daunting, it's crucial to formally complain to your lender detailing your concerns and the evidence you have.

The Path Forward: Stronger Regulations and Greater Transparency

The Guardian's call for redress is not just a plea for individual justice; it's a demand for systemic reform. The editorial advocates for stricter regulations on car finance companies, including:

- Clearer and Simpler Loan Agreements: Loan agreements must be written in plain English, easily understandable by all consumers.

- Increased Scrutiny of Lending Practices: Regulators need to actively monitor lending practices to identify and address predatory behavior.

- Strengthened Consumer Protection Laws: Legislation should be strengthened to provide consumers with greater protection against mis-selling.

The outrage fueled by The Guardian's editorial is a vital step towards achieving much-needed reform within the car finance industry. It's time for consumers to stand together and demand the justice they deserve. The fight for fair and transparent lending practices continues. Share your story and help raise awareness of this critical issue. #MisSoldCarLoans #ConsumerRights #FinancialJustice

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mis-sold Car Loans Fuel Outrage: The Guardian Editorial On Needed Redress. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Australian State Announces Machete Amnesty Before Statewide Ban

Aug 05, 2025

Australian State Announces Machete Amnesty Before Statewide Ban

Aug 05, 2025 -

Cdc Issues Alert Monitor For Palpitations And Fatigue Affecting Millions

Aug 05, 2025

Cdc Issues Alert Monitor For Palpitations And Fatigue Affecting Millions

Aug 05, 2025 -

Sterling Sharpe Eric Allen Jared Allen Antonio Gates Hall Of Fame Class Announced By Espn

Aug 05, 2025

Sterling Sharpe Eric Allen Jared Allen Antonio Gates Hall Of Fame Class Announced By Espn

Aug 05, 2025 -

Shortchanged Car Finance Victims Face Less Than 950 Compensation

Aug 05, 2025

Shortchanged Car Finance Victims Face Less Than 950 Compensation

Aug 05, 2025 -

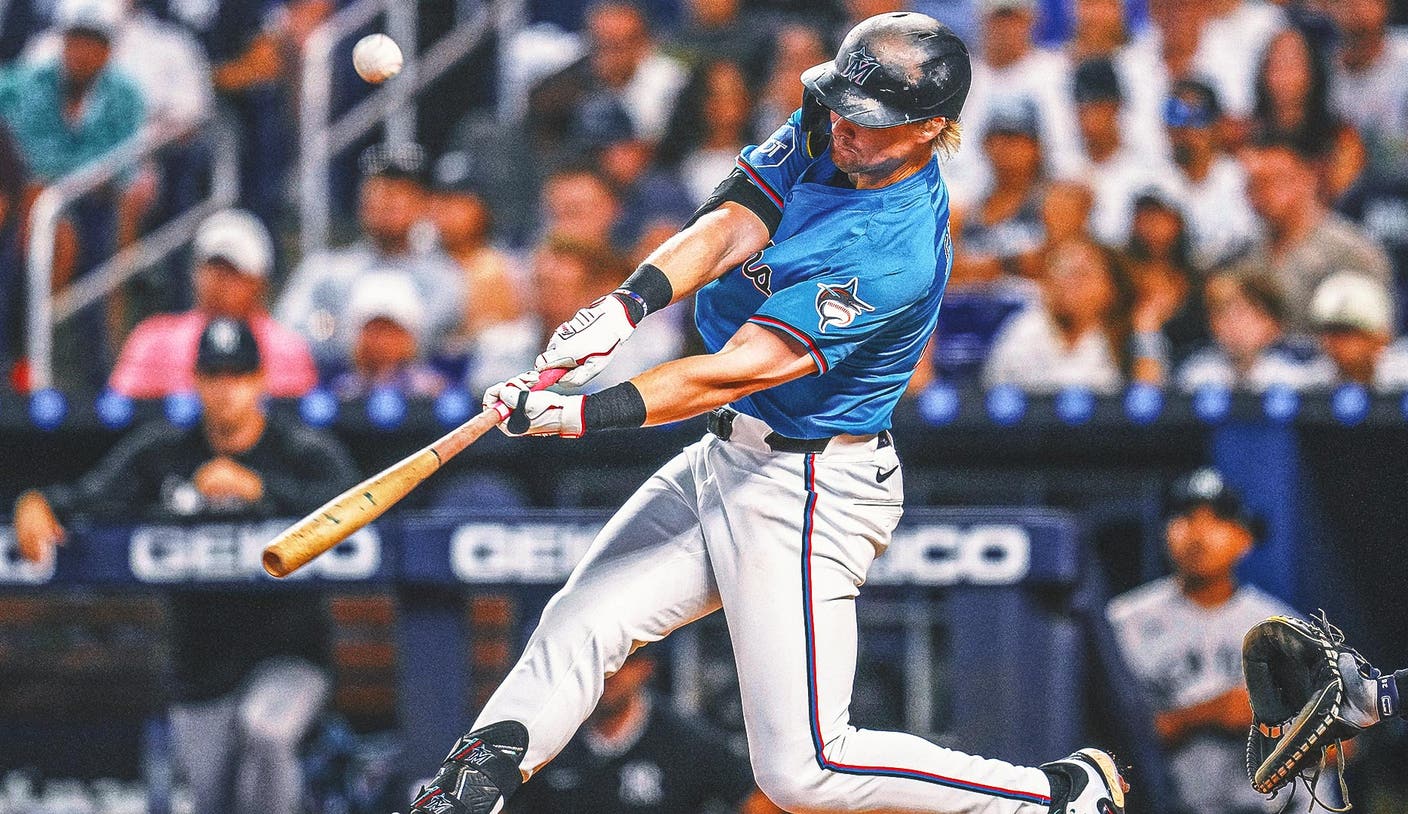

Marlins 7 3 Win Over Yankees Marks First Ever Series Sweep In Franchise History

Aug 05, 2025

Marlins 7 3 Win Over Yankees Marks First Ever Series Sweep In Franchise History

Aug 05, 2025

Latest Posts

-

Cleveland Browns Sign Tyler Huntley Depth Chart Implications

Aug 06, 2025

Cleveland Browns Sign Tyler Huntley Depth Chart Implications

Aug 06, 2025 -

Unprecedented Speed De Groms 1 800th Strikeout Marks Mlb Record

Aug 06, 2025

Unprecedented Speed De Groms 1 800th Strikeout Marks Mlb Record

Aug 06, 2025 -

Georgia Lottery Winner Claims 1 Million Powerball Prize From Decatur

Aug 06, 2025

Georgia Lottery Winner Claims 1 Million Powerball Prize From Decatur

Aug 06, 2025 -

Us Nationals 200m Lyles Wins Bednareks Shove Stirs Controversy

Aug 06, 2025

Us Nationals 200m Lyles Wins Bednareks Shove Stirs Controversy

Aug 06, 2025 -

Seattle Mariners Julio Rodriguez Makes History With Fourth 20 20 Season

Aug 06, 2025

Seattle Mariners Julio Rodriguez Makes History With Fourth 20 20 Season

Aug 06, 2025