Mis-Sold Car Loans: Demand For Action Mounts Amidst Scandal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mis-Sold Car Loans: Demand for Action Mounts Amidst Growing Scandal

Are you one of the many victims of mis-sold car loans? The pressure is mounting on lenders as the scandal grows. Recent revelations have sparked outrage and a surge in calls for regulatory intervention, leaving thousands wondering where they stand. This article delves into the unfolding scandal, outlining the key issues, offering advice to those affected, and exploring the potential for legal action.

The car loan market, once seen as a straightforward financing option, is now embroiled in controversy. Reports of predatory lending practices, misleading advertising, and unfair contract terms have flooded in, leaving borrowers facing crippling debt and financial hardship. This isn't just about a few isolated incidents; evidence suggests a widespread problem demanding immediate attention.

What constitutes a mis-sold car loan?

Several factors contribute to a car loan being deemed mis-sold. These include:

- Hidden Fees and Charges: Borrowers are often unaware of exorbitant fees added to their loan agreements, significantly increasing the overall cost.

- Misrepresentation of APR: The Annual Percentage Rate (APR) – the true cost of borrowing – is frequently misrepresented or obscured, making it difficult for consumers to compare deals accurately.

- Unaffordable Repayment Plans: Lenders may have approved loans knowing the borrower couldn't realistically afford the monthly repayments, leading to default and further financial difficulties.

- Lack of Transparency: Complex and confusing loan agreements often lack transparency, hiding crucial details and making it hard for borrowers to understand the terms.

- Aggressive Sales Tactics: High-pressure sales tactics and misleading marketing campaigns are also contributing factors in many cases.

The Growing Demand for Action:

Consumer protection groups are leading the charge, demanding stricter regulations and increased scrutiny of lending practices. The Financial Conduct Authority (FCA) in the UK, and equivalent regulatory bodies in other countries, are facing increasing pressure to investigate and take decisive action against lenders involved in these practices. Several class-action lawsuits are underway, aiming to recover losses for affected individuals.

What can you do if you suspect your car loan was mis-sold?

If you believe you've been a victim of mis-sold car finance, several steps can be taken:

- Gather Evidence: Collect all relevant documents, including your loan agreement, marketing materials, and any communication with the lender.

- Contact the Lender: Attempt to resolve the issue directly with the lender, formally outlining your concerns and requesting a review of your agreement.

- Seek Independent Advice: Consult with a financial advisor or solicitor specializing in consumer rights and mis-sold loans. They can assess your situation and advise on the best course of action.

- Consider Making a Formal Complaint: If direct negotiation fails, file a formal complaint with the relevant regulatory body (e.g., the FCA in the UK).

- Explore Legal Options: If all else fails, you may wish to consider legal action, either individually or as part of a class-action lawsuit. Many law firms specialize in assisting with mis-sold car loan claims.

Looking Ahead:

The mis-sold car loan scandal is far from over. With the demand for action growing stronger, significant changes within the industry are anticipated. Consumers need to be vigilant, understand their rights, and take proactive steps to protect themselves against unfair lending practices. Staying informed about developments in this ongoing situation is crucial for anyone considering a car loan or currently struggling with repayments.

Keywords: Mis-sold car loans, car loan scandal, predatory lending, unfair contracts, consumer rights, financial advice, legal action, FCA, regulatory intervention, class action lawsuit, car finance, debt, APR, hidden fees.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mis-Sold Car Loans: Demand For Action Mounts Amidst Scandal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2023 College Football Regular Season Stats Data Driven Analysis And Key Takeaways

Aug 04, 2025

2023 College Football Regular Season Stats Data Driven Analysis And Key Takeaways

Aug 04, 2025 -

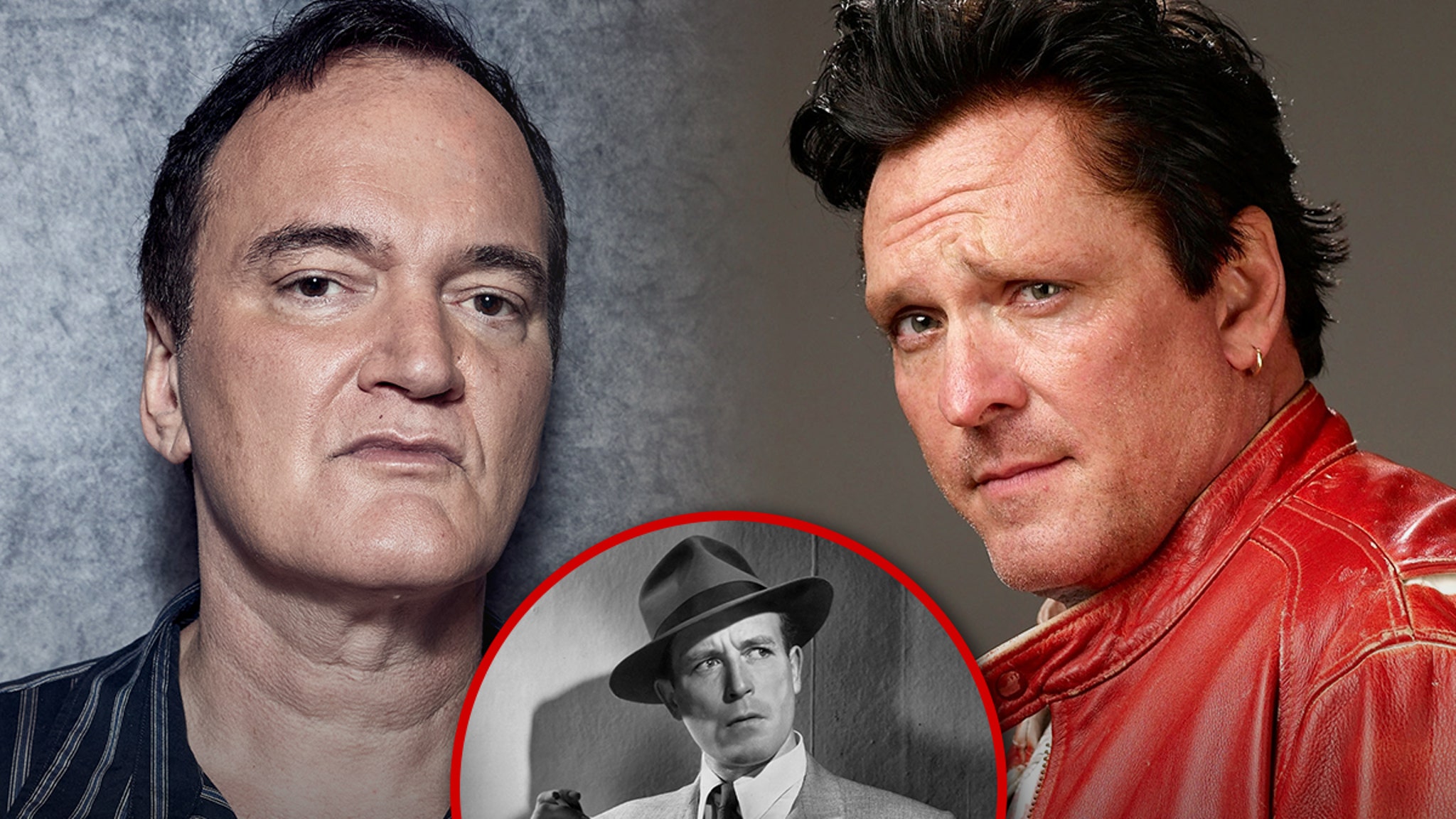

Controversy Resolved Michael Madsen On Tarantinos Tierney Dismissal

Aug 04, 2025

Controversy Resolved Michael Madsen On Tarantinos Tierney Dismissal

Aug 04, 2025 -

Unprecedented Turnout Mlb Game Breaks Records At Bristol Speedway

Aug 04, 2025

Unprecedented Turnout Mlb Game Breaks Records At Bristol Speedway

Aug 04, 2025 -

Pregnant Wife Of Ex Nba Star Bitten By Shark Worst Day Of My Life

Aug 04, 2025

Pregnant Wife Of Ex Nba Star Bitten By Shark Worst Day Of My Life

Aug 04, 2025 -

Four Killed In Anaconda Montana Bar Shooting Police Search For Suspect

Aug 04, 2025

Four Killed In Anaconda Montana Bar Shooting Police Search For Suspect

Aug 04, 2025

Latest Posts

-

Leg Injury Forces Messi Out Of Inter Miamis League Cup Competition

Aug 04, 2025

Leg Injury Forces Messi Out Of Inter Miamis League Cup Competition

Aug 04, 2025 -

Bristol Motor Speedways Mlb Speedway Classic Suspended To Continue Sunday

Aug 04, 2025

Bristol Motor Speedways Mlb Speedway Classic Suspended To Continue Sunday

Aug 04, 2025 -

North Highlands Crash Woman Cyclist Injured Need For Bicycle Accident Attorney

Aug 04, 2025

North Highlands Crash Woman Cyclist Injured Need For Bicycle Accident Attorney

Aug 04, 2025 -

From Big Screen To Small Ridley Scotts Alien Gets A Tv Adaptation

Aug 04, 2025

From Big Screen To Small Ridley Scotts Alien Gets A Tv Adaptation

Aug 04, 2025 -

Jerry Jones Downplays Micah Parsons Trade Request Dont Lose Sleep

Aug 04, 2025

Jerry Jones Downplays Micah Parsons Trade Request Dont Lose Sleep

Aug 04, 2025