Mis-sold Car Finance: Compensation Awards Fall Short Of Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mis-sold Car Finance: Compensation Awards Fall Short of Expectations

Are you one of the many drivers left disappointed by the payouts for mis-sold car finance? The recent surge in claims following revelations of widespread mis-selling practices in the car finance industry has left many feeling short-changed. While compensation is being awarded, the amounts are often significantly less than expected, leaving consumers frustrated and questioning the fairness of the process.

This article explores the reasons behind the shortfall in compensation awards for mis-sold car finance and what you can do if you feel you haven't received a fair settlement.

The Scale of the Problem: Mis-sold Car Finance

The Financial Conduct Authority (FCA) has reported a significant increase in complaints regarding mis-sold car finance agreements. These often involve:

- Unfair interest rates: Consumers being charged excessive interest rates, far higher than advertised or comparable products.

- Hidden fees and charges: Unexpected charges added to the agreement, significantly increasing the total cost.

- Misrepresentation of terms: Incorrect or misleading information provided about the terms and conditions of the finance agreement.

- Poor advice: Consumers being pressured into unsuitable finance packages without proper assessment of their financial circumstances. This is particularly prevalent with vulnerable consumers.

- Incorrect affordability assessments: Lenders failing to properly assess a borrower's ability to repay the loan, leading to financial hardship.

Why Compensation Awards Fall Short

Several factors contribute to compensation awards falling short of expectations in mis-sold car finance cases:

- Calculation methods: The methods used to calculate compensation can be complex and opaque, often favouring the lender. They may not fully reflect the total losses incurred by the consumer, including the additional interest paid and the financial distress caused.

- Limited scope of redress: Compensation often focuses on the financial losses directly related to the mis-selling, potentially excluding other consequential losses like stress and damage to credit rating.

- Lengthy and complex claims process: Navigating the claims process can be challenging and time-consuming, leading to delays and potentially reducing the final payout. Many consumers lack the time or legal expertise to pursue a claim effectively.

- Lack of awareness: Many consumers are unaware of their rights or don't realize they've been mis-sold a car finance agreement. This can lead to them missing the opportunity to claim compensation.

What to Do if Your Compensation is Insufficient

If you believe your compensation award is insufficient, you have several options:

- Review the decision: Carefully examine the compensation calculation and the reasons provided. Identify any inconsistencies or areas where you believe further compensation is justified.

- Contact the lender: Explain your concerns to the lender and request a review of the decision. Provide evidence supporting your claim for additional compensation.

- Seek independent legal advice: Consulting a solicitor specializing in consumer finance disputes can be invaluable. They can assess the strength of your claim and advise on the best course of action.

- Consider alternative dispute resolution (ADR): If negotiations with the lender fail, ADR can provide an impartial process for resolving the dispute. The Financial Ombudsman Service (FOS) is a well-established ADR provider for financial disputes in the UK.

Claiming what is rightfully yours is crucial. Don't hesitate to fight for the compensation you deserve. The process may be challenging, but with the right support and evidence, you can increase your chances of achieving a fairer outcome. Remember to keep detailed records of all communications and documentation related to your finance agreement and compensation claim.

Keywords: Mis-sold car finance, car finance compensation, insufficient compensation, FCA, Financial Conduct Authority, car loan mis-selling, consumer rights, financial ombudsman service, FOS, redress, unfair interest rates, hidden fees, legal advice, claim compensation

Related Articles: (Internal links if applicable, otherwise external links to relevant reputable sources such as the FCA website or consumer protection organizations) For example: [Link to article on how to identify mis-sold car finance] [Link to FCA website on car finance complaints]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mis-sold Car Finance: Compensation Awards Fall Short Of Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Amazon Mgms James Bond Steven Knight Takes The Helm

Aug 04, 2025

Amazon Mgms James Bond Steven Knight Takes The Helm

Aug 04, 2025 -

Scandalous New Movie Project Lena Dunham Andrew Scott And Jennifer Lawrence

Aug 04, 2025

Scandalous New Movie Project Lena Dunham Andrew Scott And Jennifer Lawrence

Aug 04, 2025 -

Post Deadline Power Rankings Mlbs Top Contenders After The Trades

Aug 04, 2025

Post Deadline Power Rankings Mlbs Top Contenders After The Trades

Aug 04, 2025 -

Jerry Jones Remains Calm Amidst Micah Parsons Trade Request Speculation

Aug 04, 2025

Jerry Jones Remains Calm Amidst Micah Parsons Trade Request Speculation

Aug 04, 2025 -

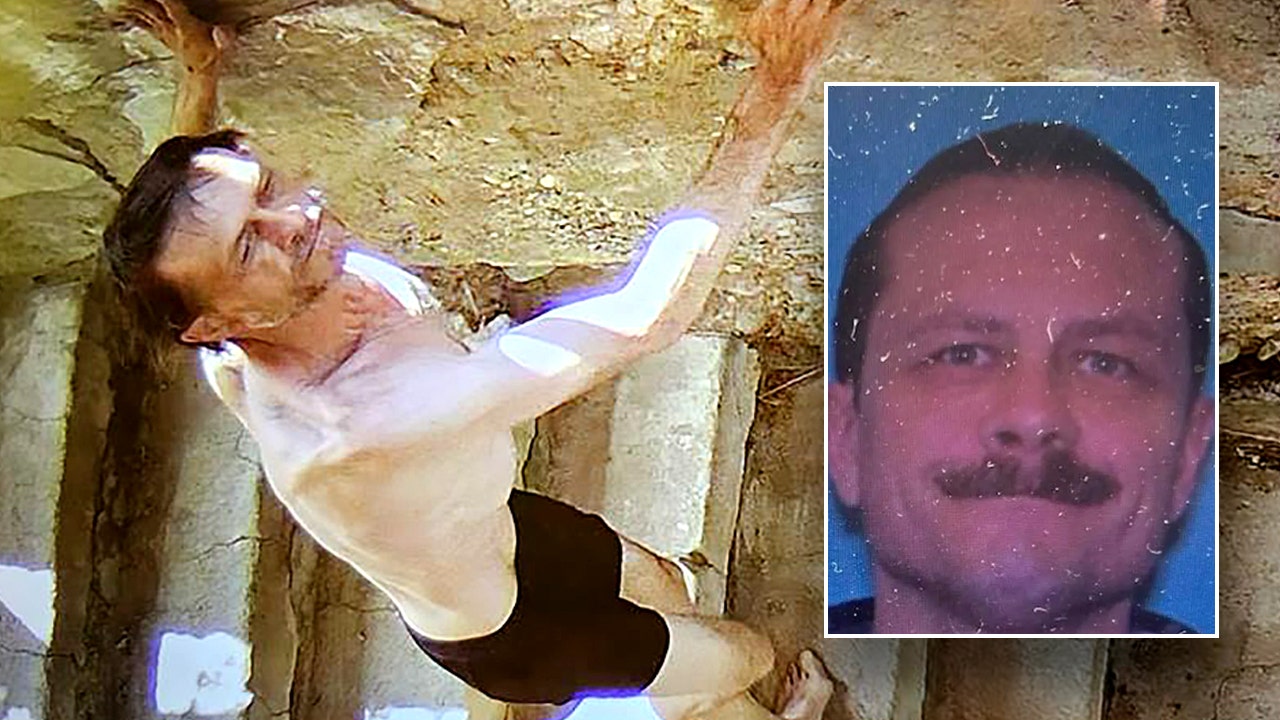

Manhunt Underway Army Veteran Sought In Quadruple Homicide At Bar

Aug 04, 2025

Manhunt Underway Army Veteran Sought In Quadruple Homicide At Bar

Aug 04, 2025

Latest Posts

-

Leg Injury Forces Messi Out Of Inter Miamis League Cup Competition

Aug 04, 2025

Leg Injury Forces Messi Out Of Inter Miamis League Cup Competition

Aug 04, 2025 -

Bristol Motor Speedways Mlb Speedway Classic Suspended To Continue Sunday

Aug 04, 2025

Bristol Motor Speedways Mlb Speedway Classic Suspended To Continue Sunday

Aug 04, 2025 -

North Highlands Crash Woman Cyclist Injured Need For Bicycle Accident Attorney

Aug 04, 2025

North Highlands Crash Woman Cyclist Injured Need For Bicycle Accident Attorney

Aug 04, 2025 -

From Big Screen To Small Ridley Scotts Alien Gets A Tv Adaptation

Aug 04, 2025

From Big Screen To Small Ridley Scotts Alien Gets A Tv Adaptation

Aug 04, 2025 -

Jerry Jones Downplays Micah Parsons Trade Request Dont Lose Sleep

Aug 04, 2025

Jerry Jones Downplays Micah Parsons Trade Request Dont Lose Sleep

Aug 04, 2025