Massive Bitcoin ETF Investment: A Deep Dive Into The Current Market Trend

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Massive Bitcoin ETF Investment: A Deep Dive into the Current Market Trend

The cryptocurrency market is buzzing with excitement following a surge in investments targeting Bitcoin exchange-traded funds (ETFs). This unprecedented influx of capital signifies a potential paradigm shift, marking a significant step towards mainstream adoption of Bitcoin and digital assets. But what's driving this trend, and what does it mean for the future of Bitcoin and the broader financial landscape? Let's delve into the details.

The ETF Boom: A Catalyst for Mainstream Adoption?

The recent surge in Bitcoin ETF investments isn't just a fleeting trend; it represents a growing confidence in Bitcoin's long-term viability as a store of value and an emerging asset class. Several factors are contributing to this boom:

-

Regulatory Approvals: The gradual acceptance and approval of Bitcoin ETFs by regulatory bodies worldwide are crucial. The potential approval of a spot Bitcoin ETF in the US, for example, is anticipated to unleash a tidal wave of institutional investment, significantly boosting Bitcoin's price and liquidity. This regulatory clarity reduces the risk associated with Bitcoin investment, making it more attractive to risk-averse investors.

-

Institutional Interest: Hedge funds, pension funds, and other institutional investors are increasingly allocating a portion of their portfolios to Bitcoin. This move is driven by the desire to diversify investments and gain exposure to a potentially high-growth asset. The availability of regulated ETFs provides a convenient and familiar framework for these institutions to enter the Bitcoin market.

-

Growing Demand: Retail investor interest in Bitcoin remains strong. ETFs offer a simpler and more regulated pathway to Bitcoin exposure compared to directly buying and holding the cryptocurrency, attracting a wider range of investors. This increased demand is fueling the price appreciation and the investment surge in Bitcoin ETFs.

Analyzing the Market Impact:

The massive investment in Bitcoin ETFs is having a noticeable impact on the market:

-

Price Volatility: While Bitcoin is known for its volatility, the increased institutional investment through ETFs may contribute to some price stabilization in the long term. The influx of capital can help absorb market shocks and reduce the impact of short-term price fluctuations.

-

Market Liquidity: The increased trading volume associated with Bitcoin ETFs enhances market liquidity. This makes it easier for investors to buy and sell Bitcoin without significantly impacting the price, contributing to a more efficient and accessible market.

-

Increased Accessibility: ETFs make Bitcoin investing more accessible to a broader range of investors. This democratization of access is critical for driving wider adoption and solidifying Bitcoin's position as a mainstream asset.

Risks and Considerations:

While the outlook appears positive, it’s crucial to acknowledge inherent risks:

-

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains fluid. Changes in regulations could impact the performance of Bitcoin ETFs.

-

Market Volatility: Despite the potential for price stabilization, Bitcoin remains a volatile asset. Investors should be prepared for potential price swings.

-

Security Risks: As with any investment, security risks exist. Investors should choose reputable and secure ETF providers.

The Future of Bitcoin ETFs:

The current trend suggests a bright future for Bitcoin ETFs. As regulatory clarity improves and institutional adoption increases, we can expect to see even greater investment flows into this asset class. The increasing accessibility and potential for stable growth are key drivers of this positive outlook. However, continuous monitoring of market conditions and careful risk assessment remain crucial for investors. Staying informed about regulatory developments and market trends will be essential for navigating this evolving landscape.

Call to Action: Learn more about Bitcoin ETFs and explore investment options through reputable financial advisors. Remember to conduct thorough research and understand the associated risks before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Massive Bitcoin ETF Investment: A Deep Dive Into The Current Market Trend. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rules Violation Schefflers Driver Problems Ahead Of Major Tournament

May 20, 2025

Rules Violation Schefflers Driver Problems Ahead Of Major Tournament

May 20, 2025 -

Over 5 Billion Invested In Bitcoin Etfs Analyzing The Market Shift

May 20, 2025

Over 5 Billion Invested In Bitcoin Etfs Analyzing The Market Shift

May 20, 2025 -

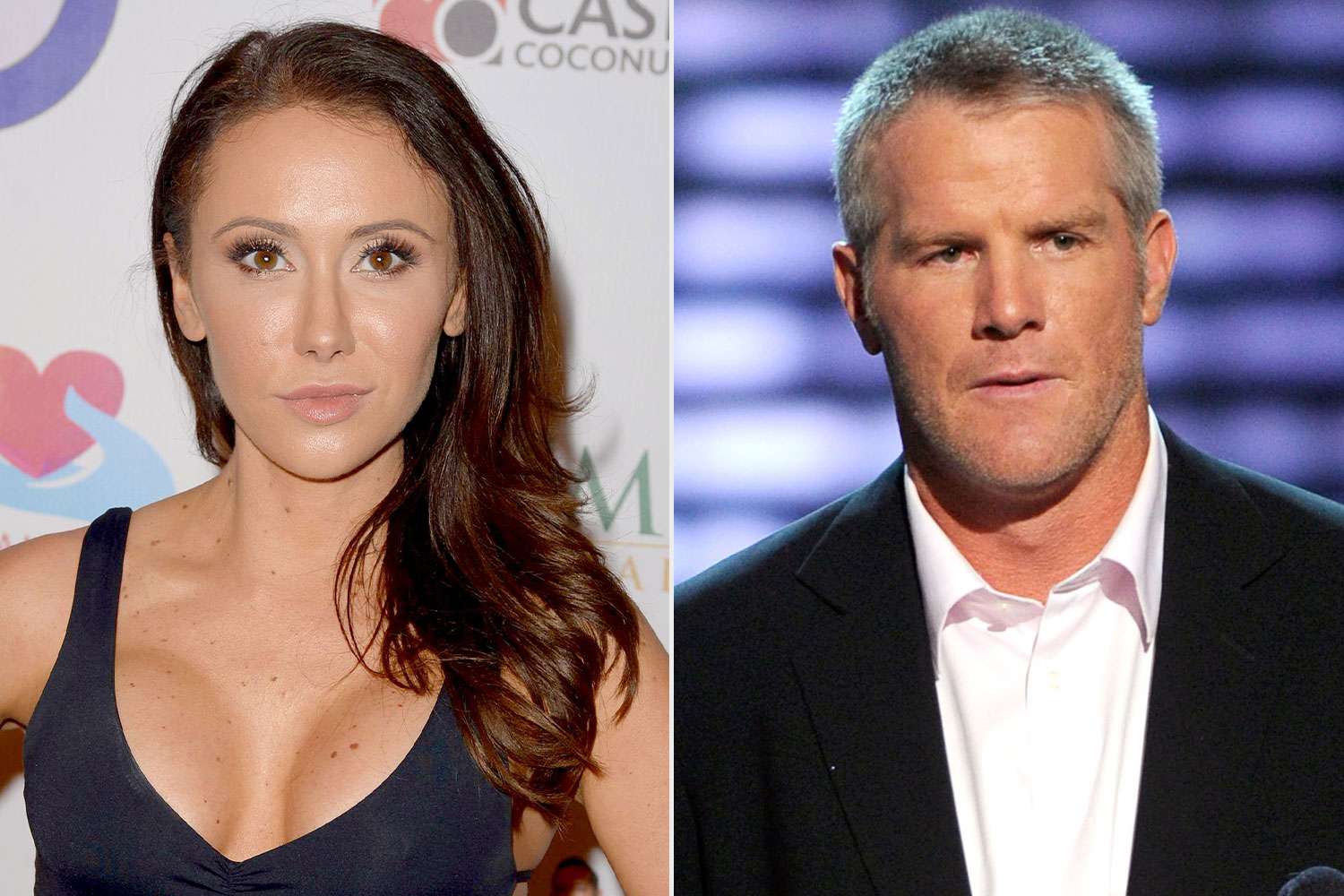

Jenn Stergers Account Of The Brett Favre Scandal A Story Of Neglect And Betrayal

May 20, 2025

Jenn Stergers Account Of The Brett Favre Scandal A Story Of Neglect And Betrayal

May 20, 2025 -

Game 7 Victory Panthers Dominant Performance Ends Maple Leafs Season

May 20, 2025

Game 7 Victory Panthers Dominant Performance Ends Maple Leafs Season

May 20, 2025 -

Knicks Fans Vs Thunder Fans Trae Young Weighs In

May 20, 2025

Knicks Fans Vs Thunder Fans Trae Young Weighs In

May 20, 2025