Market Volatility: Nasdaq 100 And The Implications Of A Potential Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Volatility: Nasdaq 100 and the Implications of a Potential Rate Cut

The Nasdaq 100, a tech-heavy index, has been experiencing significant volatility recently, leaving investors on edge. This fluctuating market behavior is largely fueled by speculation surrounding a potential Federal Reserve rate cut. Understanding the interplay between interest rate decisions and the Nasdaq 100 is crucial for navigating the current economic climate.

The Current Market Landscape:

The Nasdaq 100, comprised of 100 of the largest non-financial companies listed on the Nasdaq Stock Market, has seen dramatic swings in recent months. This volatility isn't isolated; global markets are grappling with inflation concerns, geopolitical instability, and shifting economic forecasts. The performance of tech stocks, heavily represented in the Nasdaq 100, is particularly sensitive to interest rate changes. Higher interest rates generally lead to decreased valuations for growth stocks like those found in the tech sector, as future earnings are discounted more heavily.

The Potential for a Rate Cut:

The Federal Reserve's monetary policy plays a significant role in market dynamics. A rate cut, a decrease in the federal funds rate, is often viewed as a stimulative measure intended to boost economic growth. However, the decision to cut rates is complex and depends on various economic indicators, including inflation, unemployment, and GDP growth. While a rate cut might initially boost the Nasdaq 100 by lowering borrowing costs for companies and potentially increasing investor confidence, the long-term effects are less certain.

Implications of a Rate Cut on the Nasdaq 100:

-

Short-Term Boost: A rate cut could provide a short-term boost to the Nasdaq 100, as investors react positively to the perceived easing of monetary policy. This could lead to a surge in buying activity and a temporary increase in stock prices.

-

Inflation Concerns: However, a rate cut could also exacerbate inflationary pressures if it fuels excessive spending and investment without addressing underlying supply-side issues. This could ultimately negate any positive short-term effects and lead to further volatility.

-

Long-Term Uncertainty: The long-term impact on the Nasdaq 100 remains uncertain. While a rate cut might stimulate growth, it could also lead to increased uncertainty if it signals a weakening economy or a shift in the Fed's overall strategy. This uncertainty can lead to investor hesitation and further price fluctuations.

Beyond the Rate Cut: Other Factors Affecting the Nasdaq 100:

It's crucial to remember that the Nasdaq 100's performance isn't solely determined by interest rate decisions. Other factors, including:

- Earnings Reports: Strong or weak earnings reports from major tech companies can significantly impact the index's performance.

- Geopolitical Events: Global political instability and unexpected events can trigger market volatility.

- Technological Advancements: Breakthroughs and innovations in the tech sector can influence investor sentiment and stock prices.

Navigating the Volatility:

Investors need to adopt a cautious approach and diversify their portfolios to mitigate risk. Thorough research, a long-term investment strategy, and perhaps consulting with a financial advisor are essential tools for navigating the current market volatility. Staying informed about economic indicators and news related to the Federal Reserve's policy decisions is also vital.

Conclusion:

The relationship between the Nasdaq 100 and a potential rate cut is complex and multifaceted. While a rate cut might offer a short-term boost, the long-term implications are uncertain and depend on various interconnected factors. Investors should carefully consider the potential risks and rewards before making any investment decisions. Remember to always conduct thorough research and seek professional financial advice if needed. This market volatility highlights the importance of diversification and a well-defined investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Volatility: Nasdaq 100 And The Implications Of A Potential Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Two New Prospects Wilderness Nahl Futures Draft Results

Jun 12, 2025

Two New Prospects Wilderness Nahl Futures Draft Results

Jun 12, 2025 -

Dale Earnhardt Jr Comments On Nascar Drivers Resemblance To His Famous Father

Jun 12, 2025

Dale Earnhardt Jr Comments On Nascar Drivers Resemblance To His Famous Father

Jun 12, 2025 -

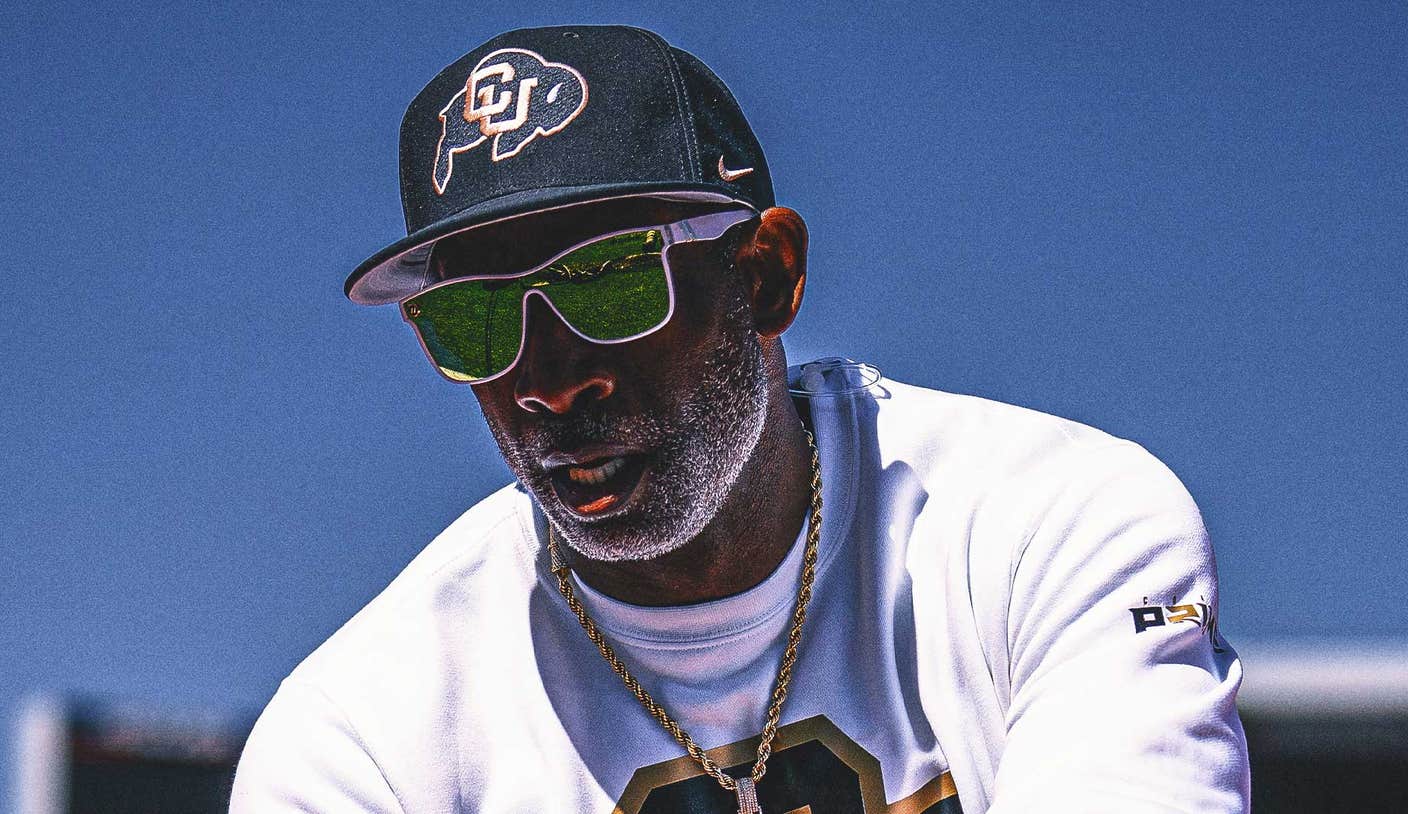

Update On Deion Sanders Colorado Coachs Absence Explained By Reported Illness

Jun 12, 2025

Update On Deion Sanders Colorado Coachs Absence Explained By Reported Illness

Jun 12, 2025 -

Falcons Dc Morris Downplays Cousins Potential Disruption Of Penix Jr

Jun 12, 2025

Falcons Dc Morris Downplays Cousins Potential Disruption Of Penix Jr

Jun 12, 2025 -

Caitlin Clark Out For Fifth Consecutive Game With Quad Strain

Jun 12, 2025

Caitlin Clark Out For Fifth Consecutive Game With Quad Strain

Jun 12, 2025