Market Update: Positive Momentum Continues Despite Moody's Downgrade Of US Credit Rating

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Update: Positive Momentum Continues Despite Moody's Downgrade of US Credit Rating

The global market showed surprising resilience this week, continuing its upward trajectory even after Moody's, a leading credit rating agency, downgraded the United States' credit rating from AAA to Aa1. This unexpected defiance of negative economic forecasts has left analysts scrambling to understand the underlying factors driving this positive momentum. While concerns remain, the market's response suggests a level of confidence that warrants closer examination.

Moody's Downgrade: A Deeper Dive

Moody's cited the US government's fiscal strength deterioration and the accumulating debt burden as primary reasons for the downgrade. This decision, announced on August 1st, sent ripples through the financial world, raising concerns about potential increased borrowing costs and inflation. However, the immediate market reaction was far less dramatic than many predicted.

This downgrade isn't the first time the US has faced a credit rating reduction. Similar events in the past have often resulted in significant market volatility. The current situation, however, presents a unique context. Understanding this context is crucial to grasping the market's surprisingly positive response.

Factors Contributing to Market Resilience

Several factors may be contributing to the market's continued positive momentum despite the downgrade:

- Strong Corporate Earnings: Many major corporations have reported surprisingly robust second-quarter earnings, defying recessionary predictions. This positive news has helped bolster investor confidence.

- Resilient Consumer Spending: Despite inflationary pressures, consumer spending remains relatively strong, indicating continued economic activity. This suggests that the economy is more resilient than some initial forecasts indicated.

- Federal Reserve's Actions: While the Federal Reserve's interest rate hikes aimed at curbing inflation have raised concerns, the central bank's recent statements suggest a potential pause or slowdown in future increases, potentially easing market anxieties.

- Global Economic Growth: Growth in certain sectors of the global economy, particularly in Asia, is offsetting some of the negative impacts of the US downgrade. This diversification of economic strength is playing a crucial role in market stability.

- Market Speculation and Anticipation: Some analysts believe the market had already priced in the potential for a downgrade, diminishing the impact of the actual announcement. Further speculation on future Federal Reserve moves also plays a significant role in market fluctuations.

Looking Ahead: Uncertainty Remains

While the current market performance is encouraging, significant uncertainties remain. The long-term implications of the Moody's downgrade are still unfolding, and the potential for increased borrowing costs could negatively impact future economic growth. Inflation remains a persistent concern, and geopolitical instability continues to pose a risk to global markets.

What This Means For Investors

The current market situation requires a cautious approach. While the positive momentum is encouraging, investors should remain vigilant and diversify their portfolios to mitigate potential risks. Regularly reviewing your investment strategy and staying informed about economic developments is crucial in navigating this period of uncertainty.

Further Reading:

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Update: Positive Momentum Continues Despite Moody's Downgrade Of US Credit Rating. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Moodys Downgrade Fails To Dent Wall Street S And P 500 Dow And Nasdaq Rise

May 20, 2025

Moodys Downgrade Fails To Dent Wall Street S And P 500 Dow And Nasdaq Rise

May 20, 2025 -

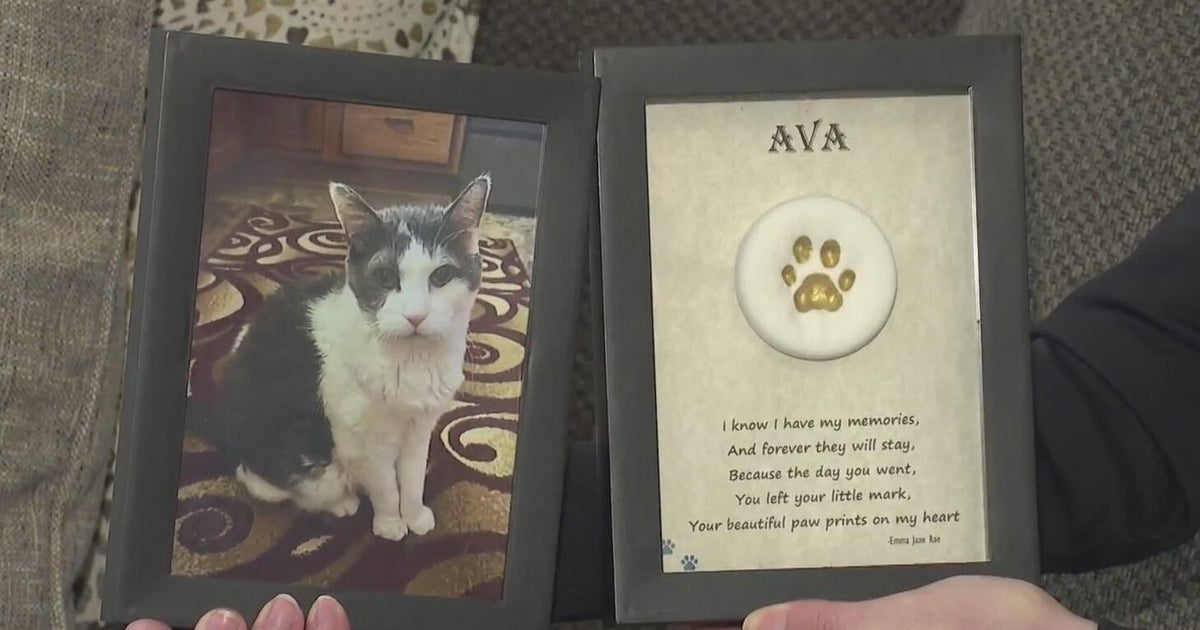

Lost Pets Remembered Memorial Service After Funeral Home Cremains Incident

May 20, 2025

Lost Pets Remembered Memorial Service After Funeral Home Cremains Incident

May 20, 2025 -

Impact Of Feds Projected Single 2025 Rate Cut On Us Treasury Yields

May 20, 2025

Impact Of Feds Projected Single 2025 Rate Cut On Us Treasury Yields

May 20, 2025 -

Thunders Triumph Conquering Nerves To Defeat Nuggets And Reach West Finals

May 20, 2025

Thunders Triumph Conquering Nerves To Defeat Nuggets And Reach West Finals

May 20, 2025 -

Okc Thunder Defeat Nuggets Punching Ticket To Western Conference Finals

May 20, 2025

Okc Thunder Defeat Nuggets Punching Ticket To Western Conference Finals

May 20, 2025