Market Movers: Today's Inflation Data, US-China Trade Deal Status, And Tesla's Self-Driving Tech

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Movers: Inflation, US-China Trade, and Tesla's Autopilot Shake Up Wall Street

Today's market saw significant shifts driven by a trifecta of impactful news: the latest inflation data release, the ongoing uncertainty surrounding the US-China trade deal, and Tesla's advancements in self-driving technology. These factors combined to create a volatile trading day, leaving investors scrambling to assess the implications for their portfolios.

Inflation Data Fuels Market Volatility

The morning's release of the Consumer Price Index (CPI) for July sent shockwaves through the market. While the headline inflation figure came in slightly lower than expected, the underlying data revealed persistent inflationary pressures. Core inflation, which excludes volatile food and energy prices, remained stubbornly high, fueling concerns that the Federal Reserve might maintain its aggressive interest rate hiking policy for longer than anticipated. This uncertainty prompted a sell-off in certain sectors, particularly those sensitive to interest rate changes like technology and real estate. Analysts are now closely scrutinizing upcoming economic indicators for further clues about the Fed's next move. [Link to reputable source on CPI data]

US-China Trade Deal: A Lingering Question Mark

The ongoing saga of the US-China trade relationship continues to cast a long shadow over global markets. While no major breakthroughs were announced today, the lingering uncertainty surrounding the existing trade agreements and potential future tariffs kept investors on edge. This ambiguity contributes to broader market instability, as businesses struggle to plan for the future amid the fluctuating geopolitical landscape. Any significant escalation or de-escalation in trade tensions could trigger substantial market swings. [Link to reputable source on US-China trade relations]

Tesla's Self-Driving Progress: A Double-Edged Sword

Tesla's latest advancements in its Full Self-Driving (FSD) beta program generated both excitement and apprehension among investors. While the progress in autonomous driving technology is undeniably impressive, concerns remain about safety, regulatory hurdles, and the potential for liability. The inherent risks associated with widespread adoption of self-driving vehicles could impact Tesla's stock price, and the broader automotive sector, in unforeseen ways. The long-term implications for the insurance industry are also being closely monitored. [Link to reputable source on Tesla's FSD technology]

What to Watch For:

- Upcoming Economic Data: The next few weeks will be crucial as investors digest further economic data, looking for signs of inflation easing or persistence.

- Fed's Next Move: The Federal Reserve's upcoming policy decisions will heavily influence market direction. Any hints about future rate hikes or pauses will significantly impact investor sentiment.

- Geopolitical Developments: Ongoing tensions between the US and China, along with other global conflicts, remain key factors influencing market stability.

- Tesla's Regulatory Landscape: The regulatory approval process for Tesla's FSD technology will be a critical determinant of its long-term success and market impact.

Conclusion:

Today's market movements underscore the interconnectedness of global economic factors and the significant impact of individual company news. Investors must remain vigilant and carefully assess the evolving situation to make informed decisions in this dynamic environment. Diversification and a long-term investment strategy are crucial for navigating market volatility effectively. Staying informed through reliable news sources and consulting with financial advisors is recommended.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Movers: Today's Inflation Data, US-China Trade Deal Status, And Tesla's Self-Driving Tech. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

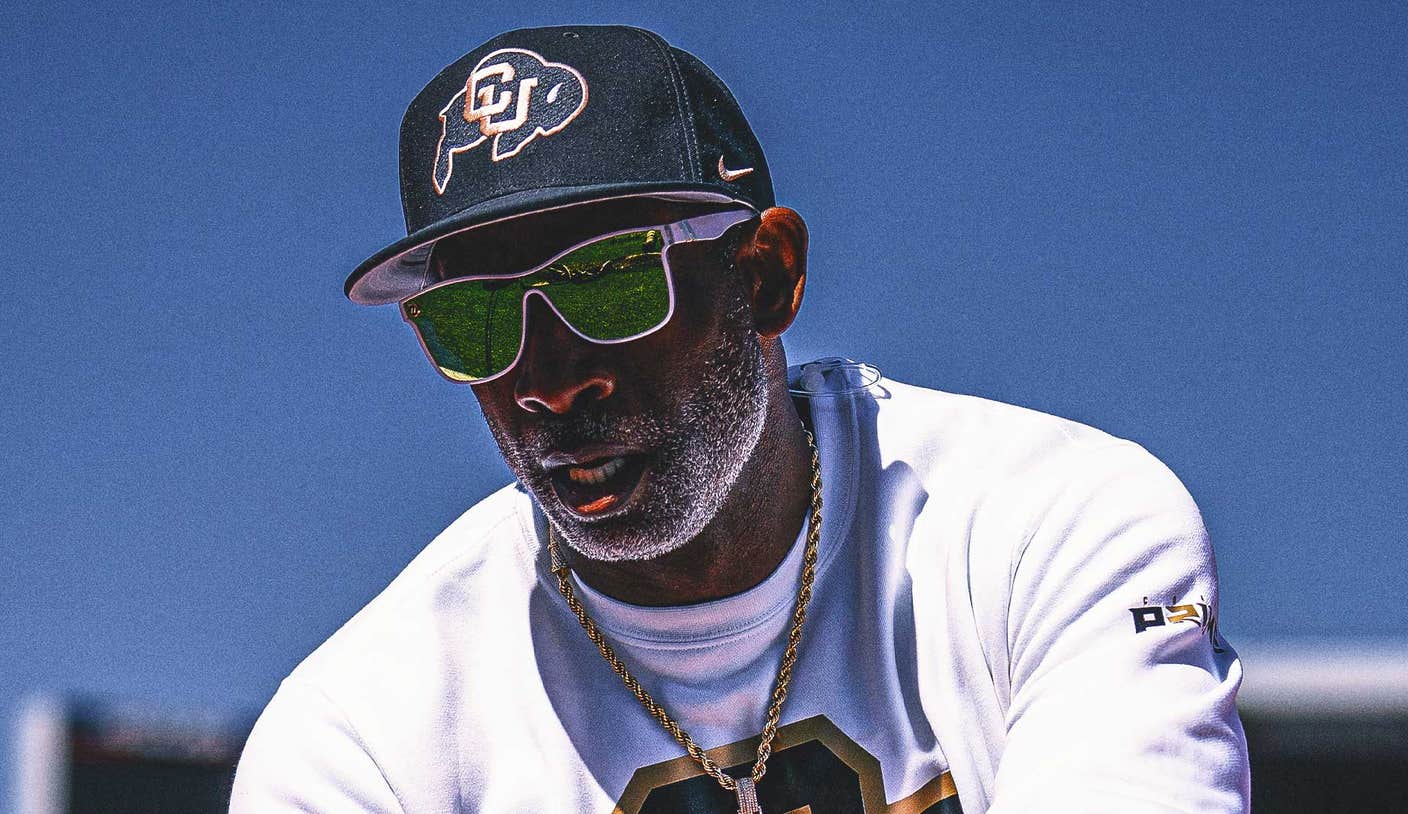

Deion Sanders Illness Colorado Football Program Awaits Coachs Return

Jun 12, 2025

Deion Sanders Illness Colorado Football Program Awaits Coachs Return

Jun 12, 2025 -

Washington Commanders Noah Brown Suffers Injury Latest Updates

Jun 12, 2025

Washington Commanders Noah Brown Suffers Injury Latest Updates

Jun 12, 2025 -

Mc Laurins Absence From Commanders Minicamp Highlights Contract Dispute

Jun 12, 2025

Mc Laurins Absence From Commanders Minicamp Highlights Contract Dispute

Jun 12, 2025 -

Long Game Dominates U S Open How Will Tiger Woods Adapt

Jun 12, 2025

Long Game Dominates U S Open How Will Tiger Woods Adapt

Jun 12, 2025 -

Wednesdays Setback Noah Browns Practice Injury

Jun 12, 2025

Wednesdays Setback Noah Browns Practice Injury

Jun 12, 2025