Major Price Target Increase For AMD: Should You Buy The Dip?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Major Price Target Increase for AMD: Should You Buy the Dip?

AMD stock has seen significant price fluctuations recently, leaving investors wondering if now is the time to buy. The recent surge in price targets from several prominent analysts has ignited renewed interest in Advanced Micro Devices (AMD), prompting the question: should you buy the dip? This article delves into the reasons behind the increased optimism, the potential risks, and helps you decide if AMD fits into your investment strategy.

The Bullish Case for AMD:

Several key factors contribute to the positive outlook for AMD:

-

Strong CPU and GPU Market Share Gains: AMD has been steadily gaining market share against its primary competitor, Intel, in the CPU market, particularly in the high-performance computing (HPC) and gaming segments. Their Ryzen processors have received widespread critical acclaim, and their dominance in the console market (through supplying chips to both Sony and Microsoft) further strengthens their position. Similarly, their Radeon GPUs are increasingly competitive with Nvidia's offerings, particularly in the mid-range and budget markets.

-

Data Center Growth: The data center market is a major growth driver for AMD's EPYC server processors. The increasing demand for high-performance computing in cloud computing and AI is fueling this growth, presenting a significant opportunity for AMD to continue its market share expansion.

-

Increased Analyst Price Targets: Several leading financial institutions have recently significantly raised their price targets for AMD stock. This reflects growing confidence in the company's long-term prospects and suggests a strong belief in its future financial performance. This surge in price targets is a key indicator for potential investors.

-

Innovative Product Roadmap: AMD continues to invest heavily in research and development, consistently releasing innovative products with advanced features. This commitment to innovation ensures they remain competitive in the rapidly evolving technology landscape.

Understanding the Risks:

While the outlook for AMD is largely positive, investors should be aware of potential risks:

-

Competition: The semiconductor industry is highly competitive. Intel and Nvidia remain formidable competitors, and new players could emerge, potentially impacting AMD's market share.

-

Supply Chain Issues: Global supply chain disruptions can impact the production and availability of AMD's products, affecting revenue and profitability.

-

Economic Downturn: A broader economic slowdown could reduce demand for electronics, impacting sales and potentially affecting AMD's stock price.

Should You Buy the Dip?

The decision of whether or not to buy AMD stock after a dip depends heavily on your individual risk tolerance and investment strategy. The increased price targets suggest significant potential for growth, but the risks mentioned above shouldn't be ignored. Consider the following:

-

Your Investment Horizon: Are you a long-term or short-term investor? AMD's long-term prospects appear strong, making it potentially attractive for long-term investors.

-

Diversification: AMD should be part of a diversified portfolio, not your sole investment.

-

Your Risk Tolerance: Are you comfortable with the inherent volatility of the tech sector?

Before making any investment decisions, conduct thorough due diligence and consult with a qualified financial advisor. This article provides information for educational purposes and should not be considered financial advice. Remember to always research and understand the risks involved before investing in any stock.

Further Reading:

- (replace with actual link)

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Major Price Target Increase For AMD: Should You Buy The Dip?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2025 Mlb Draft Washington Nationals Take Eli Willits With Top Pick

Jul 16, 2025

2025 Mlb Draft Washington Nationals Take Eli Willits With Top Pick

Jul 16, 2025 -

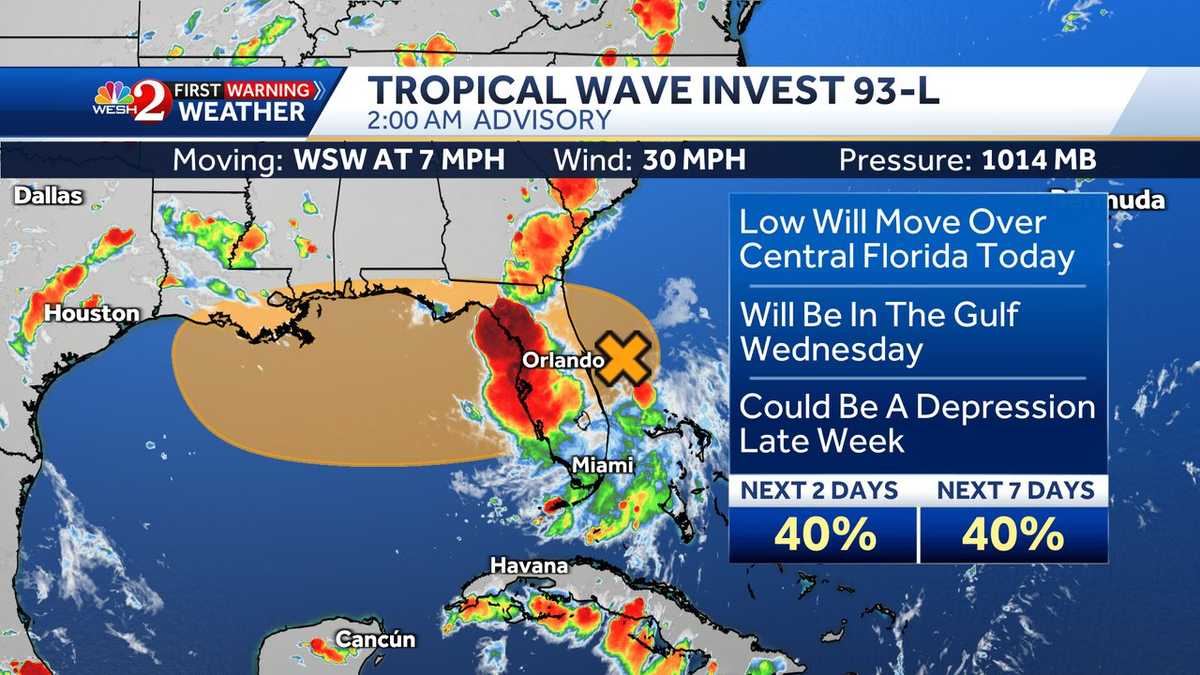

Invest 93 L Near Florida Potential For Development And Impact

Jul 16, 2025

Invest 93 L Near Florida Potential For Development And Impact

Jul 16, 2025 -

Photos 27th Annual Broadway Barks Dog Adoption Event With Bernadette Peters And Beth Leavel

Jul 16, 2025

Photos 27th Annual Broadway Barks Dog Adoption Event With Bernadette Peters And Beth Leavel

Jul 16, 2025 -

Central Florida Under Severe Storm Threat Monday Weather Update

Jul 16, 2025

Central Florida Under Severe Storm Threat Monday Weather Update

Jul 16, 2025 -

Nflpa Director Lloyd Howell Jr Receives Union Leadership Support Amidst Reports

Jul 16, 2025

Nflpa Director Lloyd Howell Jr Receives Union Leadership Support Amidst Reports

Jul 16, 2025