Lower US Treasury Yields: Fed's 2025 Rate Cut Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lower US Treasury Yields Signal Market Bets on 2025 Fed Rate Cuts

The US Treasury market is sending a clear message: investors are anticipating interest rate cuts from the Federal Reserve as early as 2025. Recent declines in Treasury yields, particularly across the longer end of the curve, suggest a growing belief that the current tightening cycle is nearing its end and a period of monetary easing is on the horizon. This shift in market sentiment has significant implications for the broader economy and financial markets.

What's Driving the Drop in Treasury Yields?

Several factors are contributing to the lower yields on US Treasuries. The most prominent is the expectation of future Fed rate cuts. While the Fed has maintained a hawkish stance, emphasizing its commitment to fighting inflation, the persistent slowdown in economic growth is prompting speculation about a pivot. Data indicating softening inflation, coupled with concerns about a potential recession, is fueling this expectation.

- Softening Inflation: While inflation remains above the Fed's target, recent data points to a cooling trend. This gives investors confidence that the Fed's aggressive rate hikes are having the desired effect and that further increases may not be necessary.

- Economic Slowdown: Concerns about a potential recession are growing. Key economic indicators, such as manufacturing activity and consumer spending, are showing signs of weakness. A recession would likely force the Fed to cut rates to stimulate economic growth.

- Market Sentiment: Investor sentiment plays a crucial role. The collective belief that rate cuts are coming can become a self-fulfilling prophecy, pushing yields lower as investors adjust their portfolios accordingly.

The 2025 Rate Cut Outlook: A Closer Look

The market is currently pricing in expectations for rate cuts beginning in 2025. This doesn't necessarily mean the Fed will cut rates then; it simply reflects the current market consensus. The actual timing and magnitude of any future rate cuts will depend on numerous economic factors, including inflation, economic growth, and the overall health of the financial system.

Implications for Investors and the Economy

Lower Treasury yields have significant implications for both investors and the broader economy. For investors, lower yields mean lower returns on fixed-income investments. However, it also typically signals a shift towards a less risky environment, potentially boosting equity markets.

For the economy, lower rates could stimulate borrowing and investment, leading to increased economic activity. However, prematurely cutting rates could also reignite inflationary pressures, creating a challenging environment for policymakers.

What to Watch For:

- Inflation Data: Continued cooling in inflation will solidify the market's expectation of future rate cuts. Conversely, a resurgence in inflation could push yields higher.

- Economic Growth Indicators: Key economic indicators, such as GDP growth and employment data, will provide crucial insights into the health of the economy and the Fed's future policy decisions.

- Fed Communication: Statements and press conferences from Fed officials will offer valuable clues about their future plans. Investors will closely scrutinize any shifts in the Fed's communication regarding its inflation target and future rate hikes or cuts.

The current decline in US Treasury yields reflects a significant shift in market sentiment. While the outlook for 2025 rate cuts remains uncertain, understanding the factors driving this trend is crucial for investors and economic analysts alike. Staying informed about key economic indicators and Fed pronouncements will be key to navigating this evolving landscape. Learn more about to better understand the implications of these market shifts.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lower US Treasury Yields: Fed's 2025 Rate Cut Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wnba Opener Caitlin Clark Triple Double Marred By Flagrant Foul Incident With Angel Reese

May 20, 2025

Wnba Opener Caitlin Clark Triple Double Marred By Flagrant Foul Incident With Angel Reese

May 20, 2025 -

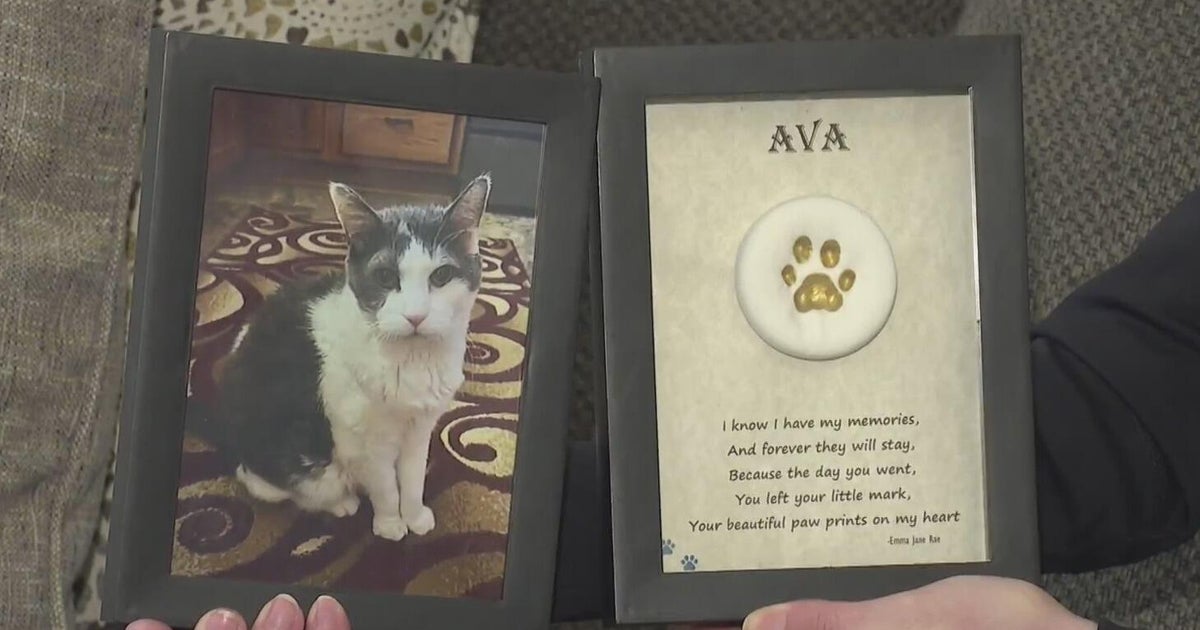

Community Mourns Pets In Wake Of Funeral Home Cremains Mismanagement

May 20, 2025

Community Mourns Pets In Wake Of Funeral Home Cremains Mismanagement

May 20, 2025 -

Rising Star Elevates A24 And Amazons Latest Collaboration

May 20, 2025

Rising Star Elevates A24 And Amazons Latest Collaboration

May 20, 2025 -

Rba Interest Rate Cut Live Updates And Analysis

May 20, 2025

Rba Interest Rate Cut Live Updates And Analysis

May 20, 2025 -

College World Series Bound Liberty Topples Top Ranked Texas A And M

May 20, 2025

College World Series Bound Liberty Topples Top Ranked Texas A And M

May 20, 2025