LMB Stock: Limbach Holdings' Bullish Outlook Analyzed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

LMB Stock: Is Limbach Holdings Poised for a Bullish Run?

Limbach Holdings (LMB) has recently garnered attention from investors, sparking debate about its future trajectory. While the stock market is inherently volatile, a closer look at Limbach's performance and recent announcements reveals a potentially bullish outlook, albeit with inherent risks. This analysis delves into the factors contributing to the optimistic sentiment surrounding LMB stock and examines the potential challenges that could impact its growth.

Understanding Limbach Holdings (LMB): A Quick Overview

Limbach Holdings, Inc. is a leading provider of mechanical, electrical, and plumbing (MEP) services primarily serving the healthcare, higher education, and science and technology sectors. Their expertise lies in complex building systems, particularly in sustainable and energy-efficient designs. This focus on specialized markets offers both opportunity and vulnerability, depending on the overall economic climate and the specific demands within these sectors.

Factors Fueling the Bullish Outlook for LMB Stock

Several factors are contributing to the optimistic sentiment surrounding LMB stock:

-

Strong Backlog of Projects: A significant backlog of projects signals a healthy pipeline of future revenue, providing a level of certainty and stability for investors. This indicates continued demand for Limbach's services and positions them for sustained growth in the near term.

-

Strategic Acquisitions: Limbach's history of strategic acquisitions has expanded their service offerings and geographical reach, bolstering their market position and potential for revenue growth. Successful integration of these acquisitions is, of course, crucial for realizing these benefits.

-

Focus on Sustainable Solutions: The increasing emphasis on sustainable and energy-efficient building practices aligns perfectly with Limbach's expertise. This positions them to capitalize on growing demand for green building technologies and projects. This focus also strengthens their long-term competitiveness.

-

Government Infrastructure Spending: Increased government spending on infrastructure projects, particularly in healthcare and education, presents significant opportunities for companies like Limbach. This sector is expected to see significant growth, potentially driving LMB's revenue further.

Potential Challenges and Risks Associated with LMB Stock

Despite the positive indicators, investors should be aware of potential challenges:

-

Supply Chain Disruptions: The ongoing impact of global supply chain disruptions could affect project timelines and profitability. The cost of materials and labor fluctuations can significantly impact margins.

-

Competition: The MEP industry is competitive, and Limbach faces competition from both large national firms and smaller regional players. Maintaining a competitive edge requires constant innovation and efficient operations.

-

Economic Downturn: An economic downturn could significantly impact demand for new construction and renovation projects, potentially affecting Limbach's revenue and profitability. This vulnerability is inherent in the cyclical nature of the construction industry.

Investment Considerations and Conclusion:

Limbach Holdings presents an interesting investment opportunity for those with a moderate to high-risk tolerance. The company's strong backlog, strategic acquisitions, and focus on sustainable solutions suggest a potentially bullish outlook. However, investors must carefully consider the inherent risks associated with the construction industry, including supply chain disruptions and the impact of potential economic downturns. Thorough due diligence and diversification are crucial before investing in LMB stock. Consult with a qualified financial advisor to determine if LMB aligns with your individual investment strategy and risk profile.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on LMB Stock: Limbach Holdings' Bullish Outlook Analyzed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

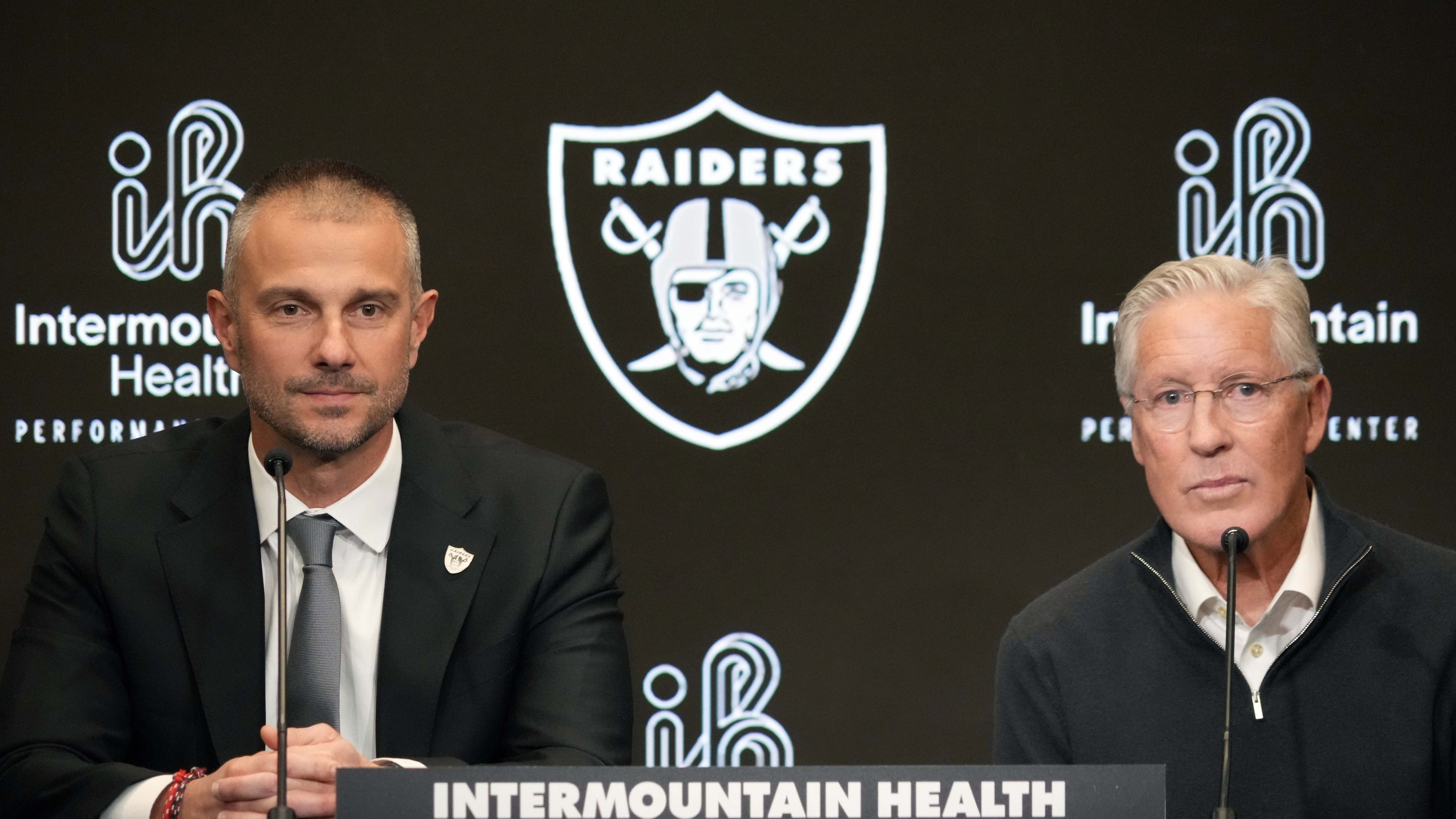

The Athletic Ranks Raiders Among Biggest Potential Winners Of 2025 Nfl Offseason

Jun 27, 2025

The Athletic Ranks Raiders Among Biggest Potential Winners Of 2025 Nfl Offseason

Jun 27, 2025 -

Club World Cup 2025 Draw Messi And Inter Miamis Round Of 16 Opponent Revealed

Jun 27, 2025

Club World Cup 2025 Draw Messi And Inter Miamis Round Of 16 Opponent Revealed

Jun 27, 2025 -

Who Is Francie Fak Exploring The New Character And Her Issues With Natalie In The Bear Season 4

Jun 27, 2025

Who Is Francie Fak Exploring The New Character And Her Issues With Natalie In The Bear Season 4

Jun 27, 2025 -

Rutgers Dylan Harpers Nba Journey Begins Spurs Select Him Second

Jun 27, 2025

Rutgers Dylan Harpers Nba Journey Begins Spurs Select Him Second

Jun 27, 2025 -

Update Air Canada Halts Dubai Flights Until August 4

Jun 27, 2025

Update Air Canada Halts Dubai Flights Until August 4

Jun 27, 2025