Life's Curveballs: Stress-Testing Your Retirement Plan For Resilience

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Life's Curveballs: Stress-Testing Your Retirement Plan for Resilience

Retirement planning is often viewed as a linear path: save diligently, invest wisely, and enjoy a comfortable golden age. But life, as we all know, rarely follows a straight line. Unexpected events – job loss, health crises, market downturns – can throw even the most meticulously crafted retirement plan a serious curveball. This is why stress-testing your retirement plan is crucial, ensuring its resilience against the inevitable bumps in the road.

The Importance of Proactive Planning: Beyond the Expected

Many retirement calculators and projections offer a rosy picture, assuming consistent returns and predictable expenses. This approach is inherently flawed. A truly resilient retirement plan anticipates the unexpected and builds in buffers to absorb shocks. Ignoring the potential for unforeseen circumstances can leave retirees vulnerable and significantly impact their quality of life.

Common Curveballs That Can Impact Retirement:

- Unexpected Medical Expenses: Health issues are a major, often underestimated, threat to retirement security. Unexpected surgeries, long-term care needs, or chronic illnesses can quickly deplete savings. Consider long-term care insurance or a dedicated health savings account (HSA) as part of your strategy.

- Market Volatility: While market fluctuations are inherent to investing, significant downturns can severely impact your retirement portfolio. Diversification and a long-term investment strategy are key to mitigating this risk. Consider consulting a financial advisor to build a portfolio suitable for your risk tolerance and time horizon.

- Inflation: Rising inflation erodes the purchasing power of your savings. Account for inflation in your retirement projections and consider investments that can keep pace with inflation.

- Unforeseen Family Emergencies: Supporting family members financially can place a strain on retirement funds. Having an emergency fund can help cushion the blow.

- Unexpected Job Loss: Losing your job closer to retirement can severely impact your savings and delay your retirement plans. Maintaining a healthy emergency fund and exploring alternative income streams are crucial safeguards.

Stress-Testing Your Plan: A Practical Approach

Stress-testing involves simulating various negative scenarios and assessing your plan's ability to withstand them. Here's how to approach it:

- Identify Potential Risks: Make a list of potential financial setbacks you might face during retirement, considering your individual circumstances and health history.

- Quantify the Impact: Estimate the financial impact of each scenario. For example, how much would a major illness cost? How would a prolonged market downturn affect your portfolio?

- Adjust Your Strategy: Based on your stress-testing, revise your retirement plan to mitigate the identified risks. This may involve increasing savings, adjusting your investment strategy, or securing additional insurance coverage.

- Regularly Review and Update: Your financial situation and risk profile can change over time. Conduct regular reviews (at least annually) to reassess your plan and make necessary adjustments.

Seeking Professional Guidance:

Working with a qualified financial advisor can significantly improve your retirement planning process. They can help you create a personalized strategy, conduct comprehensive stress testing, and adapt your plan to changing circumstances. Don't hesitate to seek professional help – it's an investment in your future security.

Conclusion:

Retirement planning isn't a one-time event; it's an ongoing process that requires adaptability and resilience. By proactively stress-testing your plan and anticipating life's curveballs, you can significantly improve your chances of enjoying a secure and comfortable retirement. Don't let unexpected events derail your dreams – plan ahead and build a retirement plan that can weather any storm.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Life's Curveballs: Stress-Testing Your Retirement Plan For Resilience. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

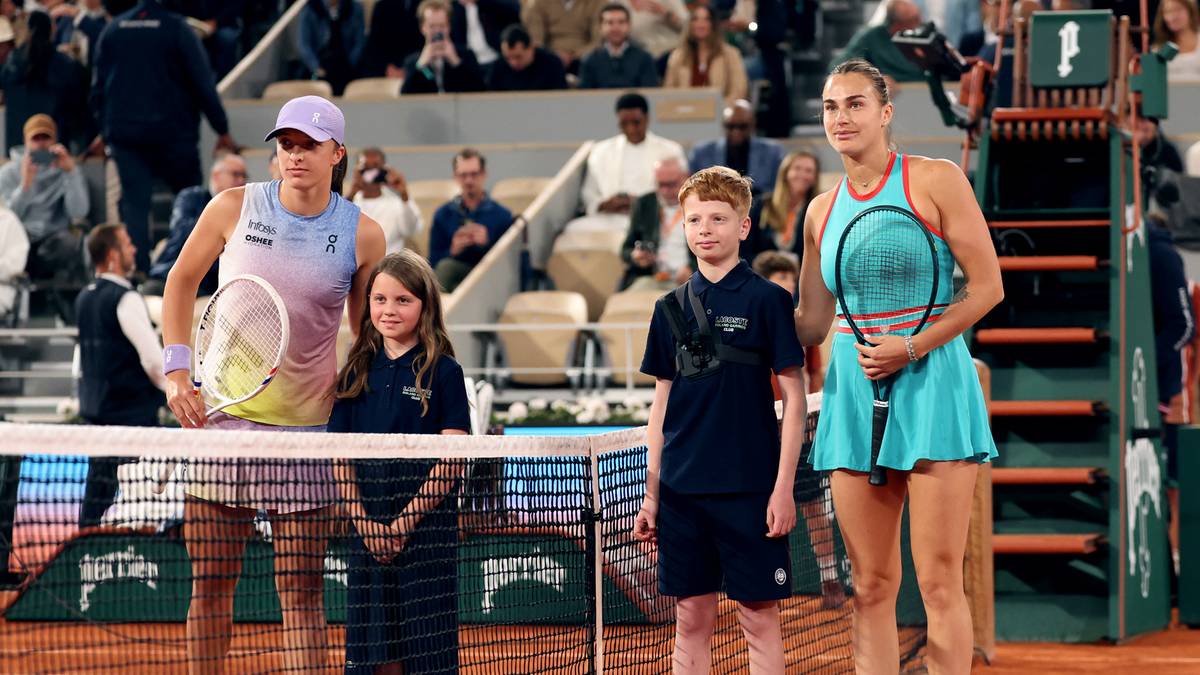

Iga Swiatek I Aryna Sabalenka Pojedynek Na Roland Garros Relacja Live

Jun 05, 2025

Iga Swiatek I Aryna Sabalenka Pojedynek Na Roland Garros Relacja Live

Jun 05, 2025 -

Australian Energy Security At Risk Key Battery Suppliers Warning Of Imminent Closure

Jun 05, 2025

Australian Energy Security At Risk Key Battery Suppliers Warning Of Imminent Closure

Jun 05, 2025 -

2025 Nfl Season Predicting The Kansas City Chiefs Game By Game Outcomes

Jun 05, 2025

2025 Nfl Season Predicting The Kansas City Chiefs Game By Game Outcomes

Jun 05, 2025 -

Escape Room Album And Straw Movie Teyana Taylors Latest Projects

Jun 05, 2025

Escape Room Album And Straw Movie Teyana Taylors Latest Projects

Jun 05, 2025 -

Legal Update Karen Read Retrial Sees Testimony Postponement

Jun 05, 2025

Legal Update Karen Read Retrial Sees Testimony Postponement

Jun 05, 2025