Key Australian Energy Storage Provider On Brink Of Bankruptcy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Key Australian Energy Storage Provider on Brink of Bankruptcy: What This Means for the Energy Transition

Australia's ambitious renewable energy targets are facing a significant hurdle. A leading energy storage provider, [Insert Company Name Here – replace with actual company name if known, otherwise use a placeholder like "SolarStore Pty Ltd."], is reportedly on the brink of bankruptcy, sending shockwaves through the already volatile energy sector. This development raises serious questions about the reliability and scalability of Australia's energy transition plans.

The potential collapse of [Company Name] highlights the significant financial risks inherent in the burgeoning energy storage market. While the demand for battery storage solutions is undeniably high, driven by the increasing adoption of solar and wind power, the industry is still relatively immature, facing challenges with supply chain complexities, fluctuating commodity prices, and intense competition.

The Impact of [Company Name]'s Potential Failure:

- Job losses: The bankruptcy of a major player like [Company Name] will undoubtedly lead to significant job losses across the company and its supply chain. This will impact communities reliant on the energy sector and could dampen investment in the renewable energy space.

- Project delays: Several large-scale renewable energy projects are reliant on [Company Name]'s storage solutions. Delays or cancellations of these projects will hinder Australia's progress toward its renewable energy goals, potentially impacting energy security and increasing reliance on fossil fuels.

- Increased energy prices: A reduction in available storage capacity could lead to instability in the electricity grid, potentially causing price spikes for consumers. The lack of sufficient storage options limits the ability to effectively manage the intermittent nature of renewable energy sources.

- Investor confidence: The situation could negatively impact investor confidence in the Australian renewable energy sector, making it harder to secure funding for future projects and hindering the nation's energy transition.

What caused this crisis?

While the specific reasons behind [Company Name]'s financial difficulties are still unfolding, several contributing factors are likely at play:

- High upfront costs: The initial investment required for energy storage projects is substantial, putting pressure on smaller companies.

- Competition: The energy storage market is becoming increasingly competitive, with both established players and new entrants vying for market share.

- Supply chain disruptions: Global supply chain issues, particularly impacting battery materials, have added to the financial strain.

- Regulatory hurdles: Complex regulatory frameworks and permitting processes can delay project completion and increase costs.

The Path Forward for Australia's Energy Storage Sector:

This situation underscores the urgent need for government support and strategic policy adjustments to ensure the long-term viability of the energy storage sector. This could involve:

- Targeted financial incentives: Government grants and subsidies could help reduce the upfront costs of energy storage projects.

- Streamlined regulatory processes: Simplifying permitting procedures and reducing bureaucratic hurdles could accelerate project development.

- Investment in research and development: Further investment in battery technology and storage solutions is crucial to improve efficiency and reduce costs.

- Strategic partnerships: Encouraging collaboration between government, industry, and research institutions can foster innovation and knowledge sharing.

The potential collapse of [Company Name] is a stark reminder of the challenges facing Australia's energy transition. Addressing these issues proactively is critical to ensuring a stable, reliable, and affordable energy future for all Australians. This situation necessitates a comprehensive review of current policies and a renewed commitment to supporting the sustainable growth of the renewable energy and storage sector.

Call to Action: Stay informed about developments in the Australian energy sector by subscribing to our newsletter and following us on social media. We will provide updates as this story unfolds. [Link to newsletter signup/social media].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Key Australian Energy Storage Provider On Brink Of Bankruptcy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

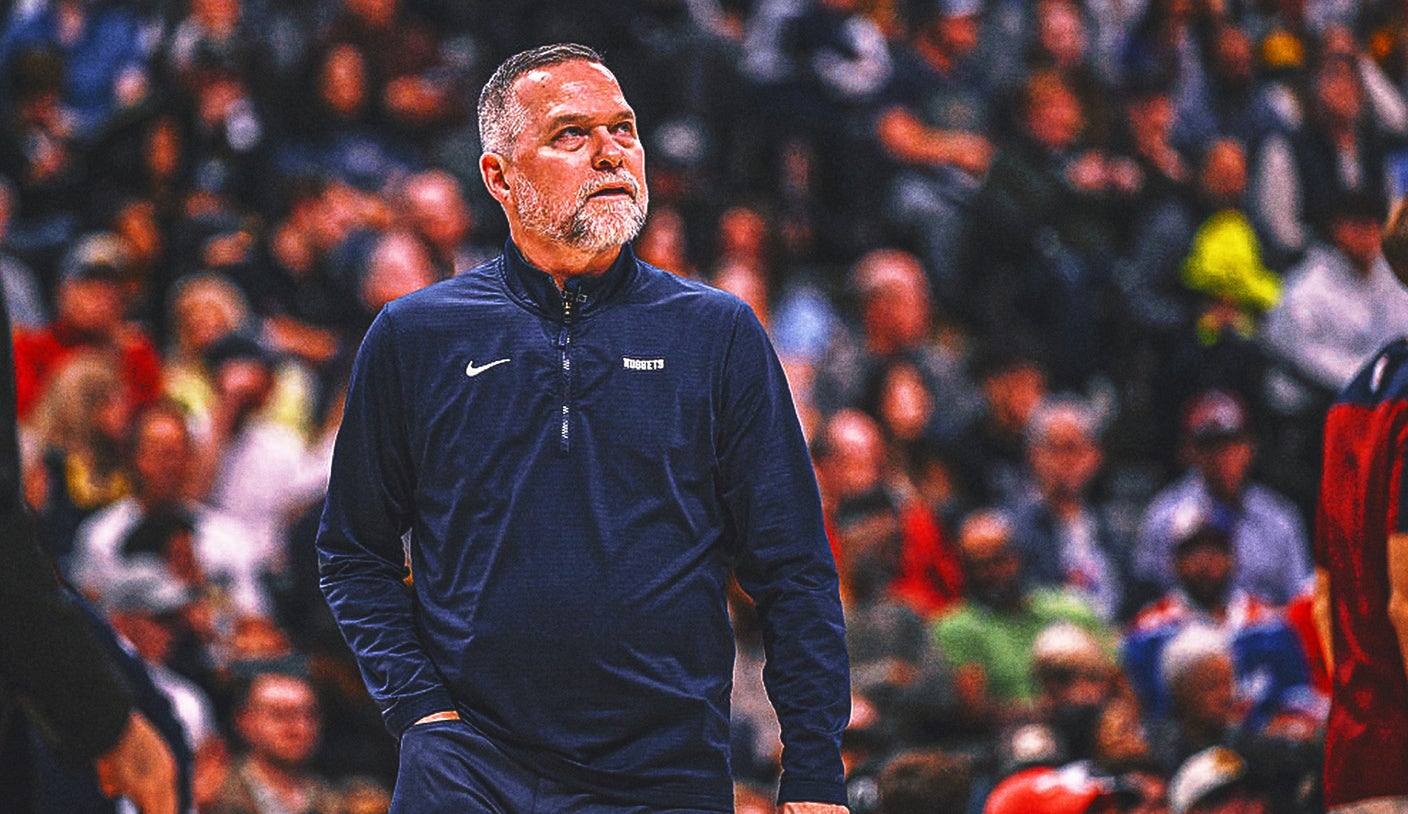

Tom Thibodeau Out Examining The Leading Contenders For The Knicks Head Coach Job

Jun 05, 2025

Tom Thibodeau Out Examining The Leading Contenders For The Knicks Head Coach Job

Jun 05, 2025 -

Core Weaves 7 Billion Lease Fuels Applied Digitals Market Rally

Jun 05, 2025

Core Weaves 7 Billion Lease Fuels Applied Digitals Market Rally

Jun 05, 2025 -

Mlb Recap Freemans Clutch Hitting Fuels Dodgers Win

Jun 05, 2025

Mlb Recap Freemans Clutch Hitting Fuels Dodgers Win

Jun 05, 2025 -

Broadcom Stock On The Brink Earnings And The 250 Question

Jun 05, 2025

Broadcom Stock On The Brink Earnings And The 250 Question

Jun 05, 2025 -

Luke Weaver Hamstring Injury Yankees Closers Timeline For Return

Jun 05, 2025

Luke Weaver Hamstring Injury Yankees Closers Timeline For Return

Jun 05, 2025