June 3rd Market Update: Robinhood (HOOD) Shares Climb 6.46%

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

June 3rd Market Update: Robinhood (HOOD) Shares Soar 6.46% – A Bullish Sign?

Robinhood Markets, Inc. (NASDAQ: HOOD) experienced a significant surge on June 3rd, with its shares climbing a remarkable 6.46%. This unexpected jump has ignited speculation amongst investors and analysts, prompting questions about the underlying factors driving this positive momentum and what it might mean for the future of the popular trading platform. This market update delves into the details of this noteworthy event and explores potential contributing factors.

What Fueled Robinhood's Impressive Gain?

While a definitive single cause remains elusive, several contributing factors likely contributed to HOOD's impressive performance on June 3rd. These include:

-

Positive Earnings Expectations: Although official Q1 2023 earnings were released earlier, lingering positive sentiment regarding future earnings may have played a role. Analysts' forecasts for upcoming quarters might be more optimistic than previously anticipated, influencing investor confidence. We'll need to wait for future earnings reports to confirm this theory.

-

Improved Market Sentiment: The broader market also showed signs of positive movement on June 3rd, creating a generally bullish environment which often lifts even individual stocks. A positive overall market trend typically benefits companies perceived as growth stocks, such as Robinhood.

-

Increased Trading Volume: A noticeable increase in trading volume for HOOD could indicate renewed investor interest. Higher volume often correlates with price increases, suggesting more buyers than sellers.

-

Speculation and Short Covering: It's also plausible that some of the price increase is attributed to short covering. If investors who had bet against Robinhood (short selling) started buying shares to limit potential losses, this would increase demand and push the price upward.

Robinhood's Ongoing Challenges and Future Outlook

Despite this positive day, it's crucial to remember that Robinhood still faces significant challenges. The company continues to navigate a competitive landscape dominated by established players and newer entrants. Maintaining user engagement and profitability amidst fluctuating market conditions remains a key focus for Robinhood.

Key challenges include:

- Competition: The online brokerage industry is highly competitive, with established players like Fidelity and Charles Schwab offering strong alternatives.

- Regulatory Scrutiny: The financial sector is heavily regulated, and Robinhood has faced its share of regulatory scrutiny in the past.

- Maintaining User Growth: Attracting and retaining users in a saturated market remains a constant battle for Robinhood.

What Does This Mean for Investors?

This single day's gain should not be interpreted as a guaranteed long-term upward trend. Investors need to exercise caution and conduct thorough due diligence before making any investment decisions based on short-term market fluctuations. The future performance of HOOD will depend on several factors, including the company's ability to address its challenges and adapt to the ever-evolving financial landscape.

Further Research and Resources:

To stay informed on Robinhood and the broader market, consider exploring these resources:

- (Replace with actual link)

- (Replace with actual link)

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on June 3rd Market Update: Robinhood (HOOD) Shares Climb 6.46%. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

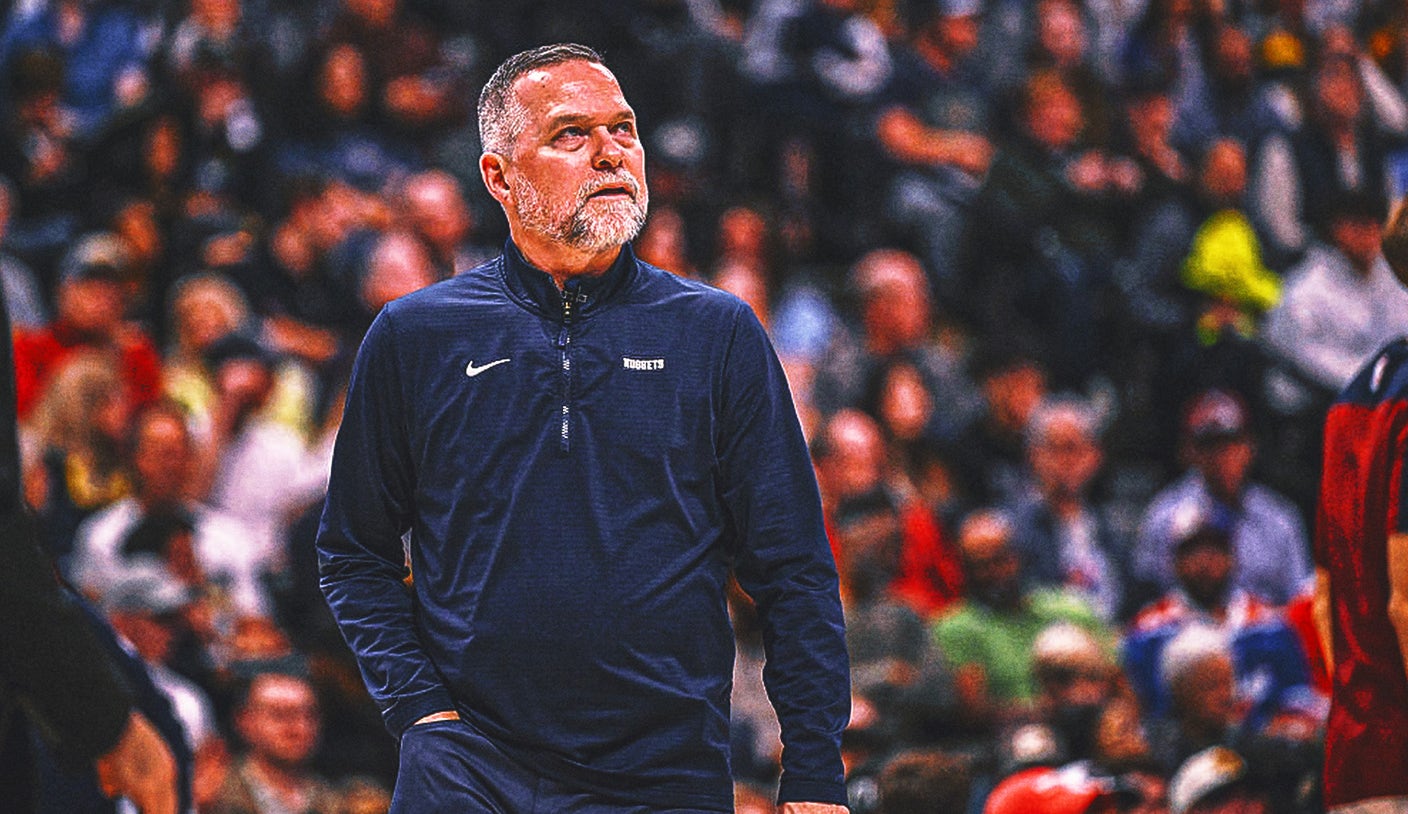

New York Knicks Head Coach Odds A Look At The Leading Contenders

Jun 05, 2025

New York Knicks Head Coach Odds A Look At The Leading Contenders

Jun 05, 2025 -

Yankees Announce Luke Weaver Injured List Placement

Jun 05, 2025

Yankees Announce Luke Weaver Injured List Placement

Jun 05, 2025 -

Karen Read Retrial Explanation For Thursdays Cancelled Testimony

Jun 05, 2025

Karen Read Retrial Explanation For Thursdays Cancelled Testimony

Jun 05, 2025 -

Australian Energy Security Threatened As Key Battery Supplier Faces Closure

Jun 05, 2025

Australian Energy Security Threatened As Key Battery Supplier Faces Closure

Jun 05, 2025 -

Marvels Black Panther Legacy Continues The New Protector And The Backlash

Jun 05, 2025

Marvels Black Panther Legacy Continues The New Protector And The Backlash

Jun 05, 2025