June 3rd Market Update: Robinhood (HOOD) Experiences Significant 6.46% Gain

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

June 3rd Market Update: Robinhood (HOOD) Soars 6.46% – What Fueled the Rally?

The stock market saw some significant movement on June 3rd, with several companies experiencing notable price changes. One standout performer was Robinhood Markets, Inc. (HOOD), whose stock price enjoyed a substantial 6.46% gain, closing the day significantly higher than its previous close. This surge sparked considerable interest, leaving many investors wondering: what drove this unexpected rally?

This article delves into the factors potentially contributing to Robinhood's impressive performance on June 3rd, examining market trends, recent company news, and broader economic influences. Understanding these factors is crucial for investors looking to navigate the complexities of the stock market and make informed decisions about their portfolios.

Robinhood's Recent Performance: A Rollercoaster Ride

Robinhood's stock has been on a rollercoaster ride in recent months, experiencing periods of both significant gains and losses. This volatility reflects the broader uncertainty in the tech sector and the company's own ongoing efforts to improve profitability and attract new users. The recent 6.46% jump, therefore, requires closer examination to understand its underlying causes.

Potential Factors Behind the June 3rd Surge

Several factors might have contributed to Robinhood's impressive performance on June 3rd:

-

Positive Investor Sentiment: A general improvement in overall market sentiment could have played a role. Positive economic indicators or a shift in investor confidence might have led to increased buying activity across the board, benefiting Robinhood alongside other stocks.

-

Increased Trading Volume: An increase in trading activity on Robinhood's platform itself could have indirectly boosted its stock price. Higher transaction volumes generally translate to increased revenue for brokerage firms. While specific data on June 3rd's trading volume is still pending, this remains a plausible contributing factor.

-

Speculative Trading: It's also possible that a wave of speculative trading contributed to the price increase. Short squeezes, or a sudden surge in buying pressure from investors betting on a price increase, can significantly impact a stock's price in a short period.

-

Lack of Specific News: It's important to note that there wasn't a major company-specific announcement on June 3rd that directly caused the surge. This suggests that broader market forces and investor sentiment likely played a more significant role.

Analyzing the Long-Term Outlook for HOOD

While the 6.46% gain is certainly positive news for Robinhood investors, it's crucial to maintain a long-term perspective. The stock's past volatility highlights the need for careful analysis before making any investment decisions. Investors should consider researching Robinhood's financial performance, growth strategies, and competitive landscape before making any investments. Consulting with a qualified financial advisor is always recommended.

Staying Informed About Market Trends

Staying updated on market trends and company-specific news is critical for investors. Reliable financial news sources, such as [link to a reputable financial news source], provide valuable insights into market fluctuations and help investors make better-informed choices. Regularly monitoring economic indicators and company performance reports can also contribute to a more comprehensive understanding of the market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on June 3rd Market Update: Robinhood (HOOD) Experiences Significant 6.46% Gain. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Can The Chiefs Dynasty Continue A 2025 Game By Game Prediction

Jun 05, 2025

Can The Chiefs Dynasty Continue A 2025 Game By Game Prediction

Jun 05, 2025 -

Soundbites Reveal Grace Potter On The Making Of Her Forgotten Album

Jun 05, 2025

Soundbites Reveal Grace Potter On The Making Of Her Forgotten Album

Jun 05, 2025 -

Wimbledon 2024 Lois Boissons Wild Card Journey Continues After Andreeva Win

Jun 05, 2025

Wimbledon 2024 Lois Boissons Wild Card Journey Continues After Andreeva Win

Jun 05, 2025 -

2025 Belmont Stakes Post Position Draw Tv Broadcast Details And Key Horses

Jun 05, 2025

2025 Belmont Stakes Post Position Draw Tv Broadcast Details And Key Horses

Jun 05, 2025 -

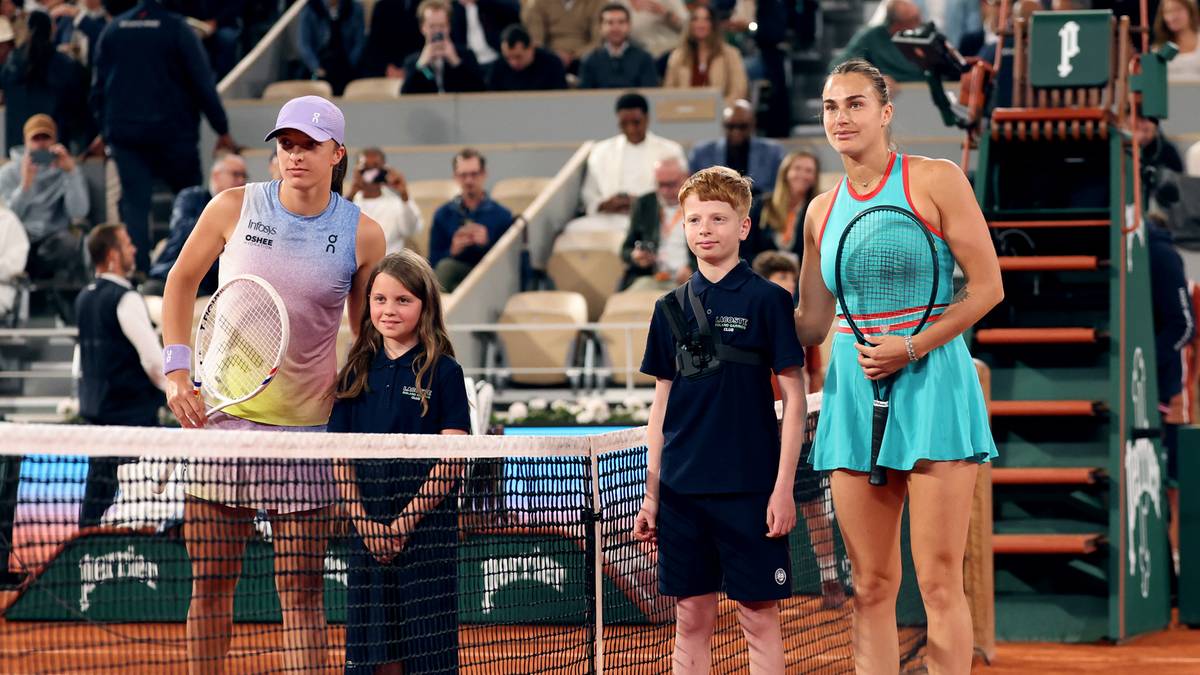

Swiatek Kontra Sabalenka Ogladaj Na Zywo Mecz Roland Garros

Jun 05, 2025

Swiatek Kontra Sabalenka Ogladaj Na Zywo Mecz Roland Garros

Jun 05, 2025