Is Your Retirement Plan Strong Enough? A Practical Stress Test Guide

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Your Retirement Plan Strong Enough? A Practical Stress Test Guide

Retirement. The word conjures images of leisurely days, travel, and finally pursuing those long-held dreams. But the reality for many is a gnawing anxiety: Is my retirement plan strong enough? The truth is, relying solely on gut feeling is a recipe for financial disaster. This guide provides a practical stress test to assess your retirement readiness and identify areas needing attention.

Why a Retirement Plan Stress Test is Crucial

Planning for retirement isn't a one-time event; it's an ongoing process requiring regular review and adjustment. Life throws curveballs – unexpected medical expenses, job loss, market downturns – all of which can significantly impact your retirement savings. A stress test helps you anticipate these challenges and build resilience into your financial plan. It's better to uncover potential weaknesses now than face a shortfall in your golden years.

Conducting Your Retirement Plan Stress Test: A Step-by-Step Guide

This stress test involves several key steps:

1. Calculate Your Current Retirement Savings: This includes all sources – 401(k)s, IRAs, pensions, and other investments. Be brutally honest and include any outstanding debts that will impact your available funds. Tools like online retirement calculators can assist in this process. [Link to a reputable online retirement calculator]

2. Project Your Retirement Expenses: This is arguably the most crucial step. Don't underestimate your expenses! Consider:

- Housing: Mortgage payments, rent, property taxes, maintenance.

- Healthcare: Medical insurance premiums, co-pays, potential long-term care costs (a significant and often underestimated expense).

- Food: Grocery bills, dining out.

- Transportation: Car payments, insurance, gas, public transportation.

- Travel & Leisure: Hobbies, vacations, entertainment.

Pro Tip: Inflate your projected expenses to account for future price increases. Use a conservative inflation rate (e.g., 3%) for a more realistic projection.

3. Factor in Unexpected Expenses: Life is unpredictable. Allocate a contingency fund for:

- Unexpected Medical Bills: Serious illnesses or injuries can drain your savings quickly.

- Home Repairs: Unexpected home maintenance costs can be substantial.

- Job Loss: Include a buffer for periods of unemployment.

4. Determine Your Withdrawal Rate: How much can you safely withdraw annually without depleting your savings before you die? A common rule of thumb is the 4% rule, but this can vary depending on your individual circumstances and risk tolerance. Consult with a financial advisor for personalized guidance.

5. Run the Simulation: Use a retirement planning software or work with a financial advisor to simulate different scenarios, including:

- Market Downturns: Model how your portfolio would perform during periods of market volatility.

- Unexpected Expenses: See how your plan holds up against unexpected costs.

- Longevity: Adjust your projections to account for the possibility of living longer than anticipated.

Addressing Shortfalls in Your Retirement Plan

If your stress test reveals a shortfall, don't panic! Several options exist to bolster your retirement savings:

- Increase Contributions: Contribute more to your retirement accounts. Even small increases can make a big difference over time.

- Delay Retirement: Working even a few extra years can significantly improve your financial security.

- Reduce Expenses: Identify areas where you can cut back on spending.

- Downsize Your Home: Moving to a smaller home can free up significant funds.

- Seek Professional Advice: Consult a financial advisor for personalized guidance on improving your retirement plan.

Conclusion: Secure Your Future

Conducting a retirement plan stress test is a crucial step in ensuring a comfortable and secure retirement. By proactively identifying and addressing potential weaknesses, you can build a more resilient financial plan and alleviate the anxiety that often accompanies retirement planning. Don't delay – take control of your financial future today! Start your stress test now and secure your tomorrow.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Your Retirement Plan Strong Enough? A Practical Stress Test Guide. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Former Jaguars Wr Gabe Davis To Meet With Pittsburgh Steelers Full Report

Jun 04, 2025

Former Jaguars Wr Gabe Davis To Meet With Pittsburgh Steelers Full Report

Jun 04, 2025 -

French Open Tiafoes Milestone Mirroring Agassis 1993 Run

Jun 04, 2025

French Open Tiafoes Milestone Mirroring Agassis 1993 Run

Jun 04, 2025 -

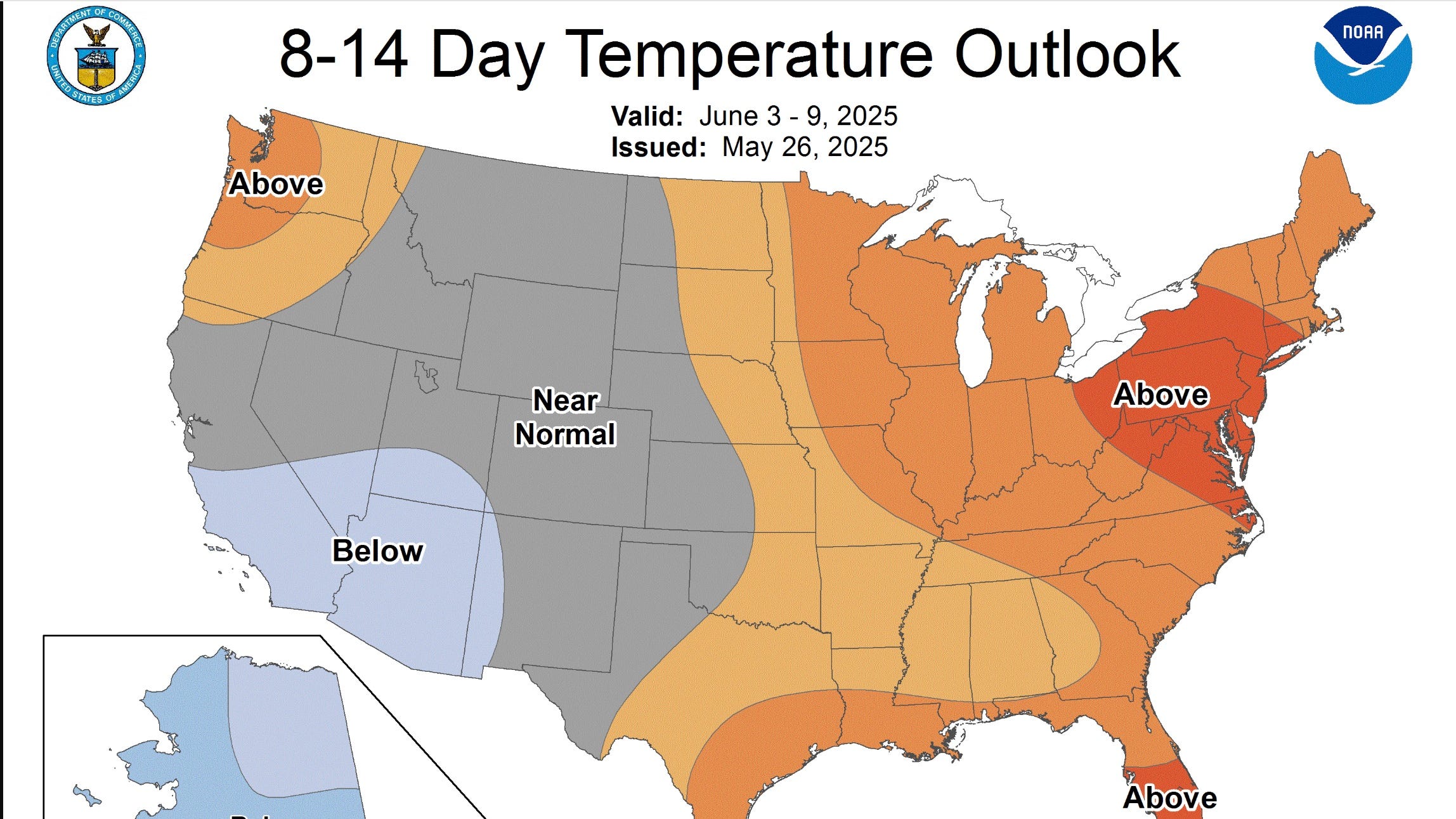

Extreme Heat Warning Willamette Valley Oregon To Experience Highs In The 80s And 90s

Jun 04, 2025

Extreme Heat Warning Willamette Valley Oregon To Experience Highs In The 80s And 90s

Jun 04, 2025 -

Warning Key Australian Big Battery Supplier May Go Bankrupt

Jun 04, 2025

Warning Key Australian Big Battery Supplier May Go Bankrupt

Jun 04, 2025 -

Mets Ronny Mauricio Promotion Expectations And Future

Jun 04, 2025

Mets Ronny Mauricio Promotion Expectations And Future

Jun 04, 2025