Is Your Retirement Plan Robust? Perform A Stress Test To Find Out.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Your Retirement Plan Robust? Perform a Stress Test to Find Out.

Are you confident you'll have enough money to retire comfortably? Many Americans harbor anxieties about their retirement savings, and with good reason. Unexpected life events, market volatility, and inflation can significantly impact your retirement nest egg. Instead of relying on hope, take proactive steps to assess your retirement plan's resilience. Performing a stress test on your retirement plan is crucial to uncovering potential vulnerabilities and making necessary adjustments before it's too late.

Why a Retirement Plan Stress Test is Essential

A retirement plan stress test isn't just about numbers; it's about peace of mind. It helps you understand how your savings might fare under various challenging scenarios. This proactive approach allows you to identify potential weaknesses and implement strategies to mitigate risks. Think of it as a financial health checkup for your golden years. Ignoring potential problems could lead to a significantly less comfortable retirement than you envisioned.

How to Perform a Retirement Plan Stress Test

Performing a stress test involves simulating different economic and personal scenarios that could impact your retirement income. Here's a step-by-step guide:

1. Project Your Retirement Income: Start by estimating your expected retirement income from all sources, including Social Security, pensions, 401(k)s, IRAs, and any other investments. Use online retirement calculators or consult a financial advisor to get a realistic projection. Consider using a conservative estimate for investment returns, accounting for potential market downturns.

2. Estimate Your Retirement Expenses: Create a detailed budget outlining your anticipated expenses in retirement. This includes housing, healthcare, food, transportation, travel, and entertainment. Remember to factor in inflation, which can significantly erode your purchasing power over time. Consider using online budgeting tools to help you accurately estimate your expenses.

3. Run Different Scenarios: This is where the "stress" comes in. Consider these scenarios:

- Market Downturn: What would happen to your portfolio if the market experienced a significant drop (e.g., 20%, 30%)? Would you still be able to meet your retirement expenses?

- Unexpected Medical Expenses: A major illness or long-term care could significantly deplete your savings. How would you cope with unexpected medical bills? Do you have adequate health insurance?

- Inflation: How will inflation affect your purchasing power over the next 20-30 years? Will your retirement income keep pace with rising costs?

- Longevity: Are your savings sufficient to cover your expenses if you live longer than expected? Many people underestimate their lifespan.

4. Analyze Your Results: After running these scenarios, analyze your results. Are you comfortable with the potential outcomes? If not, you need to adjust your plan.

Adjusting Your Retirement Plan

If your stress test reveals potential shortfalls, don't panic. You have options:

- Increase Savings: Contribute more to your retirement accounts. Even small increases can make a big difference over time.

- Delay Retirement: Working longer can significantly boost your savings and reduce the duration you need your retirement funds to last.

- Reduce Expenses: Identify areas where you can cut back on spending in retirement.

- Diversify your Investments: Spreading your investments across different asset classes can help reduce risk.

- Seek Professional Advice: Consult with a qualified financial advisor for personalized guidance and strategies to optimize your retirement plan.

Conclusion:

Performing a retirement plan stress test is a vital step in ensuring a secure and comfortable retirement. By proactively identifying and addressing potential vulnerabilities, you can increase your chances of achieving your financial goals and enjoy your golden years with peace of mind. Don't delay – take control of your financial future today. Start your stress test now and secure your retirement dreams!

(CTA: Consider consulting a financial advisor for personalized retirement planning.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Your Retirement Plan Robust? Perform A Stress Test To Find Out.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Frances Tiafoe Unique Training Method Creates French Open Buzz

Jun 04, 2025

Frances Tiafoe Unique Training Method Creates French Open Buzz

Jun 04, 2025 -

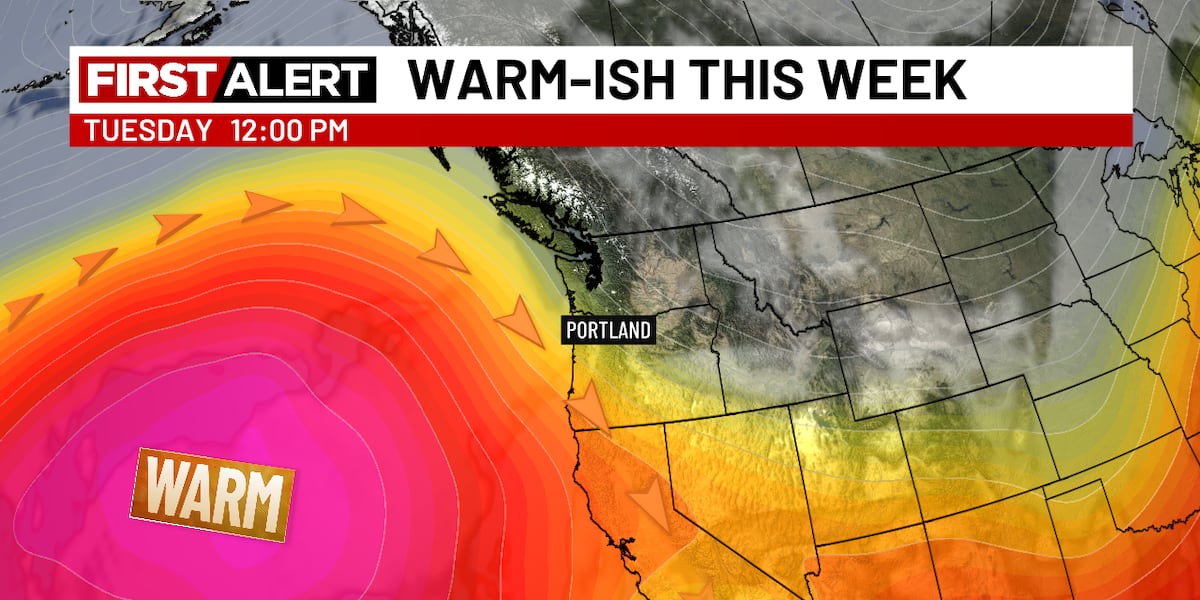

Warm Sunny And Dry Start To June Impact On Local Conditions

Jun 04, 2025

Warm Sunny And Dry Start To June Impact On Local Conditions

Jun 04, 2025 -

Financial Crisis Threatens Key Component Supplier For Australias Grid Scale Batteries

Jun 04, 2025

Financial Crisis Threatens Key Component Supplier For Australias Grid Scale Batteries

Jun 04, 2025 -

Is This The Next Big Netflix Comedy Fans Are Already Asking For Season 2

Jun 04, 2025

Is This The Next Big Netflix Comedy Fans Are Already Asking For Season 2

Jun 04, 2025 -

Facing Retirement Stress Test Your Financial Plan Now

Jun 04, 2025

Facing Retirement Stress Test Your Financial Plan Now

Jun 04, 2025